Blackberry Shares Tumble But It's Not Too Late To Hedge

Blackberry BBRY shares tumbled 7.74% Friday on reports of a lukewarm response to the company's new Z10 phone by US consumers. Nevertheless, it's not too late (or too expensive) for Blackberry longs to hedge against a significant further decline from here. In this post we'll look at a way to do that.

Of Two Ways To Hedge, One Works Here

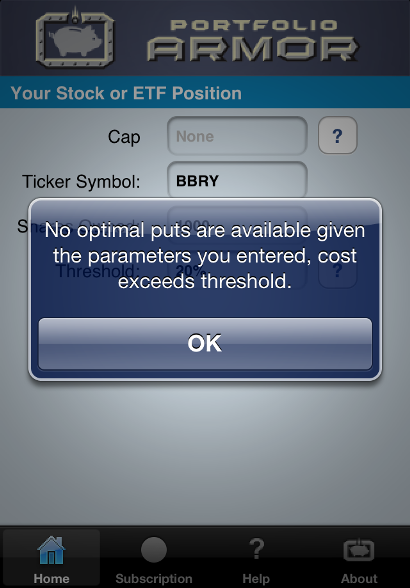

In recent posts, we've looked at two ways to hedge stocks: with optimal puts* and with optimal collars**. Optimal puts are generally more expensive, but allow uncapped upside. We usually look at hedging against greater-than-20% drops for equities, because that's a decline threshold that's large enough that it reduces the cost of hedging, but not so large that it's an insurmountable decline to recover from -- and, in some cases, e.g., with Affymetrix AFFY here, or with Cliffs Natural Resources CLF here -- the optimal hedges against >20% drops can provide more protection than promised. In the case of BBRY on Friday, it was too expensive to hedge against a greater-than-20% drop using optimal puts, as the screen capture from Portfolio Armor below explains.

In the case of BBRY on Friday, the cost of hedging it against a greater-than-20% loss was itself higher than 20% of your position value, so Portfolio Armor indicated there were no optimal puts available for it.

Hedging BBRY With An Optimal Collar

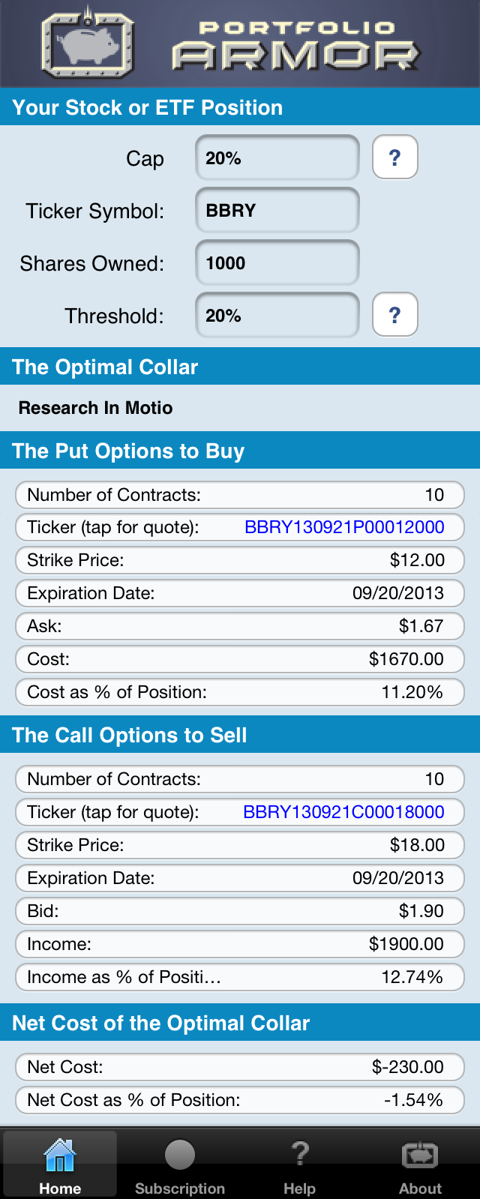

Although it was too expensive to hedge BBRY against a >20% drop over the next several months with optimal puts, it was not too expensive to hedge it against the same drop using an optimal collar, if you were willing to cap your potential upside by the same percentage over the same time frame. The screen capture below shows the optimal collar, as of Friday's close, to hedge 1000 shares of BBRY against a greater-than-20% drop by September 20th, with an upside cap of 20%.

As you can see at the bottom of the screen capture above, the net cost of this optimal collar is negative, meaning that a BBRY investor would be getting paid to hedge in this case.

*Optimal puts are the ones that will give you the level of protection you want at the lowest possible cost. Portfolio Armor uses an algorithm developed by a finance Ph.D to sort through and analyze all of the available puts for your stocks and ETFs, scanning for the optimal ones.

**Optimal collars are the ones that will give you the level of protection you want at the lowest net cost, while not limiting your potential upside by more than you specify. The algorithm to scan for optimal collars was developed in conjunction with a post-doctoral fellow in the financial engineering department at Princeton University. The first two screen captures above come from the Portfolio Armor iOS app.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.