NetApp, Inc. NTAP has introduced new capabilities to bolster VMware Cloud Foundation deployments. These enhancements will allow mutual customers to optimize their IT environments for efficient scaling of VMware workloads.

These offerings are built on last month's enhancements to NetApp BlueXP disaster recovery service, which now includes guided workflows for automating disaster recovery plans for VMware workloads in hybrid cloud environments, with new support for VMFS datastores.

Customers of both NetApp and Broadcom can now simplify VCF hybrid cloud environments with NetApp ONTAP software. It will also support all storage needs and incorporate SnapMirror active sync for enhanced data replication and availability. For those migrating to the cloud, NetApp's Spot Eco with Azure VMware Solution (AVS) reserved instances and Azure NetApp Files offer significant cost savings. Additionally, the expanded Cloud Insights VM Optimization features help reduce costs, improve VM density and ensure optimal performance and adherence to configuration.

For more than a decade, NetApp has been a key engineering design partner with VMware, recently acquired by Broadcom Inc. The company continues to drive innovation in highly available, scalable and performant storage as a design partner for VMware's Next-Generation vSphere Virtual Volumes.

NetApp and Broadcom joined forces to eliminate uncertainty in hybrid cloud environments. With more than 20,000 customers depending on NetApp for VMware workload support, NetApp emphasized that its ongoing collaboration with Broadcom, following VMware's acquisition, guarantees seamless integration of their solutions. This ensures that mutual customers can efficiently utilize a unified, "intelligent data infrastructure" for their VMware operations.

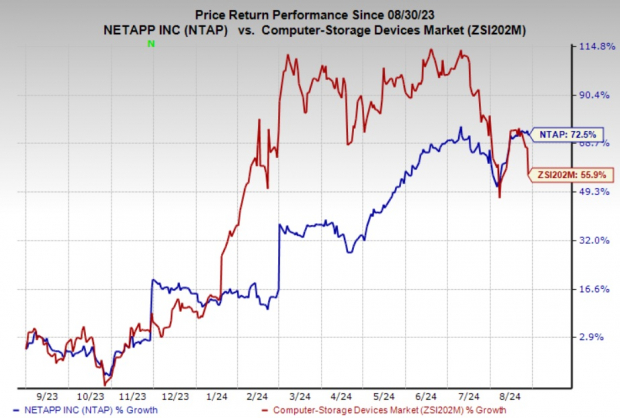

NTAP'S Zacks Rank & Stock Price Performance

Currently, NTAP carries a Zacks Rank #2 (Buy). Shares of the company have gained 72.5% compared with the sub-industry's growth of 55.9%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Manhattan Associates, Inc. MANH, ANSYS, Inc. ANSS and Adobe Inc. ADBE. MANH presently sports a Zacks Rank #1 (Strong Buy) each, whereas ANSS & ADBE carry a Zacks Rank #2.

Manhattan Associates delivered an earnings surprise of 26.6%, on average, in the trailing four quarters. In the last reported quarter, MANH pulled off an earnings surprise of 22.9%. The Zacks Consensus Estimate for MANH increased 9.2% in the past 60 days to $4.26.

ANSYS delivered an earnings surprise of 4.8%, on average, in three of the trailing four quarters. In the last reported quarter, ANSS pulled off an earnings surprise of 28.9%. It has a long-term earnings growth expectation of 6.4%.

Adobe delivered an earnings surprise of 2.7%, on average, in the trailing four quarters. In the last reported quarter, ADBE pulled off an earnings surprise of 2.1%. It has a long-term earnings growth expectation of 13%.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.