JPMorgan Chase & Co. JPM reported better-than-expected third-quarter FY24 earnings on Friday.

Reported revenue rose 7% year-on-year to $42.654 billion, beating the consensus of $41.649 billion. Net revenue (managed) stood at $43.3 billion (+6% Y/Y) in the quarter. Net income fell 2% Y/Y to $12.90 billion in the quarter. EPS of $4.37, exceeding the consensus of $4.00.

JPMorgan said it now expects FY24 net interest income, excluding Markets, of ~$92.5 billion (up from ~$91 billion earlier). The bank continues to project card services NCO rate of ~3.40%.

Jamie Dimon, Chairman and CEO, said, “We await our regulators’ new rules on the Basel III endgame and the G-SIB surcharge as well as any adjustments to the SCB or CCAR…Regardless of the outcome of these rules, we have an extraordinarily strong balance sheet, evidenced by total loss-absorbing capacity of $544 billion plus cash and marketable securities of $1.5 trillion, while our riskiest assets, loans, total $1.3 trillion.”

JPMorgan shares fell 0.6% to trade at $221.00 on Monday.

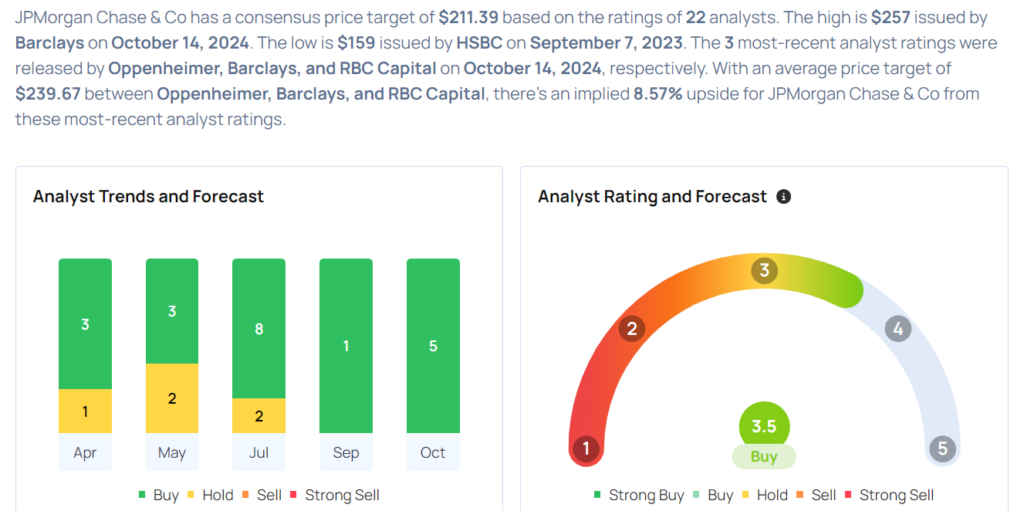

These analysts made changes to their price targets on JPMorgan following earnings announcement.

- Evercore ISI Group analyst Glenn Schorr maintained JPMorgan Chase with an Outperform and raised the price target from $217 to $230.

- RBC Capital analyst Gerard Cassidy maintained JPMorgan Chase with an Outperform and boosted the price target from $211 to $230..

- Barclays analyst Jason Goldberg maintained JPMorgan with an Overweight and raised the price target from $217 to $257.

- Oppenheimer analyst Chris Kotowski maintained JPMorgan with an Outperform and lowered the price target from $234 to $232.

Considering buying JPM stock? Here’s what analysts think:

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.