Investors have become enamored with dividend ETFs for their strong capital appreciation and income stream over the last several years. However, one area of the dividend spectrum that failed to produce strong returns in 2014 are emerging market dividend funds.

In fact, many of these financial-heavy indexes have underperformed broad-based and low volatility emerging market ETFs despite their much more attractive yields than U.S.-based alternatives.

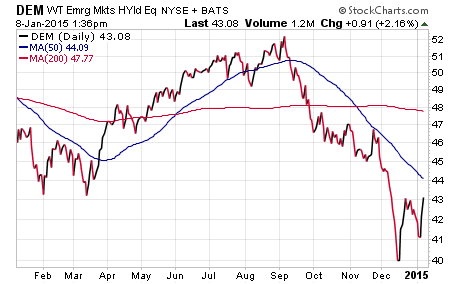

The WisdomTree Emerging Markets Equity Income Fund (DEM) is the largest ETF in this space with over $2.2 billion in total assets. This ETF tracks over 300 high yield stocks from countries such as China, Russia, and Taiwan to name a few.

The companies within the DEM index are ranked and weighted according to dividend payout, which combines to generate a 30-day SEC yield of 5.26 percent. This contrasts sharply with the majority of U.S.-listed high dividend ETFs, which sport yields closer to 3 percent.

Last year, DEM had a total return of -13.34 percent with dividends included. This performance came in well below even a broad index such as the Vanguard FTSE Emerging Market ETF (VWO), which was flat in 2014.

Russia makes up 15 percent of the total exposure in DEM, which weighed on the index as one of the worst performing emerging market countries last year.

The SPDR S&P Emerging Markets Dividend ETF (EDIV) is another high yielding equity option for international investors. This fund focuses on a narrower range of 120 stocks with strong dividend characteristics. In addition to liquidity and market cap requirements, companies in EDIV must have positive 3-year earnings growth and profitability.

EDIV fell 8.87 percent last year, which bested DEM but still fell short of expectations. This ETF currently has over $425 million in total assets and a 30-day SEC yield of 5.34 percent.

These emerging market dividend ETFs have an uphill battle to climb in the New Year, but may find themselves as a value-oriented opportunity for investors looking to diversify overseas.

Disclosure: the author has a position in VWO at the time this article was published.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.