Wingstop WING reported mixed third-quarter financial results on Wednesday.

The company reported third-quarter earnings per share of 88 cents, missing the street view of 95 cents. Quarterly sales of $162.498 million beat the analyst consensus estimate of $161.535 million.

The companydeclared a quarterly dividend of $0.27 per share of common stock, resulting in a total dividend of approximately $7.9 million. This dividend will be paid on December 6

The company reaffirmed approximately 20% domestic same-store sales growth for FY24 and updated guidance to 320 – 330 global net new units (previously 285 – 300), $22.5 million in stock-based compensation (up from $20 million), $117.5-$118.5 million in SG&A (previously $114-$116 million), and $19 million in depreciation and amortization (previously $18-$19 million).

Wingstop shares gained 0.5% to trade at $291.38 on Thursday.

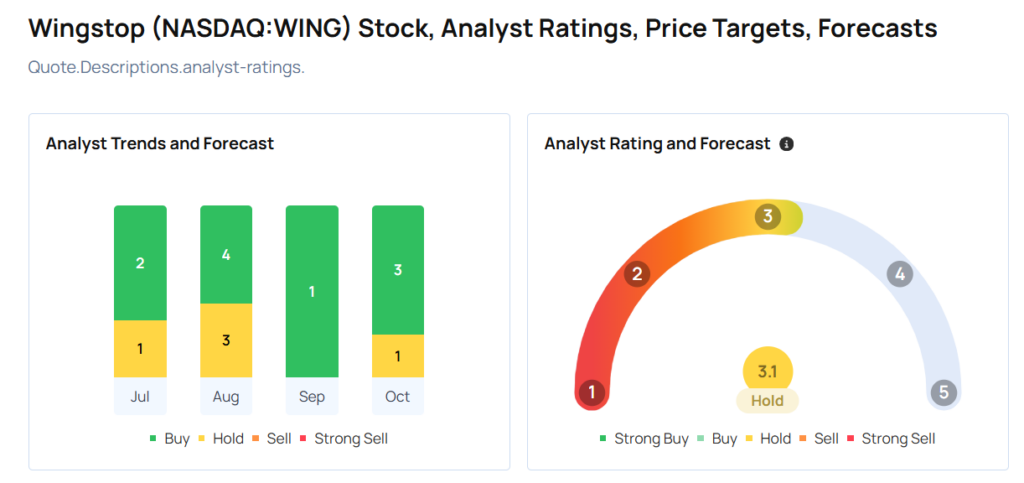

These analysts made changes to their price targets on Wingstop following earnings announcement.

- TD Cowen analyst Andrew Charles maintained Wingstop with a Buy and lowered the price target from $450 to $365.

- Stephens & Co. analyst Jim Salera maintained the stock with an Overweight and lowered the price target from $490 to $468.

- Barclays analyst Jeffrey Bernstein maintained Wingstop with an Overweight and cut the price target from $470 to $380.

Considering buying WING stock? Here’s what analysts think:

Read More:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.