Applied Digital Corporation APLD will release earnings results for its first quarter, after the closing bell on Wednesday, Oct. 9.

Analysts expect the Dallas, Texas-based company to report a quarterly loss at 29 cents per share, versus a year-ago loss of 12 cents per share. Applied Digital projects to report revenue of $54.85 million for the quarter, according to data from Benzinga Pro.

On Sept. 5, Applied Digital entered agreements for a $160 million private placement financing priced at market, from a group of institutional and accredited investors including NVIDIA NVDA and related companies.

Applied Digital shares fell 4.7% to close at $7.10 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

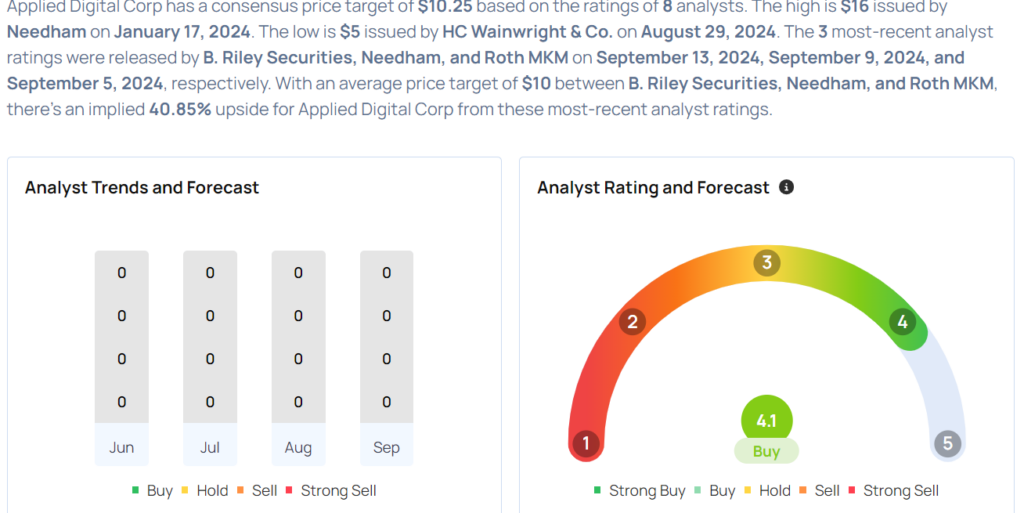

- B. Riley Securities analyst Lucas Pipes maintained a Buy rating and raised the price target from $8 to $9 on Sept. 13. This analyst has an accuracy rate of 68%.

- Needham analyst John Todaro reiterated a Buy rating with a price target of $11 on Sept 9. This analyst has an accuracy rate of 81%.

- HC Wainwright & Co. analyst Kevin Dede reiterated a Buy rating with a price target of $5 on Aug. 29. This analyst has an accuracy rate of 61%.

- Lake Street analyst Rob Brown maintained a Buy rating and cut the price target from $19 to $7 on April 12. This analyst has an accuracy rate of 82%.

Considering buying APLD stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.