Source: Streetwise Reports 09/18/2024

This mining professional was involved in discovering and delineating a 30 billion pound copper resource in Panama. Read on to learn more about him.

Prosper Gold Corp. PGXFF appointed Colin Burge, a retired exploration geologist with a 30-year career, as an adviser to the company starting immediately, it announced in a news release.

"Colin brings a wealth of porphyry knowledge and expertise to our team" President and Chief Executive Officer Peter Bernier said in the release. "We look forward to Colin's expert engagement and assistance in guiding exploration at the Cyprus project and future development opportunities for the company."

Burge's expertise lies in discovering and delineating porphyry copper and volcanogenic massive sulfide (VMS) deposits, mostly using geophysical techniques.

Discovery-oriented Burge was part of Inmet Mining Corp.'s corporate development team that led on-site geological activities that resulted in the discovery and delineation of 30,000,000,000 pounds of copper at the Cobre Panama project in Panama. Subsequently, First Quantum Minerals Ltd. FQVLF acquired Inmet for US$5 billion (US$5B) in 2013.

Previously, Burge managed exploration activities at the Cayeli copper-rich VMS deposit in northeast Turkey and conducted project work in Peru, Australia, Nevada, and Greece for various companies, including Falconbridge Copper Ltd. in British Columbia. He has a bachelor of earth science degree from the University of Waterloo.

Since retiring in 2016, Burge has been evaluating properties for senior and junior mining companies in Canada and the U.S.

In another news announcement in the release, Prosper granted 150,000 stock options to its chief financial officer and an aggregate of 350,000 options to certain of the company's advisers and employees. Options may be exercised over the next years at CA$0.15 per share. They will vest equally every six months over a two-year period.

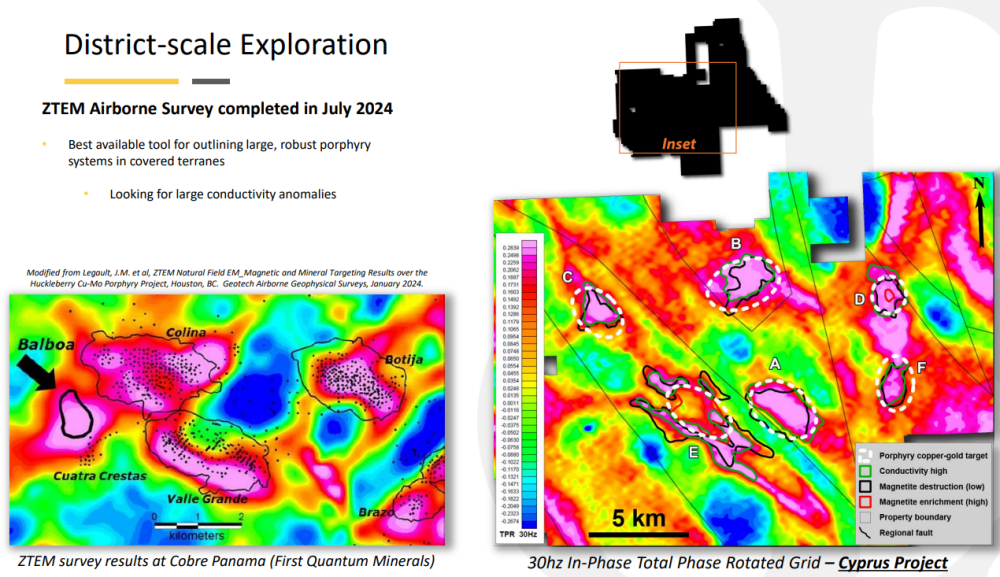

District-Scale Exploration

Prosper Gold, headquartered in Vancouver, British Columbia (B.C.), is a minerals explorer concentrating on porphyry copper-gold and high-grade gold vein systems, according to its website. Modeled after its predecessor Richfield Ventures, bought out after defining a multimillion-ounce resource, Prosper pursues "the right type of projects at the right time in an improving market."

The company has two district-scale exploration projects in Canada: Cyprus in north-central B.C. and Golden Sidewalk in northwestern Ontario

Cyprus, the focus of a current exploration program, is a porphyry copper-gold project comprising 623 square kilometers (623 sq km) of contiguous claims in part of an Eocene porphyry belt. It is on trend with American Eagle Gold Corp.'s AMEGF NAK Project, 60 km to the south in the same metallogenic belt, Technical Analyst Clive Maund reported in an Aug. 16 report.*

The three known copper prospects at Cyprus are Kaza, Northstar, and Big-Time. Historically, the property showed 138 meters (138m) of 0.55% copper. Most recently, a property-wide ZTEM survey was conducted, which outlined six high-priority porphyry copper-gold targets, named Targets A through F, undercover, in areas with little to zero outcrop. They were shown to have multikilometer footprints extending to depth.

