Zinger Key Points

- November's PCE price index release holds market's attention, with expectations of lower inflation and potential impact on interest rates.

- Key ETFs to monitor include TLT, QQQ, IWM, XLRE, and UUP, reflecting various market responses to PCE data.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

The November release of the Personal Consumption Expenditure (PCE) price index stands as the most eagerly anticipated economic event this week, scheduled for Friday at 8:30 a.m. ET.

This indicator, referred to as the Federal Reserve’s favorite inflation gauge, captures a more comprehensive range of goods and services compared to the Consumer Price Index (CPI) report. Investors and Fed watchers closely monitor this event, as it provides critical insights into the future interest rate path.

November PCE Report: What Are Economists Expecting?

- The consensus among economists is for the headline PCE to come in at 2.8% year-on-year, down from the 3% recorded in October. If these expectations hold true, it would mark the lowest figure since March 2021.

- On a monthly basis, the headline PCE index is expected to remain unchanged, mirroring October’s reading. This suggests that inflationary pressures have been virtually null on a month-to-month basis.

- When we exclude energy and food from the overall basket of goods and services, the core PCE index is projected to be at 3.3% year-over-year, a deceleration from the 3.5% increase observed in October.

- On a monthly basis, the core PCE is anticipated to increase at a rate of 0.2%, mirroring the previous month’s pace.

- In November, the CPI inflation rate was 3.1% year-on-year, a slight decrease from October’s 3.2%, aligning with earlier estimates. The Core CPI remained at 4%, also in line with forecasts.

Why The PCE Report Holds Importance For Markets

The PCE is the inflation gauge that the Federal Reserve relies on for shaping its monetary policy. The central bank’s goal is to bring inflation back to a target of 2%, as consistently emphasized by Fed Chair Jerome Powell, and the PCE serves as a key indicator in this endeavor.

In its latest Summary of Economic Projections, the Fed has revised its future inflation estimates downwards and anticipates a gradual return to the 2% target.

PCE inflation is expected to decline from 2.8% at the close of 2023 to 2.4% by the end of 2024, and further to 2.1% by the close of 2025. Core PCE inflation is projected to decrease from 3.2% at the close of 2023 to 2.4% by the end of 2024, and further to 2.2% by the close of 2025. Both measures are expected to stabilize at 2% for 2026.

The market currently prices six 25-basis-point interest rate cuts in 2024, which is twice as many as the Fed projected in its latest dot plot.

5 ETFs To Monitor

Historically, PCE inflation data has led to significant market volatility when it has revealed surprises.

Here are five exchange-traded funds (ETFs) that are particularly sensitive to expectations regarding interest rates and warrant close attention:

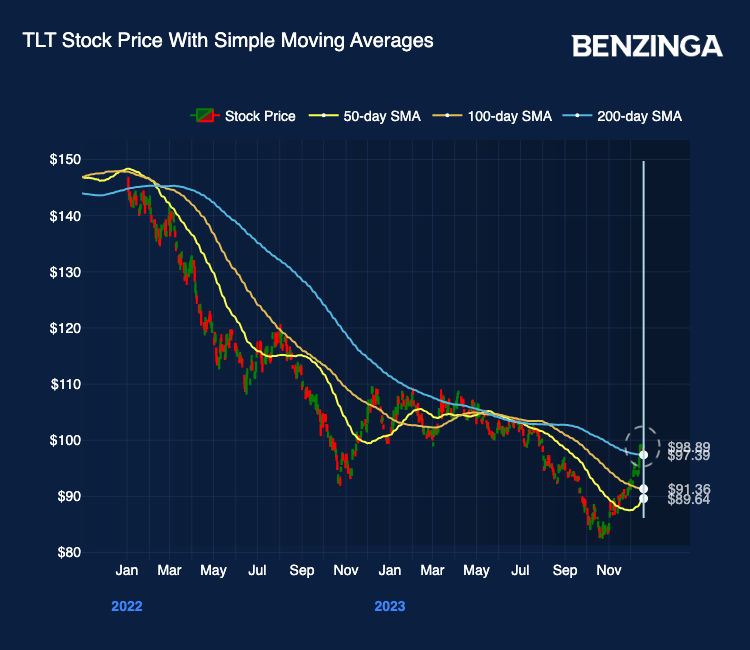

- iShares 20+ Year Treasury Bond ETF TLT: TLT has experienced a 20% rally from its October lows, benefiting from declines in inflation. From a technical standpoint, TLT has recently crossed above its 200-day moving average, signaling the potential for a major trend reversal.

- Invesco QQQ Trust QQQ: Nasdaq 100 technology stocks reached new all-time highs this week. To sustain this momentum, they rely on a stable inflation and interest rate environment.

- iShares Russell 2000 ETF IWM: Small-cap stocks have outperformed large-cap indices recently, displaying a heightened sensitivity to market optimism about potential rate cuts in 2024.

- Real Estate Select Sector SPDR Fund XLRE: Real estate has been the best-performing sector lately, driven by declining mortgage rates and an improved outlook for the U.S. real estate market. Maintaining a trend of slowing inflation is crucial for sustaining this recovery.

- Invesco DB USD Index Bullish Fund ETF UUP: A measure of the dollar’s performance tracked by the UUP ETF has declined by nearly 7% since the beginning of the month, marking its worst performance since December 2008. A further decline in PCE inflation could solidify expectations of Fed rate cuts in 2024, exerting pressure on dollar bulls.

Now Read: End-Of-Year Rally For Oil As Red Sea Tensions Drive Up Shipping Costs

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.