Zinger Key Points

- Newmont eyes best session since April 2020, as the gold miner giant beats Q1 estimates, declares dividend.

- Gold miners rally in response to both Newmont's stellar results and stagflationary concerns from GDP report.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Newmont Corp. NEM, the world’s largest gold miner, saw its share price spike 13% on Thursday after the Denver-based company posted stronger-than-expected earnings.

This ignited a broad-based rally in the gold mining industry, despite the overall weak investor sentiment elsewhere.

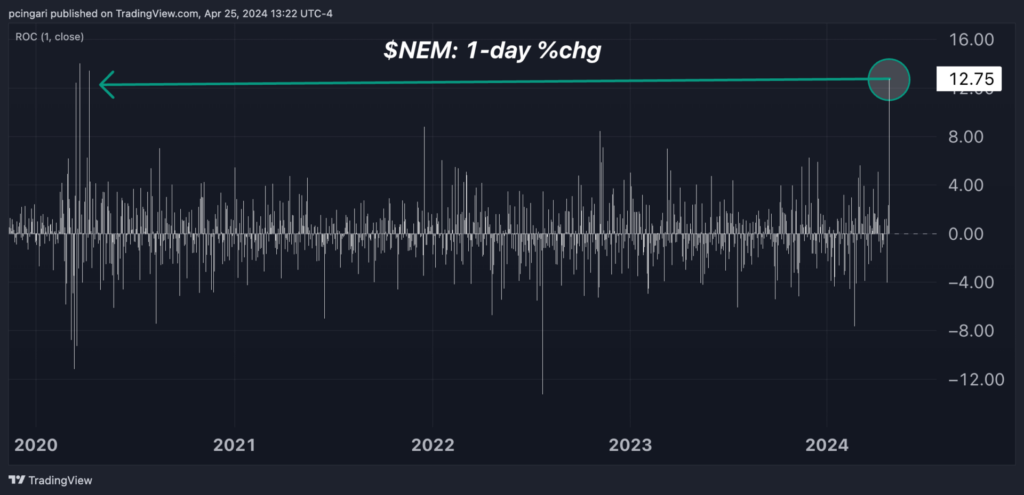

Newmont is currently on track to achieve its best-performing session since April 2020, when the mining giant rallied following a major volatility event due to the Covid-19 pandemic.

Chart: Newmont Eyes Top-Performing Session Since April 2020

Newmont Sharply Beats Estimates, Declares First Quarter Dividend

- Newmont reported earnings per share (EPS) of $0.55 in Q1 2024, marking a 38% increase from the corresponding quarter of the previous year and surpassing Street’s consensus estimates of $0.36 by a significant 54%, according to Benzinga Pro platform.

- Revenue for the quarter amounted to $4.02 billion, indicating a 50% rise from Q1 2023 and surpassing forecasts of $3.66 billion by a noteworthy 10% margin.

- Newmont delivered $288 million in dividends to shareholders and declared a dividend of $0.25 per share of common stock for the first quarter of 2024.

- Newmont reported gold Costs Applicable to Sales (CAS) per ounce of $1,057 and gold All-In Sustaining Costs (AISC) per ounce of $1,439, both notably lower than the average realized gold price of $2,090 per ounce. This stark contrast indicates wide profit margins for the company.

- “Newmont delivered a strong first quarter operational performance, producing 2.2 million gold equivalent ounces and generating over $1.4 billion in cash from operations before working capital changes,” Tom Palmer, Newmont’s president and CEO, stated.

See Also: Why Gold Miner Newmont Shares Are Surging Today

Gold Miners Rally In Response To Newmont’s Results

Newmont’s remarkable Q1 earnings report catalyzed a significant rally in gold mining stocks, drawing investors to the industry in anticipation of potentially positive results from other players.

Additionally, miners showed a positive response to the rise in gold prices, with the precious metal gaining 0.7% to $2,330 per ounce, buoyed by escalating stagflationary worries triggered by the latest gross domestic product report.

The VanEck Gold Miners ETF GDX rose 3.1%, while junior gold miners, as tracked by the VanEck Junior Gold Miners ETF GDXJ rose 1.8%.

The top-performing North American gold miners on Thursday included:

| Name | 1-Day % | Market Cap |

| Newmont Corporation | 13.06% | $ 50.54B |

| Buenaventura Mining Company Inc. BVN | 6.75% | $ 4.30B |

| DRDGOLD Limited DRD | 4.73% | $ 705.14м |

| AngloGold Ashanti plc AU | 4.29% | $ 9.57B |

| Coeur Mining, Inc. CDE | 3.52% | $ 1.88B |

| K92 Mining Inc. KNT | 2.69% | $ 1.31B |

| OceanaGold Corporation OGC | 2.31% | $ 1.61B |

| Calibre Mining Corp. CXB | 2.19% | $ 1.07B |

| Royal Gold, Inc. RGLD | 1.91% | $ 8.12B |

| Agnico Eagle Mines Limited AEM | 1.90% | $ 32.36B |

Now Read: Equinox Gold Snaps Up Greenstone Gold Mines For $995M In ‘Incredibly Rare’ Deal

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.