Autoliv, Inc. ALV reported better-than-expected third-quarter sales results on Friday.

The company reported third-quarter adjusted earnings per share of $1.84, missing the analyst consensus of $1.95. Quarterly revenues of $2.56 billion topped the street view of $2.53 billion.

"Light vehicle production was weak in the third quarter, declining by close to 5% globally. This was driven by a combination of inventory reductions, especially in the Americas and a high comparison base, especially in China," said Mikael Bratt, President & CEO.

Autoliv now expects full-year 2024 organic sales growth to be 1%, down from the previously anticipated 2%, due to unfavorable market mix developments.

Autoliv shares fell 1.2% to trade at $98.36 on Monday.

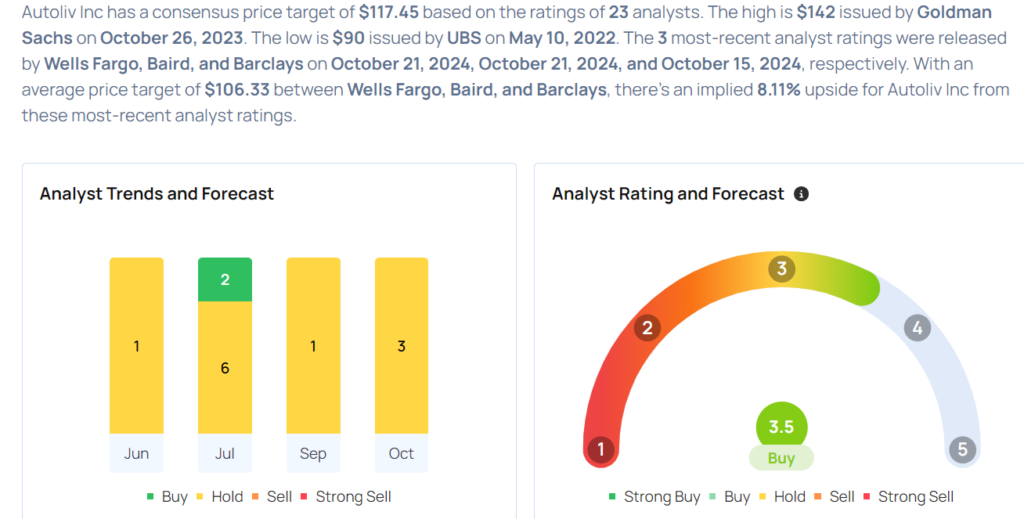

These analysts made changes to their price targets on Autoliv following earnings announcement.

- Baird analyst Luke Junk maintained Autoliv with a Neutral and raised the price target from $103 to $108.

- Wells Fargo analyst Colin Langan maintained Autoliv with an Equal-Weight and cut the price target from $102 to $101.

Considering buying ALV stock? Here’s what analysts think:

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.