The big event of Tuesday was Federal Reserve Chairwoman Janet Yellen's semi-annual testimony on monetary policy before the Senate Banking Committee.

No one really expected Ms. Yellen to break any new ground with her prepared testimony. So the key for traders was to listen to the tone of the Fed Chair's testimony and more importantly, how she responded to the Senator's questions.

While Yellen’s prepared remarks and the vast majority of the Q&A session did not provide any new, meaningful insight on the Fed monetary policy, the session with the Senate Banking Committee did wind up moving the markets.

On the policy front, the key takeaway was that Ms. Yellen wasn't quite her usual uber-dovish self. No, the bottom line is she was seen as slightly more hawkish than expected. Not a big deal really, but the "tone" was worth noting.

Specifically, Ms. Yellen said, "If the labor market continues to improve more quickly than anticipated by the [Fed], then increases in the federal-funds rate target likely would occur sooner and be more rapid than currently envisioned."

Remember, the Fed has kept short-term rate near zero since late 2008 and that the consensus expectation for the Fed's first rate hike is June 2015 or slightly thereafter. So, given that Yellen's testimony and the way she worded her responses (which stressed that the Fed would be data dependent going forward) was slightly less dovish, analysts believe that the door may now be open for rate hikes to occur sooner than expected.

The Big Surprise

As tends to be the case around any Fed-related event, the market was fairly volatile while Yellen was testifying. The bottom line here is the HFT algos were trained on both the prepared testimony and then every single word that came out of the Fed Chair's mouth during the Q&A session. Therefore, there were several spikes during the testimony yesterday - all to the downside.

Some in the financial press called it Yellen's "Irrational Exuberance" moment (referencing Alan Greenspan's suggestion that the stock market had gotten a bit out of hand in the late 1990s). The big surprise in Ms. Yellen's speech appeared to be not one, but two references to the idea that valuations had become stretched in the areas of biotech and social media.

Picking on Biotech and Social Media

Since Ms. Yellen's comments on the two embattled sectors came from her prepared testimony, this was NOT a slip of the tongue. No, the Fed Chair apparently wanted to send a message.

Yellen wrote: "...Valuation metrics in some sectors do appear substantially stretched—particularly those for smaller firms in the social media and biotechnology industries, despite a notable downturn in equity prices for such firms early in the year."

It was surprising enough for the Fed Chair to mention specific industry groups, which have absolutely nothing to do with monetary policy, the economy, or inflation, which are the Fed's traditional bailiwicks. However, Yellen brought up the stock market valuation issue a second time in her testimony.

Yellen also wrote: "Equity valuations of smaller firms as well as social media and biotechnology firms appear to be stretched," she said, "with ratios of prices to forward earnings remaining high relative to historical norms."

The Algos Respond

The news-feed algos are pretty good at identifying potential market-moving issues and this time was no different. Boom - biotech XBI, social media SOCL, internet FDN and small caps IWM were hit with sell algos.

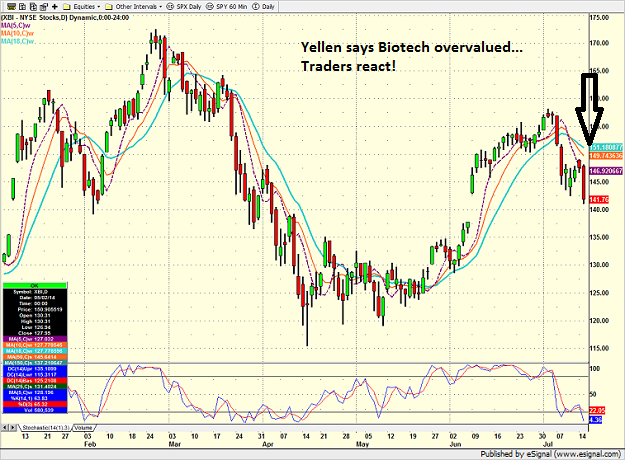

SPDR S&P Biotech ETF XBI

As the graph of the XBI clearly illustrates, traders and their ultra-fast computers sold the former momentum names in earnest on Tuesday. And given that the XBI appeared to break down into a downtrend, one could argue that the momentum meltdown trade could be "on" again.

Yellen Trumps Earnings

It was not surprising to see the market focus on Yellen's comments about the mo-mo names and the small caps. However, it was also interesting to note that Yellen's valuation call basically trumped positive earnings and some pretty good economic data.

For example, the earnings from Citigroup C, JPMorgan JPM, Goldman Sachs GS, Johnson & Johnson JNJ and Intel INTC were ALL better than expected on both the top and bottom lines. Heck, Intel even raised guidance for the coming quarter. Not bad.

In addition, the Empire Manufacturing Index, which measures business conditions in the New York region came in at 25.6 in July, which was a 4-year high and well above the consensus for 16.8 and last month's reading of 19.3.

So... the question of the day is what will drive the markets going forward. Will it be Yellen's valuation call and the potential for rates to rise sooner than expected? Or will the improving earnings/economic data will drive the markets.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.