Will Russia Finally Retaliate Outside Of The Ukraine?

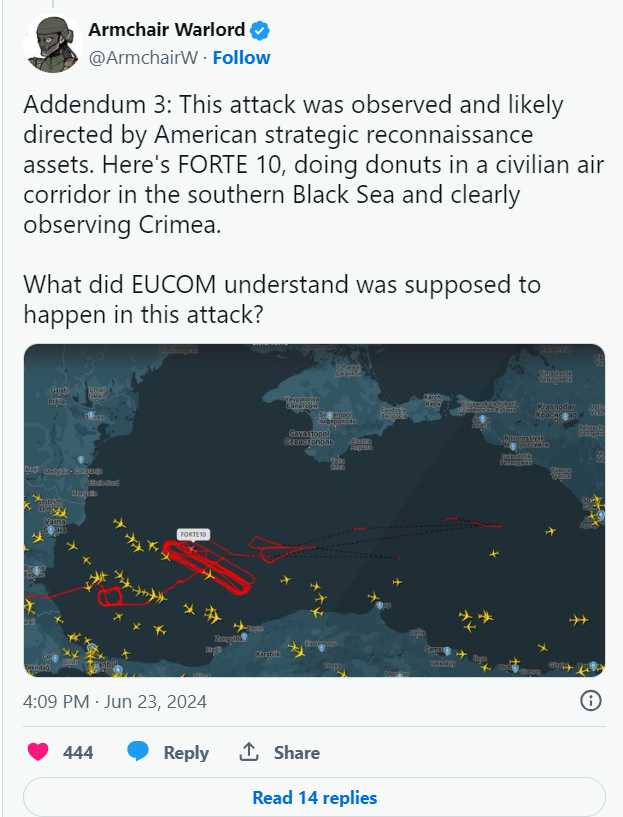

The Ukrainian attack that killed at least 5 Russian beachgoers and wounded another 124 in Sevastopol on Sunday reportedly used American-supplied ATACMS missiles armed with cluster munition warheads. A number of open source intelligence analysts have suggested the missiles were observed and may have even been directed by a U.S. Air Force surveillance drone operating nearby at the time.

As ZeroHedge noted in the post I linked to above,

Likely Russia is gearing up to pummel multiple sites across Ukraine, and will try to go after bases hosting foreign military equipment and arms storehouses.

But will Russia also retaliate outside of the Ukraine? There have been hints by Russian officials that it might. According to Russia's Ministry of Foreign Affairs Telegram channel, Russian Ambassador to the U.S. Anatoly Antonov said this when asked to comment on the ATACMS strike on Crimea (emphasis ours):

The [U.S.] administration demonstratively supports the crimes of the Kiev regime. [...]

Washington's attempts to silence the terrible crime against Russian citizens cause anger and indignation. Americans cannot sit overseas and escape responsibility for the blood and tears of innocent people. [...]

It is obvious to policymakers in Washington that cluster munitions in ATACMS missiles cannot be launched without the participation of American specialists and support from US intelligence. It is no coincidence that enemy drones are circling over the Black Sea almost every day.

Let's pause for a moment and note that this is a seasoned diplomat using the word "enemy" to describe the U.S. Back to Ambassador Antonov, skipping to the end of his answer:

We are confident that the Nazis will receive a harsh response at the front. And not only there.

Similarly, this was what former Russian President and Prime Minister and current deputy chairman of the Security Council of Russia, Dmitry Medvedev, had to say on his Telegram channel after the attack (again, emphasis ours):

The US bastards are supplying banderovsty with cluster munitions and help them take aim at targets. The Kiev bastards are choosing a beach filled with civilians as their target and press the button. Both will burn in hell; hopefully, not just in the sacral flames, but even before that, in early fire.

What happened is not military actions but a sneaky and vile terrorist attack on an Orthodox holiday, just like the massacre that extremists had carried out in Dagestan. Which is why we do not differentiate between any of them, whether it is the American authorities, bandera regime, or insane fanatics.

How Would Russia Retaliate Against The U.S.?

There's a good chance Russia won't retaliate against the U.S. now, preferring instead to see how the U.S. election in November plays out. It seems crazy to say this, but so far the prudence and restraint of Putin and Xi are what has prevented World War III.

The Current Worst Case Scenario

Currently, the U.S.S Eisenhower is in the Mediterranean, and The U.S.S. Roosevelt is headed toward the Middle East. Last week, Israel's military approved battle plans for an offensive against Hezbollah in Southern Lebanon, in retaliation for Hezbollah's missile attacks from there against Northern Israel. Israel is already bombing Southern Lebanon.

The worst case scenario would seem to be Russia giving advanced anti-ship missiles to Hezbollah, and Hezbollah hitting a U.S. aircraft carrier with them.

Protecting Your Portfolio In The Worst Case Scenario

Last October, after the current round of hostilities in the Middle East started, we shared this post about our hedged portfolio method.

As it happened, hedging proved unnecessary then, because the war didn't spread as feared. There were the Iranian and Israeli attacks on each other, but neither did much damage, and both countries made clear that they wanted to avoid an all-out war with each other.

A successful missile strike on a U.S. aircraft carrier would be different though. For decades, aircraft carriers have been the global symbol of American power--who knows how markets would react to seeing one hit with Russian-supplied missiles. If you're worried about that, you might consider our hedged portfolio method. We summarized that approach in our post last October:

The Hedged Portfolio Method

The basic idea here is to buy and hedge a handful of promising names that are relatively inexpensive to hedge. Here's the process we use do that:

- Estimate potential returns over the next six months for every security with options traded in the U.S.

- Calculate the least expensive way of hedging each of those securities while capturing that estimated return.

- Subtract the hedging cost from the estimated returns, and rank the names by estimated return net of hedging cost.

- Buy and hedge and handful of the top names.

There's a bit more to the process than that--we also include a step to minimize cash, since everything's hedged--but that's the basic idea.

Sounds Difficult?

Manually, it would be. But we use an automated system where you just type in the amount of money you want to invest, the largest drawdown you're willing to risk, and our portfolio construction algorithm does the rest.

The interface looks like this.

What If Nothing Happens?

There's a mutual fund manager whose name we won't mention, who predicted doom for years, hedged, and generated lousy returns as a result. We try to avoid that. Let's see what would have happened if you used our hedged portfolio method around the time of our hedging post back in October.

This is the hedged portfolio our system presented on October 19th of last year, to an investor with $3 million who was unwilling to risk a decline of more than 20% over the next six months if the Mideast war sank the market. This portfolio included ACM Research Inc. ACMR, Affirm Holdings, Inc. AFRM, Abercrombie & Fitch Co. ANF, Dell Technologies, Inc. DELL, Fabrinet FN, NextGen Energy, Ltd NXE, Super Micro Computer, Inc. SMCI, and Sterling Infrastructure, Inc. STRL.

As you know, the Mideast didn't sink the market.

Here's how his hedged portfolio performed over the next six months, net of hedging and trading costs: It returned 30.68%, versus the S&P 500's return of 16.59%.

You can see an interactive version of that chart here.

Seems like a pretty good deal, no? If the market crashes, you're protected, and if it doesn't, you still have a shot at a market-beating return.

If you'd like to stay in touch

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.