From Spanish banks to Greek elections to the ECB/China/IMF saving the world rumor du jour, there has been a flurry of headlines out of Europe for the better part of the last year and it is these headlines that have been moving the market. There is reason to be alarmed and to fear, not from a Greek default or a Greek exit, but the ensuing contagion and bank runs on peripheral banks. This is where the real risk is, and investors must understand that. The question really becomes: what is the best way to play this? What is the best way for investors and traders to profit from the different scenarios?

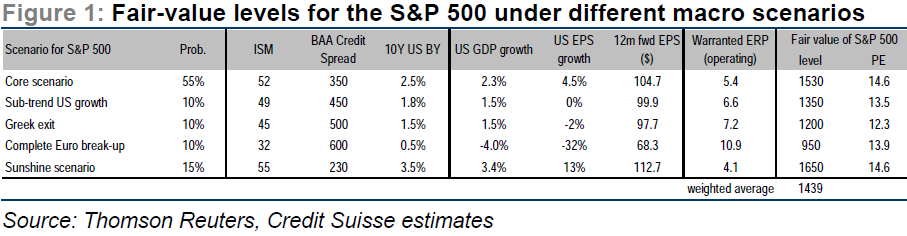

First, we must recognize all of the different scenarios and try to assign a probability to each of these, and the researchers at Credit Suisse have done that for us. They see a 55% chance of a core scenario, where US GDP grows 2.3% this year, earnings grow 4.5%, and an end of year price target on the S&P 500 of $1530. If US growth slows, their price target falls to $1350 and in the case of a Greek exit it falls further to $1200. Also, in the case of a complete dissolution of the European Monetary Union, they have a price target of $900 for the S&P 500, and all of the previous three scenarios carry a 10% probability. Lastly, they have the sunshine scenario, which entails hyper-charged US growth in the second half of the year and 13% earnings growth by US companies, putting the S&P 500 at $1650. Altogether, they get an expected fair value of the S&P 500 of $1439.

Under all scenarios, they like anything with lots of dollar exposure and little euro exposure. They see the euro weakening into the 1.00-1.10 range in the core scenario, and a break through parity in the less optimistic ones. Traders can short the FXE FXE to take advantage of this trade. However, if investors wish to look for a different trade to take advantage of dollar strength, they could buy the dollar index UUP or long US stocks SPY and short European stocks EZU, to take advantage of the out-performance of the US. Investors could also short German bonds BUND if they believe that the Eurozone will not dissolve and Europe will return to normal.

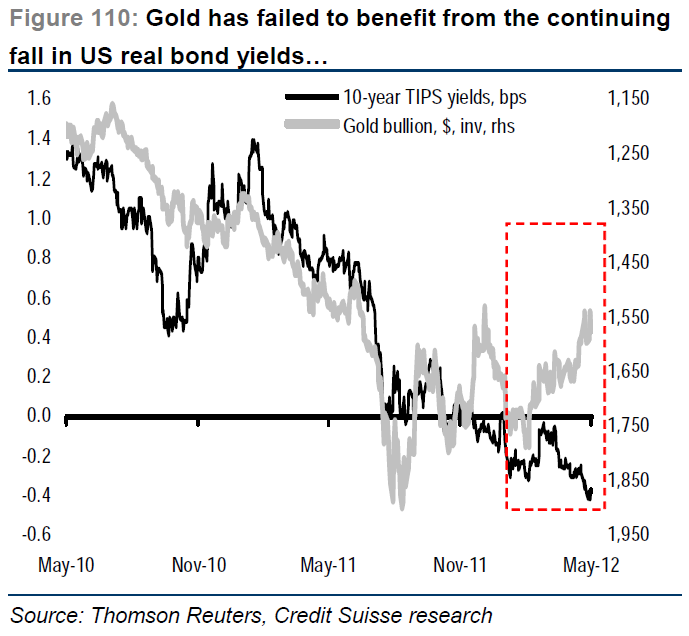

In the darker scenarios, investors may want to look at simpler trades. Going long the US dollar is the easiest trade here, but also shorting the euro makes sense. Further, they like pharma stocks, for they are lower risk stocks. CS likes the fact that they have low leverage and have the least economic sensitivity of any sector; pharma was the best performing sector in the six months after Lehman failed. Investors should look at buying pharma stocks IHE. Lastly, they say buy gold GLD in the event of financial chaos, as gold has decoupled recently from inflation expectations (measured through the TIPS yield) and German bond yields.

Bullish:

Traders who believe that the European Monetary Union will remain intact might want to consider the following trades:

- long US stocks SPY

- short euro FXE, as inflation in the core will be the only solution to avoid deflationary spirals in the periphery to restore competitiveness, keeping the union intact

- long European stocks EZU

Traders who believe that Greece or any other nation will leave the European Monetary Union may consider alternative positions:

- long gold GLD as authorities will have to print to sustain the global financial system

- long US stocks SPY against European stocks EZU

- short euro FXE

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.