W. R. Berkley Corporation WRB reported better-than-expected earnings for its third quarter on Monday.

The company posted quarterly earnings of 93 cents per share which beat the analyst consensus estimate of 92 cents per share. The company reported quarterly sales of $3.400 billion which missed the analyst consensus estimate of $3.444 billion.

WR Berkley shares fell 4.7% to trade at $58.14 on Tuesday.

These analysts made changes to their price targets on WR Berkley following earnings announcement.

- Evercore ISI Group analyst David Motemaden maintained WR Berkley with an In-Line and raised the price target from $57 to $60.

- Keefe, Bruyette & Woods analyst Meyer Shields maintained the stock with a Market Perform and lowered the price target from $59 to $58.

- RBC Capital analyst Scott Heleniak maintained WR Berkley with a Sector Perform and raised the price target from $57 to $63.

- UBS analyst Brian Meredith maintained the stock with a Buy and raised the price target from $67 to $69.

- Wells Fargo analyst Elyse Greenspan maintained WR Berkley with an Overweight and raised the price target from $63 to $68.

- B of A Securities analyst Joshua Shanker maintained WR Berkley with a Buy and boosted the price target from $73 to $76.

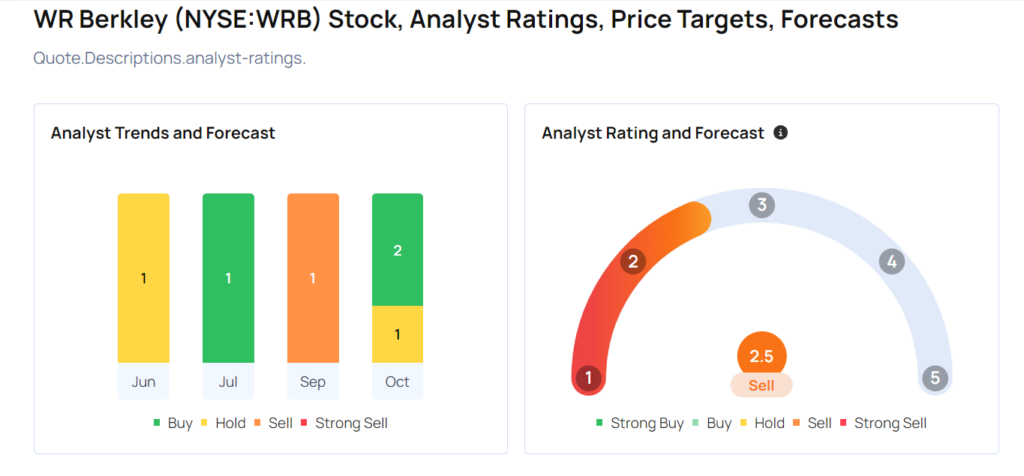

Considering buying WRB stock? Here’s what analysts think:

Read More:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.