Abbott Laboratories ABT reported better-than-expected third-quarter results on Wednesday.

The company posted sales of $10.64 billion, up 4.9% year over year, beating the consensus of $10.55 billion. Abbott’s adjusted diluted earnings per share was $1.21, beating the analyst estimates of $1.20.

"Our results this quarter demonstrate the strength of our diversified business model," said Robert Ford, chairman and CEO of Abbott. "We're well-positioned to achieve the upper end of our initial guidance ranges for the year and have great momentum heading into next year."

Abbott projects full-year 2024 adjusted EPS of $4.64-$4.70 versus prior guidance of $4.61-$4.71 and consensus of $4.66. Abbott forecasts that in the fourth quarter of 2024, the adjusted EPS will be $1.31-$1.37 versus the consensus of $1.20.

Abbott shares gained 1.5% to close at $117.82 on Wednesday.

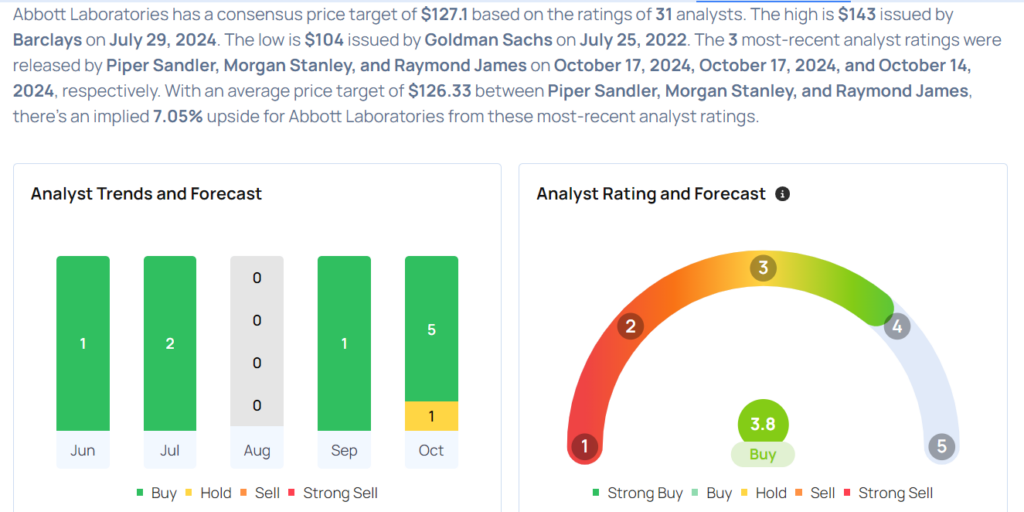

These analysts made changes to their price targets on Abbott following earnings announcement.

- Morgan Stanley analyst David Lewis maintained Abbott with an Equal-Weight and raised the price target from $107 to $117.

- Piper Sandler analyst Adam Maeder maintained the stock with an Overweight and boosted the price target from $131 to $133.

Considering buying ABT stock? Here’s what analysts think:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.