Zinger Key Points

- Marathon Petroleum will reassess its dividend level post completion of $15 billion share repurchase.

- In the second quarter, Howmet saw share repurchases up to $60 million and debt repurchases of $60 million.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Activist investor Paul Singer is the founder, president and co-CEO of Elliott Management, which was founded in 1977 with $1.3 million and is now controlling some $45 billion in assets under management.

In July 2018, Singer took over beleaguered soccer club AC Milan, after Asian businessman Li Yonghong defaulted on a loan payment owed to the hedge fund, to the tune of $400 million.

Since the start of the first quarter, Singer reduced his portfolio from 45 stocks to 42, with his top two positions providing dividends in the defense and energy sector, respectively.

Howmet Aerospace Inc HWM is offering a dividend yield of 0.24% or 8 cents per share annually, through quarterly payments, with an inconsistent track record of raising its dividends. Howmet Aerospace produces products that are used primarily in aerospace, commercial transportation, and industrial and other markets.

In the second quarter, Howmet saw share repurchases of up to $60 million and debt repurchases of $60 million.

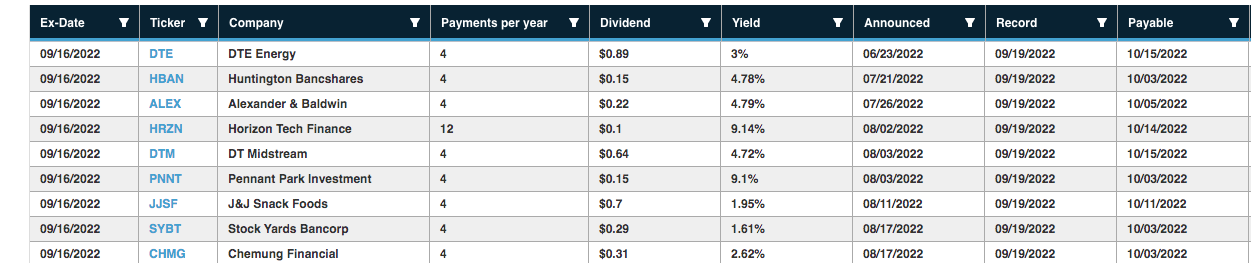

Check Out: Benzinga's Dividend Calendar To Stay On Track With The Latest Distributions

Marathon Petroleum Corp MPC is offering a dividend yield of 2.43% or $2.32 per share annually, utilizing quarterly payments, with an inconsistent track record of raising its dividend payments. Marathon Petroleum is an independent refiner with 13 refineries in the mid-continent, West Coast, and Gulf Coast of the United States with a total throughput capacity of 2.9 million barrels per day, as of 2021.

Since Marathon’s last earnings call, the firm repurchased $4.1 billion in shares, and also announced a separate $5 billion share authorization. The company will reassess its dividend level post-completion of a $15 billion share repurchase.

Photo: Courtesy of commons.wikimedia.org

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.