Biogen Inc BIIB to acquire gene therapy company Nightstar Therapeutics PLC NITE.

Roche Holdings AG Basel ADR RHHBY agrees to buy Spark Therapeutics Inc ONCE.

Sarepta Therapeutics Inc SRPT exercises option to buy Myonexus Therapeutics for $165 million, acquiring five gene therapy candidates to treat limb-girdle muscular dystrophy.

Johnson & Johnson JNJ's Janssen unit signs a licensing deal with gene therapy company MeiraGTx Holdings PLC MGTX for developing a portfolio of drugs for inherited retinal disease. Incidentally, J&J's investment arm JJDC buys $40 million of MeiraGTx shares in a $80 million private placement that closed March 1.

Pfizer Inc. PFE picks up a 15-percent stake in French gene therapy company Vivet Therapeutics, along with an option to fully acquire the company.

Gene therapy M&A headlines have taken the spotlight this year, following up on two major gene therapy deals announced in 2018: Celgene Corporation CELG's $9-billion purchase of Juno and Novartis AG NVS's acquisition of AveXis for $8.7 billion.

The following is a look at why gene therapy M&A is on a roll.

Genes: A Novel Therapeutic Option

Gene therapy is a technique that taps into genes as a curative or preventive treatment option, according to the National Institutes of Health.

In layman's terms, gene therapy is treating diseases by replacing, supplementing or altering a gene that is absent or abnormal.

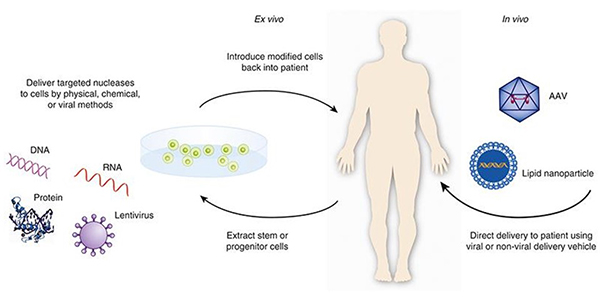

The treatment approach can be in more than one mode, including:

- Replacing a disease-causing mutated gene with a healthy copy of the gene.

- Inactivating an improperly mutated gene.

Introducing a new gene to fight against an existing disease or disorder.

Gene therapy is used for rare and orphan diseases for which there are no existing treatment options. It holds promise for several conditions such as inherited disorders, certain cancer types and certain viral infections.

Some of the gene therapy products used are plasmid DNA, or genetically engineered circular DNA that carries therapeutic genes into human cells; viral vectors; bacterial vectors; and patient-derived cellular gene therapy products.

A technique called human gene editing technology is also a part of gene therapy, whereby harmful genes are disrupted or mutated genes are repaired.

Source: FDA

The Importance Of Gene Therapy

Gene therapy is considered a patient-friendly treatment option. For example, in the ordinary course of diabetes treatment, using insulin injections can be managed only as long as the proteins exist in the bloodstream. Gene therapy ensures longer-term expression of the necessary proteins.

Due to the accuracy associated with gene therapy, it creates the potential to treat cancer without damaging healthy cells.

The deterrent to the therapies has been high prices, especially at a time when lawmakers are fuming over elevated drug prices.

See Also: Analysts Positive On Insys Ahead Of 2019 Pipeline Catalysts

FDA-Approved Gene Therapies

Among the FDA-approved cell therapies are Gilead Sciences, Inc. GILD's Yescarta and Novartis AG NVS's Kymriah.

Novartis' Kymirah — a CAR T-cell therapy — has been approved for two indications. The first: patients up to 25 years of age with B-cell precursor acute lymphoblasticleukemia, or ALL, that is refractory or in second or later relapse. The second indication is for adult patients with diffuse large B-cell lymphoma and high-grade B-cell lymphoma.

Yescarta is a CD19-directed genetically modified autologous T cell immunotherapy indicated to treat adult patients with relapsed or refractory large B-cell lymphoma after two or more lines of systemic therapies. Gilead acquired Yescarta following its Kite Pharma purchase.

