Iron ore: not as pretty as gold, but in demand now. Photo by Peter Craven, Wikimedia Commons.

The Post-COVID Reflation Trade

Inflation and shortages seem to rival the weather now as elevator conversation. On Saturday, a neighbor seeing our cups of Starbucks cold brew, mentioned hearing about shortages at their stores, and mused about what their customers would do without Frappuccinos this summer. The combination of unprecedented fiscal and monetary stimulus over the past year, lots of production having been shut down, and pent demand due to lockdowns has been coming to a head.

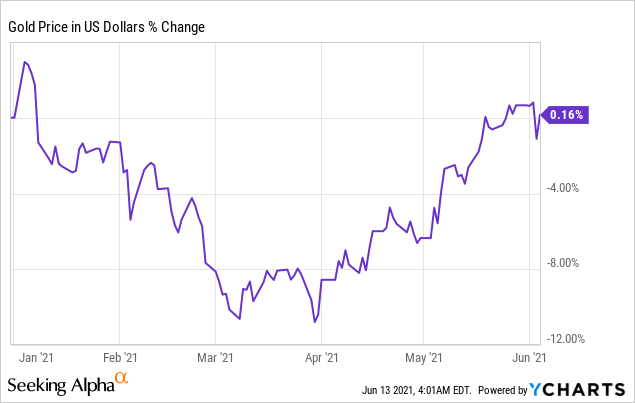

One way investors have attempted to play the reflation trade has been to buy gold, but gold has been flat so far this year.

Two other ways investors have attempted to play this have been industrial commodities and crypto. Our security selection system, which draws on investor sentiment expressed via the options markets, has picked up commodity and crypto names this year as well.

Industrial Commodities And Crypto Names

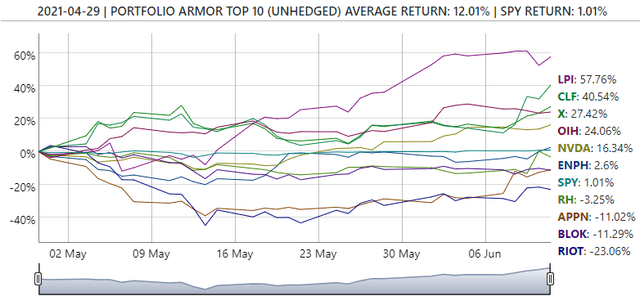

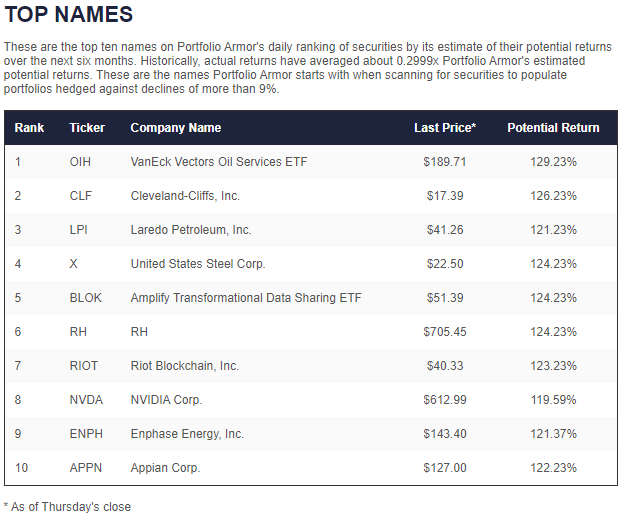

A good illustration of this was our top ten names from April 29th. The first four there were industrial commodities names: the VanEck Vectors Oil Services ETF OIH, Cleveland-Cliffs, Inc. CLF, Laredo Petroleum, Inc. LPI, and United States Steel Corp. X. Numbers 5 and 7 were crypto-related names, the Amplify Transformational Data Sharing ETF BLOK and Riot Blockchain, Inc. RIOT, and number 6 was a play on pent-up demand in home renovations RH, the company formerly known as Restoration Hardware RH.

Screen capture via Portfolio Armor on 4/29/2021.

Since then, as you can see, the industrial commodity names have led the pack, while the crypto names have sagged since Bitcoin corrected.

Cleveland-Cliffs A Top Name Again

What brought this to mind was the iron miner Cleveland-Cliffs appearing in our top ten again on Friday. If our system is right, CLF may have more room to run, and some of our goldbug readers may want to consider its shares as a complement to their gold holdings. That said, it's possible our system will end up being wrong about CLF this time. And whenever we see a stock that's up 40% in month and a half, we start thinking about downside protection. With that in mind, below is a way to invest in Cleveland-Cliffs while strictly limiting your downside risk.

A Hedged Bet On Our Top Iron Miner

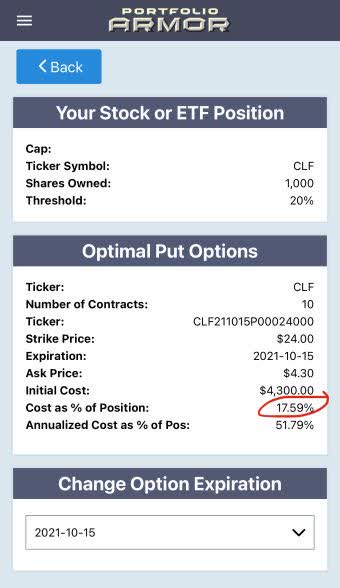

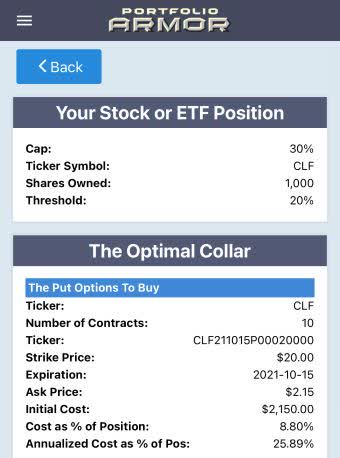

Let's say you have a thousand shares of CLF and you want to limit your risk over the next several months to a drawdown of no more than 20% in the worst case. Here's a look at two ways of doing that.

Uncapped Upside - Expensive

CLF is pretty expensive to hedge with puts now. As of Friday's close, these were the optimal puts to hedge against a >20% drop by mid-October.

This and subsequent screen captures are via the Portfolio Armor iPhone app.

The cost was $4,300, or 17.59% of position value. To be conservative, that cost was calculated at the ask (you can often buy and sell options at some price between the bid and ask), but it was extremely high in any case.

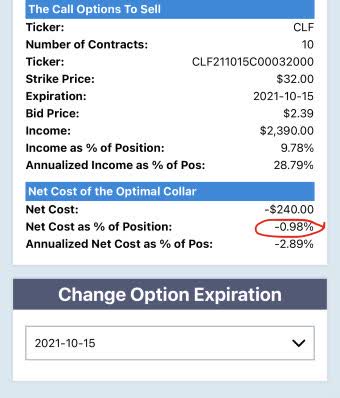

Capped Upside - Negative Cost

If you were willing to cap your possible upside at 30%, this was the optimal collar to hedge 1,000 shares of CLF against a >20% drop over the same time frame.

Here, the cost was negative, meaning you would have collected a net credit of $240 when opening that hedge, assuming to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.