Zinger Key Points

- Nasdaq 100 index closes Friday down 2.1%, marking worst day since late October 2023 and fourth straight week of declines.

- Tech stocks face pessimistic sentiment amid delays in interest rate cuts, mixed earnings and geopolitical tensions.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

The tech-heavy Nasdaq 100 index closed Friday’s session down 2.1%, marking the worst day since late October 2023, and the fourth consecutive week of declines, a negative streak not seen since May 2022.

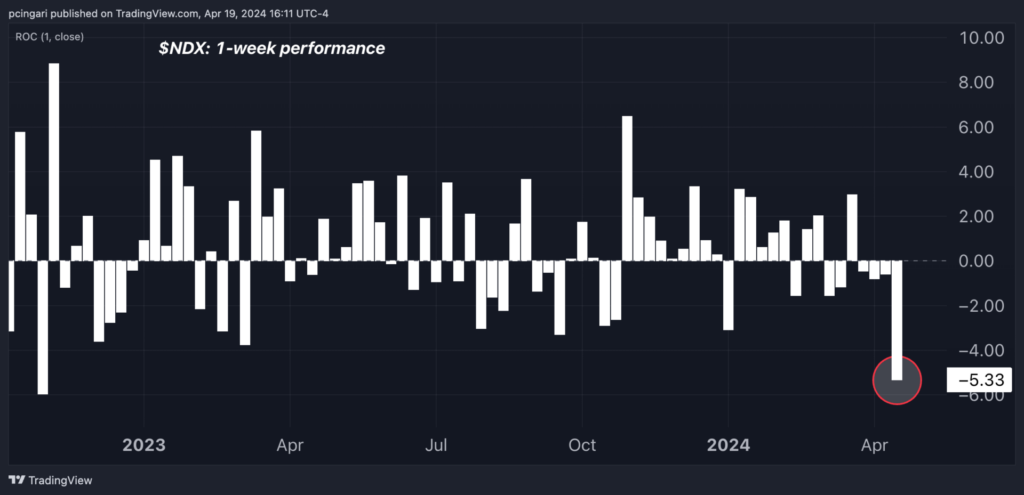

On a weekly basis, the Nasdaq 100, which is closely tracked by the Invesco QQQ Trust QQQ, tumbled 5.3%, notching its worst performance since October 2022.

Chart: Nasdaq 100 Notches Worst Week Since October 2022

What Happened To Tech Stocks?

Friday’s downturn echoes an already pessimistic sentiment surrounding U.S. tech stocks.

Delays in interest rate cuts, mixed guidance from corporate earnings, and growing geopolitical risks have formed a detrimental environment for tech companies.

During the week, Federal Reserve Chair Jerome Powell dismissed the possibility of rate cuts, citing a lack of confidence in the pace of disinflation.

Renowned veteran Wall Street investor Ed Yardeni said: “The Fed is in no rush to lower interest rates,” suggesting the Federal Open Market Committee could afford to take “the rest of the year off.”

Adding to that, what really tanked tech stocks this week has been the broad-based losses within the semiconductor industry, triggered by weaker guidance from ASML Holding N.V. ASML and Taiwan Semiconductor Manufacturing Company TSM.

The VanEck Semiconductor ETF SMH experienced a 10% decline, marking its worst performance since January 2022, prompting investors to reassess the outlook for the artificial intelligence sector.

Even high-performing Nvidia Corp. NVDA was not immune to the downturn, plummeting by 12.9% this week, its most significant decline since August 2022.

Compounding the already complex situation were geopolitical tensions, with Israel responding to Iranian attacks within a week. Israel’s limited response eased the possibility of further escalation, yet it also underscored the failure to heed calls from President Joe Biden and other allies to refrain from retaliating.

As the week drew to a close, investors exhibited a lack of confidence in expanding their exposure to equity risks.

Technical Indicators Signal Bearish Trends For The Nasdaq 100

The Nasdaq 100 breached its 100-day moving average for the first time since October 2023, signaling a potential end to the six-month-long bull market.

The breadth of the tech market appears exceedingly weak, with only 22% of stocks trading above the 50-day moving average, the lowest level since late October 2023.

Additionally, a mere 9% of stocks are trading above the 20-day moving average.

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.