Spark notched a gene therapy approval for Luxturna in December 2017. Luxturna, priced at $850,000 for both eyes, is a one-time gene therapy for treating adult and pediatric patients with vision loss due to inherited retinal dystrophy. It also has the distinction of being the first adeno-associated virus vector gene therapy approved in the U.S.

Novartis is also on the cusp of gaining another approval, with its AVXS-101, aka Zolgensma, an investigational gene replacement therapy candidate to treat spinal muscular dystrophy, or SMA Type 1. The FDA is set to rule on the asset in May.

Potential Gene Therapy Takeout Candidates

1. Regenxbio Inc RGNX

Regenxbio could be the "the best fit" for Novartis as the larger company seeks to build its adeno-associated virus pipeline, Christopher Venutolo said in a Jan. 21 Seeking Alpha article.

Two of the gene therapy deals seen so far this year involved companies developing therapies for genetic eye disorders.

The company's proprietary NAV Technology platform is being used across 18 diverse clinical stage programs, with Novartis' Zolgensma for treating SMA Type 1 developed using the platform inching closer to approval in 2019.

2. Uniqure NV QURE

Dutch biotech Uniqure has been credited as a gene therapy pioneer, having introduced Glybera, the first gene therapy, in the European market. The company later pulled out of the market due to the exorbitant cost.

Uniqure has a manufacturing capacity that is five times that of Spark's, S&P Global said, citing Leerink analyst Joseph Schwartz. The analyst said market readiness for a gene therapy largely depends on manufacturing capability and clinical data.

S&P Global also quoted Stifel analyst Stephen Wiley, who drew a parallel between the Uniqure and Spark pipelines. The former's hemophilia B gene therapy AMT-061 closely resembles Spark's hemophilia therapy SPK-0091, but carries fewer serious risks, the analyst said.

"Now that AveXis and Spark have been acquired, Uniqure is the only public company left with an AAV-based gene therapy asset which has both Breakthrough Therapy and PRIME designations," Chardan's Gbola Amusa said in a late February note.

"Uniqure has the potential to be the market leader in hemophilia B with AMT-061, as it could be of high interest to big biopharma companies."

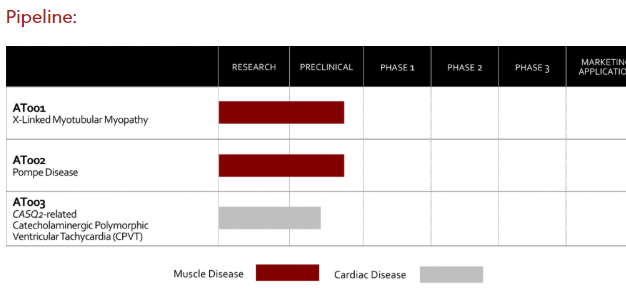

3. Audentes Therapeutics Inc BOLD

Audentes is also identified as a potential M&A target, with Leerink's Schwartz suggesting that the company uses a suspension process similar to Spark's for its investigational therapy.

Source: Audentes

4. Solid Biosciences Inc. SLDB

Solid Biosciences' potential as a M&A target is due to its manufacturing process.

"Solid Biosciences' manufacturing could yield more potent gene therapy that may appeal to some parties," Schwartz said.

The company has a Phase 1/2 asset: SGT-001, a corrective gene therapy for Duchenne muscular dystrophy.

5. Sarepta

Sarepta is the most likely M&A candidate, given its $10-billion market cap; the deepest gene therapy pipelines in the industry; emerging large-scale manufacturing capacity; and first-mover position with its DMD gene therapy lead program, Credit Suisse analyst Martin Auster said in a recent note.

6. BioMarin Pharmaceutical Inc. BMRN

Analysts also do not rule out the possibility of M&A activity with relatively bigger companies such as BioMarin.

"The M&A interest in hemophilia-based gene therapy bodes well for BioMarin's risk-reward, with a Phase 2 data readout for its valrox hemophilia A candidate due in the second quarter of 2019," Credit Suisse's Auster said.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.