The Ensign Group, Inc. ENSG reported worse-than-expected third-quarter adjusted EPS results and narrowed its FY24 EPS guidance, after the closing bell on Thursday.

Ensign Group reported quarterly earnings of $1.34 per share which missed the analyst consensus estimate of $1.38 per share. The company reported quarterly sales of $1.081 billion which beat the analyst consensus estimate of $1.068 billion.

“Our local leaders continue to consistently drive outstanding clinical and financial performance and we are happy to report another record quarter,” said Barry Port, Ensign’s Chief Executive Officer. “We are particularly impressed with these results when we’ve added 53 new operations across several markets in our recently acquired bucket.”

Ensign Group said it sees FY24 adjusted earnings of $5.46 to $5.52 per share, versus analysts' estimates of $5.46 per share. The company expects FY24 revenue of $4.25 billion to $4.26 billion, versus estimates of $4.22 billion.

Ensign shares gained 0.9% to trade at $154.14 on Monday.

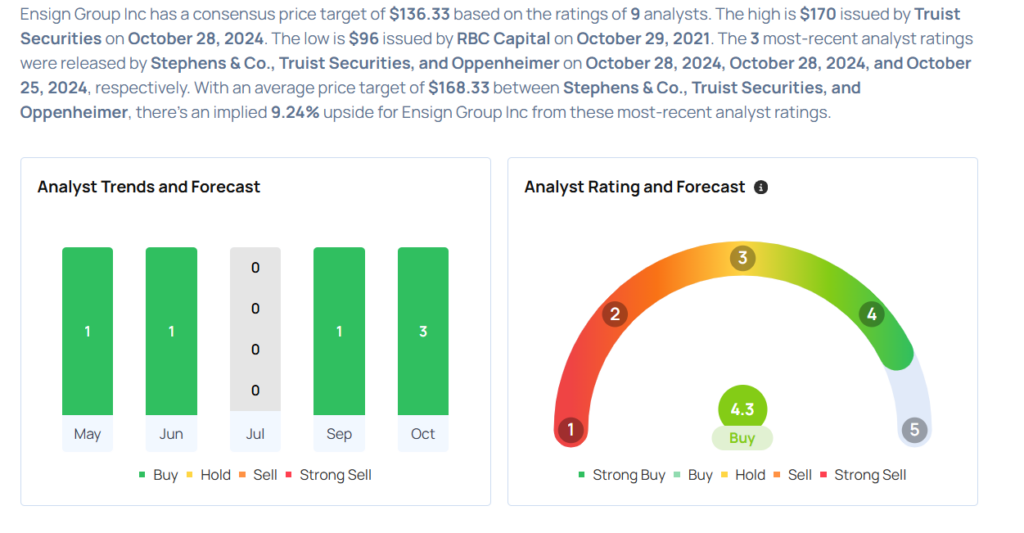

These analysts made changes to their price targets on Ensign following earnings announcement.

- Truist Securities analyst David Macdonald maintained Ensign Group with a Hold and raised the price target from $160 to $170.

- Stephens & Co. analyst Scott Fidel maintained the stock with an Overweight and raised the price target from $163 to $167.

Considering buying ENSG stock? Here’s what analysts think:

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.