Logitech International S.A. LOGI reported better-than-expected second-quarter FY25 results on Tuesday.

Revenue rose 6% (both reported and constant currencies) to $1.116 billion, marginally exceeding the consensus of $1.11 billion. Adjusted EPS of $1.20 beat the consensus of $0.99.

The company raised its FY25 sales outlook to $4.39 billion -$4.47 billion, up 2% – 4% (from the previously expected $4.34 billion – $4.43 billion) versus the consensus of $4.512 billion. Logitech now sees an adjusted operating income of $720 million – $750 million (versus $700 million – $730 million prior view).

Hanneke Faber, chief executive officer, said, "Growth was broad-based, across regions, categories, and both our consumer and business customers. We launched a terrific set of innovations in the quarter and we are ready for the holidays."

Logitech shares fell 4.4% to trade at $80.26 on Wednesday.

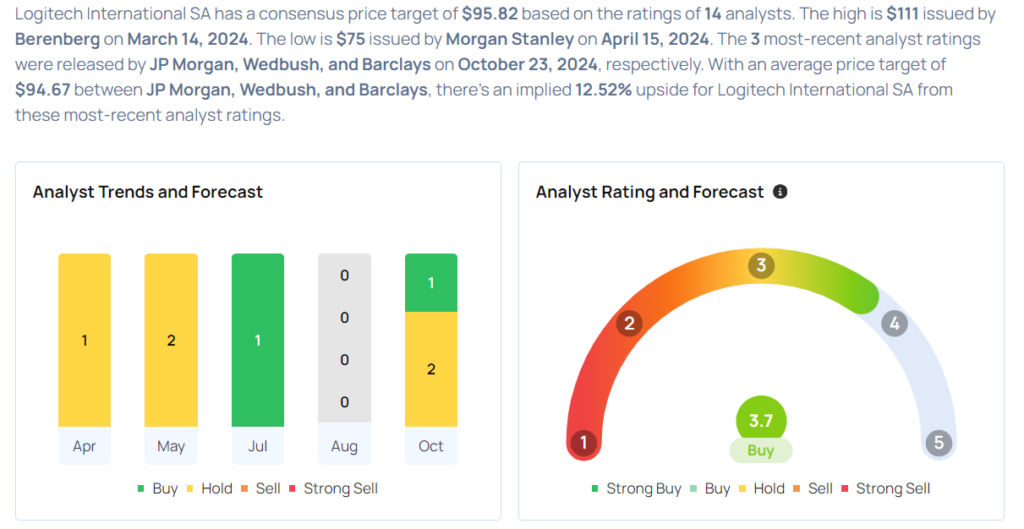

These analysts made changes to their price targets on Logitech following earnings announcement.

- Barclays analyst Tim Long maintained Logitech International with an Overweight and lowered the price target from $105 to $103.

- JP Morgan analyst Samik Chatterjee maintained the stock with a Neutral and lowered the price target from $98 to $93.

- Wedbush analyst Alicia Reese reiterated Logitech International with a Neutral and maintained a price target of $88.

Considering buying LOGI stock? Here’s what analysts think:

Read Next:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.