On June 4, Oppenheimer REIT analysts Steve Manaker and Amit Nihalani published an "Industry Update -- NAREIT Preview," focused upon interest rate trends and the overall real estate environment.

Oppenheimer remains bullish for the next 12 to 18 months and remains Overweight on the REIT sector, because they feel the data indicates that the overall real estate environment trumps interest rates when it comes to REIT performance.

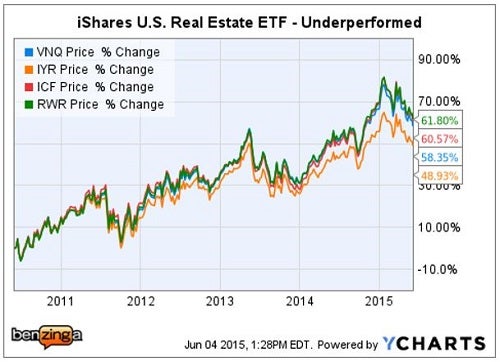

The easiest way for most investors to gain exposure to the real estate asset class is to allocate a portion of their portfolio to real estate ETFs. Here are the four largest ETFs by dollar volume:

- Vanguard REIT Index ETF VNQ - $26 billion, 143 REITs, 37.7 percent Top 10

- iShares U.S. Real Estate ETF IYR - $4.5 billion, 115 REITs, 34.9 percent Top 10

- iShares Cohen & Steers REIT ETF ICF - $3.2 billion, 31 REITs, 57.5 percent Top 10

- SPDR DJ Wilshire REIT ETF RWR - $3 billion, 92 REITs, 44.5 percent Top 10

Tale Of The Tape - Past 12 Months

The VNQ tracks the MSCI Equity REIT Index, a good proxy for the overall sector.

On the other side of the coin, top performing ICF is comprised of 31 large/mid-cap REITs, heavily weighted toward the largest 10 REITs by market cap.

Tale Of The Tape - Past 5 Years

Having the lowest exposure to the Top 10 REITs contributed to underperformance by the IYR ETF vs. this peer group over the past five years.

<>Oppenheimer - REIT Trends

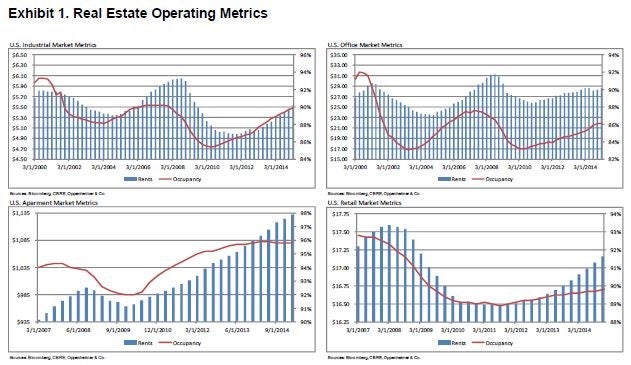

1. Real Estate Fundamentals: "The operating environment remains strong with demand growing faster than supply across most sectors and geographies. This is causing rising occupancy and rental rates. Development is increasing but remains relatively modest."

2. REITs vs. Rates: "REITs both out- and underperformed in rising short- and long-term rate environments. During the last three Fed rate hikes REIT returns vs. the broader market were mixed."

3. NAREIT Preview: Oppenheimer believes that NAREIT's upcoming REITWeek will be "good-boring," with few surprises, and doesn't view it as catalyst for REIT shares, either up or down.

4. REIT Valuations: Oppenheimer "continue[s] to believe REITs will outperform the broader market given the attractive real estate environment and relatively attractive valuations.

The valuations of commercial real estate and REITs are similar, absolutely expensive but relatively attractive."

5. REIT Sector Growth: Oppenheimer noted that there continue to be more REIT publicly listed through IPOs and spin-outs, than lost via M&A or being taken private.

A potential bigger catalyst cited by Oppenheimer, was in about a year equity REITs will become their own sector, separate and apart from Financials. Oppenheimer believes this will lead to a greater number of investors who will be buying REIT shares.

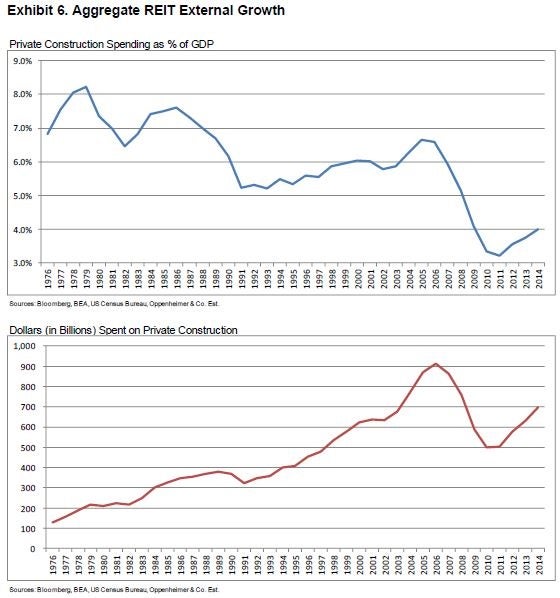

Oppenheimer - A Muted Supply

Oppenheimer points out that "the longer the duration of the development phase, the more vulnerable the real estate environment is to a slowing economy."

It is especially striking to look at the percent of private construction dollars vs. U.S. GDP, the top chart in blue, above.

If demand for real estate were to begin to slow, the muted supply vs. historical averages should help mitigate occupancy losses and downward pressure on rental rates.

Oppenheimer - Bottom Line

Oppenheimer believes that "REIT underperformance YTD is due to investor concerns about the negative impact of rising rates on REITs and commercial real estate valuations."

Oppenheimer's view continues to be that REITs are more economically sensitive than interest rate sensitive.

A key takeaway is that "given the strong investor interest in commercial real estate and the relatively wide spread between cap rates and interest rates, [Oppenheimer] believe[s] there is enough spread to absorb a rate increase.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.