Of the sextet, Target A is the highlight as it "represents a very attractive porphyry target." Next to a regional fault, Target A is a 2-by-4 km conductivity anomaly coinciding with a pronounced magnetic low.

"The recent ZTEM (Z‐Tipper Axis Electromagnetic) survey results are encouraging given the characteristics of the anomalies and the presence of copper-gold mineralization elsewhere on the project" Burge said in the release.

Prosper's Golden Sidewalk is an Archean orogenic gold project covering 160 sq km of contiguous mineral claims and mining leases in the western Birch-Uchi Greenstone belt, about 60 km east of Ontario's Red Lake. Three mineralized trends have been identified at the property.

The Canadian exploration company also boasts "an experienced and outstanding management team" as described by Maund. CEO Bernier at Richfield Ventures delineated a significant bulk tonnage deposit whose initial resource estimate was 4,200,000 ounces of gold in the Indicated and Inferred categories. New Gold Inc. NGD acquired Richfield in 2011 for US$550 million.

"The fact that people like Peter Bernier are on the management team of Prosper Gold means that there is a very good chance of it making a significant discovery or discoveries, for the simple reason that if it didn't, he probably wouldn't be there" Maund wrote. "If Peter Bernier can do what he did with Richfield Ventures once, he can do it again."

Demand for Copper "Unstoppable"

The global copper market is expected to grow in value by 2030 to US$259B from US$170B in 2022, according to Statista.

"Copper has become indispensable" Marin Katusa of Katusa Research wrote in a recent article. From electric vehicles to renewable energy systems, its role in the global economy is critical. The ongoing electrification of the world depends heavily on copper, and this dependence is only set to grow.

This is good news for copper exploration companies, particularly those with a copper-gold porphyry deposit. These deposits, according to Investing News Network, are "among the world's most valuable deposits" because they contain the largest known exploitable concentrations of copper.

INN explained in another article, "Due to their size and scope, copper porphyry deposits have the potential to become large-tonnage, low-cost operations based on mineralization."

"The strongly positive results from this ZTEM survey make the stock even more of a Buy than it was before" Technical Analyst Clive Maund wrote.

According to Katusa, demand for "the engine of the green economy" is "unstoppable" and a supply crunch is inevitable, as indicated by three metrics.

They are the rapid decline in days of forward consumption of copper, the long-term global market balance for copper moving toward a deficit, and a slowing of global mine production of copper. From 2015 to 2023, only 18,000,000 (18 Mt) of copper were discovered versus 28 Mt in 2014 alone.

While demand for the red metal is increasing, supply remains constrained. Joe Austin, senior analyst at Chaikin Analytics, reported that the copper supply is expected to start declining after peaking at some point in the next two years, according to the International Energy Agency. The agency estimates a copper shortfall of about 7 Mt by 2035, about a third of the output forecasted for that year.

"By 2040, the available supply of copper will be roughly two-thirds of what we produce today. But by then, the demand for copper will have soared far higher than where it is today" Austin wrote.

This anticipated tightening of the copper market is likely to cause a price surge, Katusa purported. In fact, the outlook for the copper price, important for Prosper Gold, is favorable, Maund wrote on Sept. 10.

"The recent reaction appears to have run its course" noted the analyst. "It now looks like it is shaping up to begin another major uptrend, which is hardly surprising given the huge copper supply deficit that is right now starting to bite and is set to get a lot worse as this decade unfolds."

The Catalyst: Exploration Progress

Along with the now completed ZTEM survey, the work planned for Prosper's in-progress 2024 exploration program includes 2,500m of drilling, trenching, and regional exploration, according to the company's September 2024 Presentation.

The results of any of these components could push up the explorer's share price.

Stock is an Immediate Strong Buy

The stock charts indicate Prosper Gold is positioned now to break out of its consolidation pattern and begin a new upleg, Maund wrote. This anticipated rally could be better than the last one.

Therefore, Maund rated the stock an Immediate Strong Buy for all time horizons and indicated he intends to remain long in it.

"The strongly positive results from this ZTEM survey make the stock even more of a Buy than it was before" he wrote.

Ownership and Share Structure

According to the company,17.9% of Prosper Gold is owned by management and insiders. Of those, CEO Peter Bernier owns the most with 12.88% and Director Jason Hynes owns 1.86%.

The rest is with retail investors.

The company presently has 36.7 million free float shares and a market cap of 4.3 million. The 52-week range of Prosper Gold is US$0.06–$0.15,

Important Disclosures:

Prosper Gold Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

* Disclosure for the quote from the Clive Maund article published on August 18, 2024

- For the quoted article (published on August 18), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$1,500.

- Author Certification and Compensation: [Clive Maund of clivemaund. com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

Clivemaund .com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.