Apple Inc. AAPL is set to report its Q2 2025 earnings on May 1st, Let's see what the charts suggest so far in line with the Adhishthana Principles.

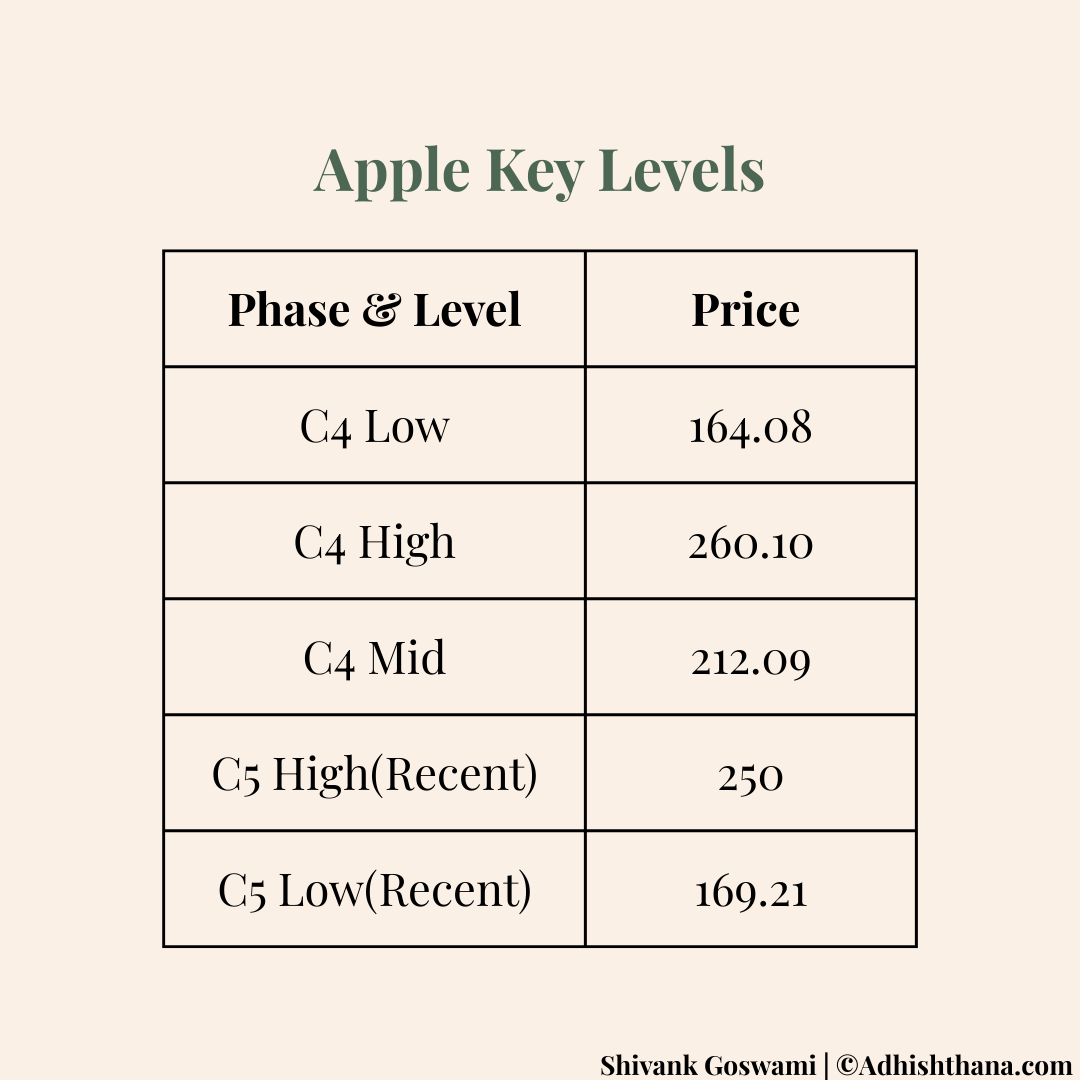

Currently, Apple is trading within the C5 phase of its Adhishthana market cycle, a stage where a test of the prior C4 phase low at $164.08 is expected. After entering C5 at $224.02, the stock climbed to an interim high of $250.00, then reversed sharply in line with the principles. It recently bottomed at $169.21, coming close to the C4 low.

With these levels in mind, let’s now assess the structural implications:

The C4 low of $164.08 is expected to serve as a strong support level during the volatile trading sessions leading up to earnings.

The C5 phase has formed eight red bars, suggesting that a final downward move is likely before the structure shifts, with the C4 low continuing to act as a stabilizing support.

Apple's price behavior in the coming sessions will determine the course of the next five-phase Cakra cycle, shaping the stock's medium-term trajectory.

Fundamentals Check

In the last quarter, Apple reported $124.3 billion in revenue. Operating income stood at $42.83 billion, with total operating expenses of $15.44 billion. The company posted a net income of $36.33 billion, resulting in earnings per share (EPS) of $2.41. From the principles standpoint, an EPS of $2.52 in the upcoming release would be constructive in reinforcing Apple’s alignment with the Adhishthana framework.

With price behavior hovering near key structural supports and 40 weekly bars remaining to the discovery of the Nirvana level in C6, Apple's next move could help define the shape of its forthcoming market cycle.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.