Couchbase, Inc. BASE reported worse-than-expected second-quarter EPS results and announced it is unable to provide GAAP targets for the third quarter and FY25.

Couchbase reported a quarterly loss of 39 cents per share which missed the analyst consensus estimate for a loss of 32 cents per share. The company reported quarterly sales of $51.60 million which beat the analyst consensus estimate of $51.09 million.

“I’m pleased with our hard work and execution in the quarter,” said Matt Cain, Chair, President and CEO of Couchbase. “We delivered revenue and operating loss results that exceeded the high end of our outlook, generated strong new business and new logos, and saw a meaningful increase in our Capella mix. I remain highly confident in our outlook and ability to achieve our objectives in fiscal 2025.”

Couchbase shares gained 0.1% to close at $18.99 on Wednesday.

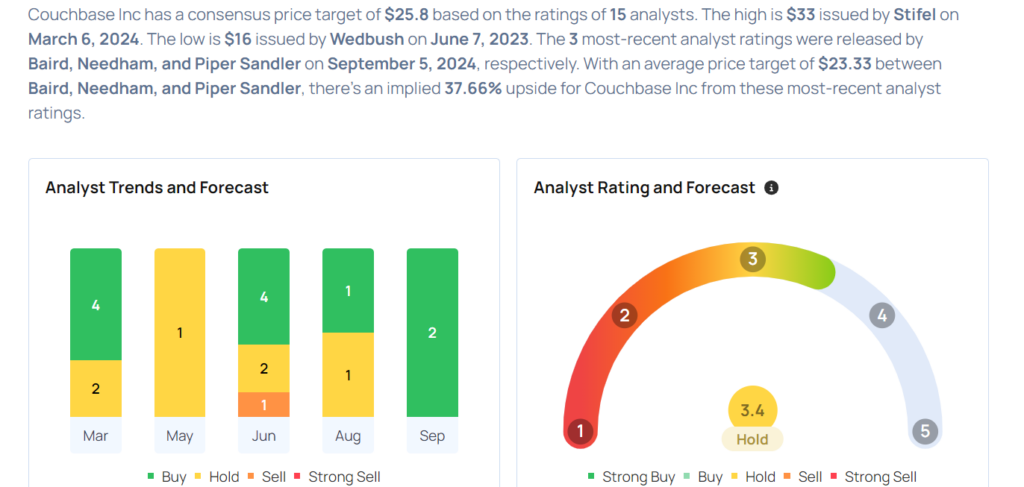

These analysts made changes to their price targets on Couchbase following earnings announcement.

- Piper Sandler analyst Brent Bracelin maintained Couchbase with an Overweight and lowered the price target from $22 to $21.

- Baird analyst Rob Oliver maintained the stock with an Outperform and lowered the price target from $32 to $27.

- Needham analyst Mike Cikos reiterated Couchbase with a Buy and maintained a $22 price target.

Considering buying BASE stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.