Analysts' sentiment is important in determining the right time to buy stock. However, the trend in sentiment and coverage is more important than the consensus rating. A Moderate Buy or Buy rating doesn't mean as much if recent revisions include downgrades, price target revisions, and lapsed coverage. Those are headwinds for stock prices that can signal a top and a high potential for bearish reversals. A stock with a consensus rating of sell with recent upgrades and price target increases would be a better choice; those are tailwinds that can help a market bottom and enter a bullish reversal.

Increasing analyst coverage is another tailwind for stock prices because growing coverage equates to growing inflows of investor money. The stocks in this article are attracting new coverage, and upgrades and revisions support their markets. Because Chewy CHWY and Gitlab GTLB are leaders in their respective fields, the odds are high that their stock prices will follow the analysts' lead and move higher.

TD Cowen Takes a Bite of Chewy, Inc. Citing Long-Term Growth Potential

Chewy analysts began increasing their price targets over the summer after results outperformed expectations. MarketBeat.com tracks 22 analysts showing a high conviction in the Moderate Buy rating, with the latest price targets leading to the high-end range above the consensus estimate. The latest report initiated coverage by TD Cowen, which rated the stock at Buy with a price target of $38. The $38 is 28% above the recent action and the consensus target, which assumes fair value with the stock at around $28.50. Consensus is up 12% in the last three months and is likely to continue rising, given the revenue growth and earnings outlook.

Chewy's growth slowed in F2025 to the low single digits, but it was sustained and expected to continue and accelerate in F2026. Analysts forecast revenue growth to top 5% in F2026; TD Cowen forecasts acceleration to persist over the next few years and drive a 9% CAGR over the next five years. At 9%, TD Cowen's CAGR target is nearly double the forecasted industry average and will be compounded by a widening margin. The EBITDA margin is expected to double almost 8%, driving increased free cash conversion and balance sheet improvement. Drivers for growth will be an increasing customer count and revenue per customer in the retail business and deepening penetration of services tied to the pet health business.

Chewy's balance is in healthy condition. The company's positive cash flow business helps it maintain ultra-low debt levels, with long-term liabilities, including lease obligations, less than 1x cash and just over 1x equity. Institutional activity is also bullish for this stock. Institutions own nearly 95% of the stock and have been buying on balance in calendar 2024.

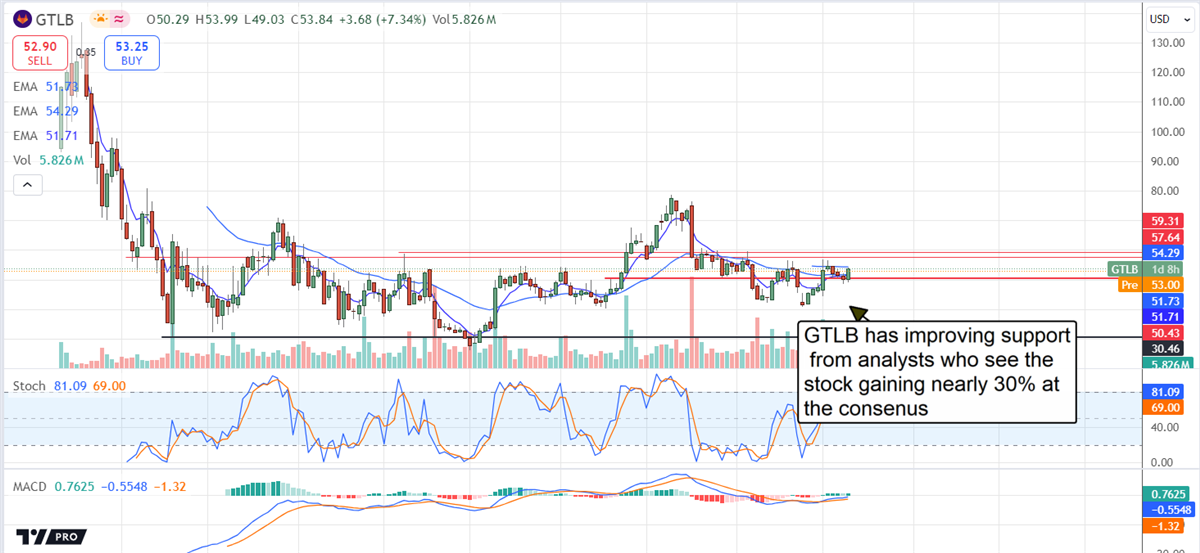

Morgan Stanley Says Gitlab Is a Key Consolidator of a Fragmented Market

Morgan Stanley initiated coverage on Gitlab at Overweight with a price target of $70, 30% above the recent price action. They view the DevSecOps platform as an emerging enterprise-quality platform and a crucial consolidator of a highly fractured market. The firm forecasts a 25% revenue CAGR for the next four years, compounded by a doubling of the margin as software developers lean into efficiency and security.

MarkeBeat.com tracks 25 analysts with high conviction in the Moderate Buy rating. The consensus target is rising, as is the number of analysts covering the stock, which has increased by 100% in the last 18 months. Consensus assumes a 23% upside from recent price action; Morgan Stanley's target adds another 600 basis points, aligning with the trend. A move to consensus would put the stock at an 8-month high.

The article "Top 2 Analyst Picks: Stocks Poised for Double-Digit Growth" first appeared on MarketBeat.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.