Advance Auto Parts Inc. AAP reported weak second-quarter earnings and slashed FY24 outlook on Thursday.

The company reported earnings per share of 75 cents, missing the street view of $1.07. Quarterly sales of $2.683 billion beat the street view of $2.679 billion.

Advance Auto Parts revised its FY24 outlook, lowering its earnings per share forecast to $2.00 – $2.50 from the previous range of $3.75 – $4.25, which contrasts with the $3.63 estimate. Additionally, the company adjusted its sales projection to $11.15 billion – $11.25 billion, down from $11.30 billion – $11.50 billion, versus the $11.30 billion estimate.

In a separate press release, the company has confirmed a definitive agreement to sell Worldpac, Inc., its automotive parts wholesale distribution business, to funds managed by global investment firm The Carlyle Group Inc. CG for $1.5 billion in cash.

Advance Auto Parts shares dipped 17.5% to close at $51.10 on Thursday.

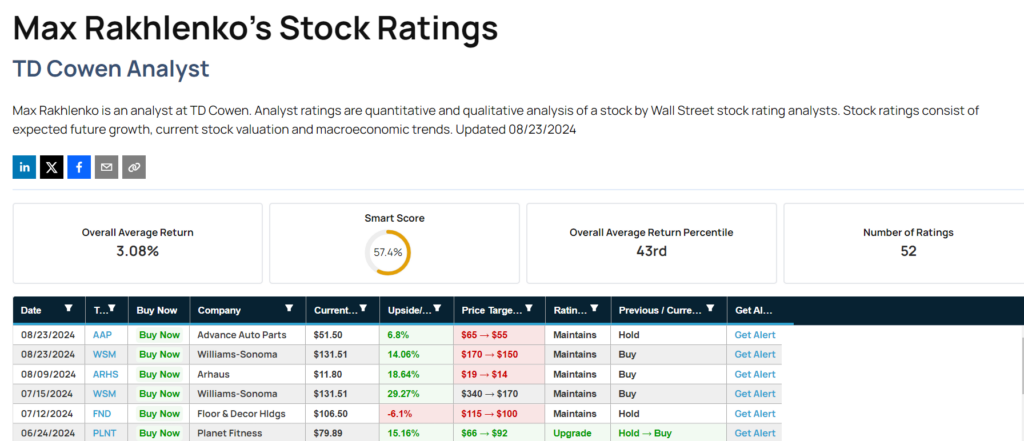

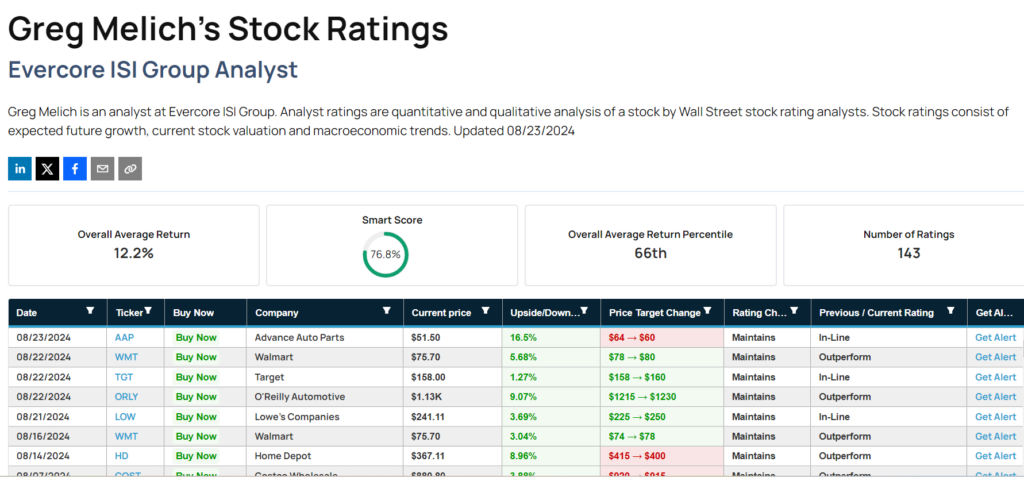

These analysts made changes to their price targets on Advance Auto Parts following earnings announcement.

TD Cowen analyst Max Rakhlenko maintained Advance Auto Parts with a Hold and lowered the price target from $65 to $55.

Evercore ISI Group analyst Greg Melich maintained Advance Auto Parts with an In-Line and cut the price target from $64 to $60.

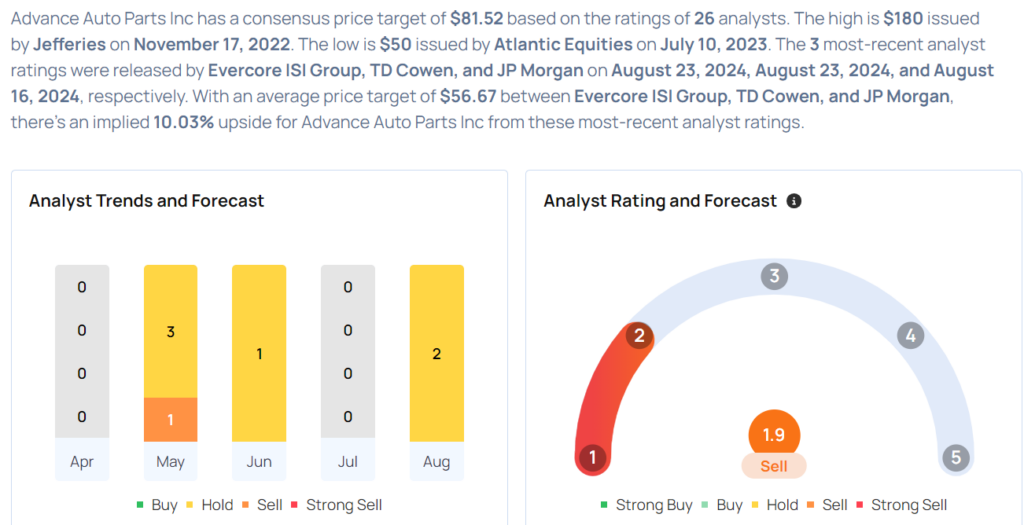

Considering buying AAP stock? Here’s what analysts think:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.