NetApp, Inc. NTAP will release earnings results for its first quarter, after the closing bell on Wednesday, Aug. 28.

Analysts expect the San Jose, California-based company to report quarterly earnings at $1.45 per share, up from $1.15 per share in the year-ago period. NetApp is projected to post revenue of $1.53 billion, according to data from Benzinga Pro.

On July 29, NetApp announced June Yang as new independent nominee for election to board of directors.

NetApp shares gained 0.5% to close at $133.12 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

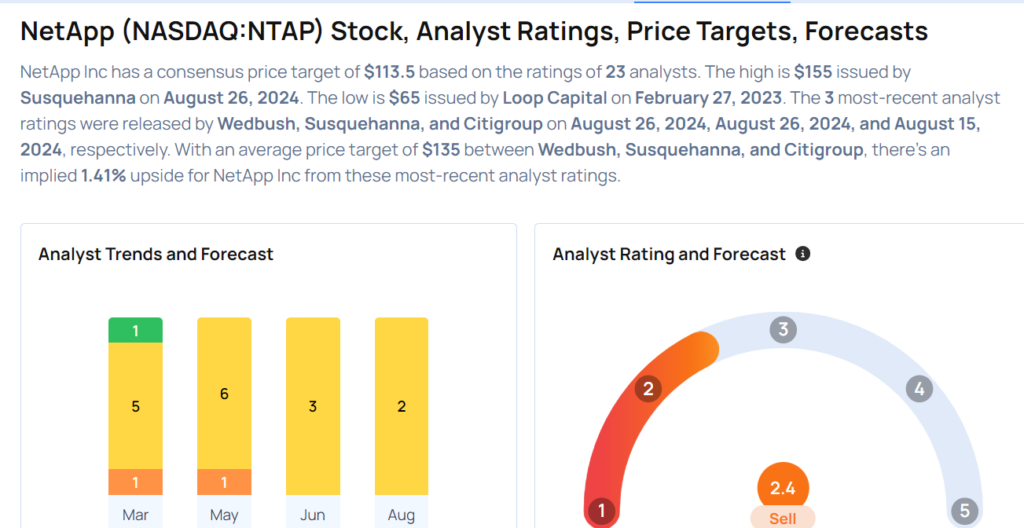

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Matt Bryson reiterated a Neutral rating with a price target of $120 on Aug. 26. This analyst has an accuracy rate of 83%.

- Citigroup analyst Jim Suva maintained a Neutral rating and raised the price target from $120 to $130 on Aug. 15. This analyst has an accuracy rate of 69%.

- Evercore ISI Group analyst Amit Daryanani maintained an In-Line rating and boosted the price target from $120 to $130 on Aug. 12. This analyst has an accuracy rate of 75%.

- Stifel analyst Matthew Sheerin maintained a Buy rating and raised the price target from $130 to $138 on June 12. This analyst has an accuracy rate of 75%.

- Morgan Stanley analyst Meta Marshall maintained an Equal-Weight rating and raised the price target from $106 to $127 on June 12. This analyst has an accuracy rate of 74%.

Considering buying NTAP stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.