The world’s energy needs are expected to increase considerable in the next decade and renewable energy sources shall play a key role in helping meet new energy demands.

In 2013, energy production from wind and solar grew at their fastest pace ever, according to data from the International Energy Agency. During the same year, more than $250 billion was invested into various renewable energy projects.

Just to gauge the scale at which the world will rely on renewables to meet its future energy requirements, look at the graph below:

Renewables will account for 15 percent of installed energy generation capacity by 2035. A large chunk of this growth will be from wind and solar.

A combination of government subsidies, private sector investment and other factors are responsible for the growth trend we are witnessing in the renewable energy sector. The fall in sunk and operational costs of running generation stations is also an important factor.

The price of solar panels has fallen by 80 percent since 2008, and so have those of wind turbines, which are also on a downward trend.

Storage Capacity A Key Aspect

Storage Capacity A Key Aspect

With a chunk of future energy likely to come from the wind or the sun, this presents a major challenge, one which has not been given enough attention. The sun does not shine all day and the wind does not blow all the time.

There is a need for solutions that can store energy during peak production periods and save them for later when they are needed. Seeing this challenge, local government actors are already beginning to take action.

The states of California, Texas and New York are currently supporting the research and design of the next-generation energy storage solutions.

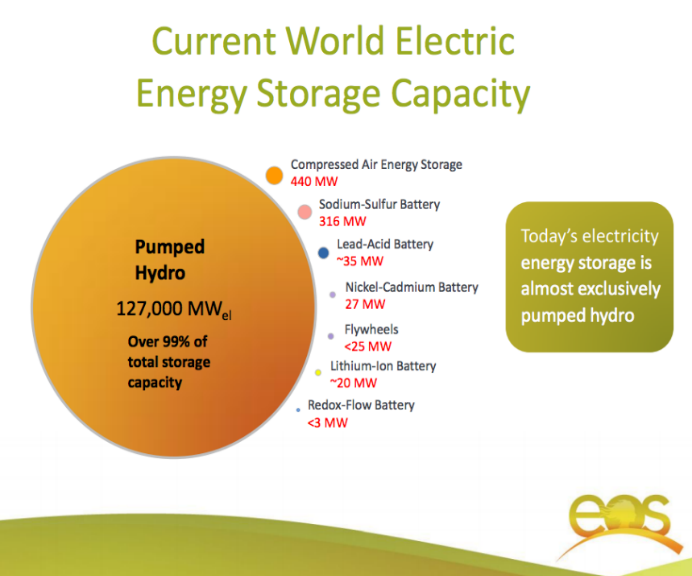

According to a research conducted by the Electric Power Research Institute (EPRI) in 2010, global energy storage capacity is only 3.2 percent of total energy generated.

Pumped hydro represents more than 90 percent of the stored energy capacity; it is not yet very reliable, as it is restricted to areas with the right geographical conditions. That leaves one type of technology: old-fashioned “batteries.”

In order to serve the demands posed by increase in the generation capacity of renewable energy sources, there is a need for research and development of technologies that allow mass storage to serve whole communities. It here that there is a revolution going on, as various players jostle for a slice of this growing industry.

The lithium-ion sub segment is the one generating much interest due to the amount of potential that it holds.

A silent revolution is currently taking place that would have major ramifications for the energy industry. Lithium-ion batteries offer a number of advantages as compared to the other technologies employed in batteries:

- High Energy density: Compared to the traditional nickel-cadmium batteries, lithium-ion has twice the energy density. This makes it suitable for a whole range of purposes, including mobile phones, and other handheld devices that need to continue operating between charges. For large-scale energy storage operations, this is also a big advantage.

- Self-discharge: Lithium-ion batteries have a low self-discharge rate compared to other batteries.

- Low maintenance required: Lithium-ion batteries do not require much maintenance to ensure that that they keep working at their optimum capacity.

- Different types available: the advantage of lithium-ion battery technology is that it can be modified for use in different applications.

With the energy storage market thought to be worth over $20 billion by 2020, there is a lot of opportunity ahead. These companies are currently at the forefront of the battery revolution, so investors should take a look.

Tesla Motors Inc TSLA

Tesla Motors Inc. comes top in a number of research reports for investors looking for opportunities in the growing battery market. Over the last five years, the company has solidified its position as the one of the top electric battery makers and its shares have skyrocketed during this period.

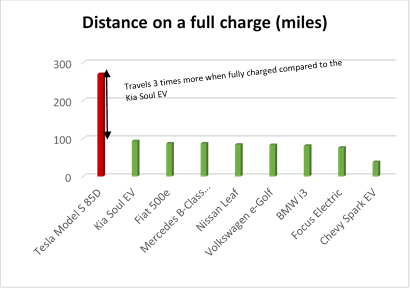

The distance a car can travel on a single charge, charging time, easy access to a power source, battery safety and others have always been major sticking points in this area. Tesla is winning in a number of these areas -- the Model S can travel 270 miles on a single full charge.

Based on the most recent survey that ranks electric vehicles by possible distance traveled on a single charge, the Model S travels thrice the distance when fully charged compared to its closest rival, the Kia Soul EV.

The company is currently developing one of the biggest electric vehicle charging networks in the United States. At these points, vehicles can achieve a full charge within 1 to 20 minutes.

Besides giving a boost to the commercial feasibility of using lithium-ion batteries to power vehicles, Tesla is also developing systems for storing large amounts of energy produced from wind and solar sources for domestic and industrial use. While the potential seems enormous, Tesla still has a long way to go in turning most of its announced ideas into reality.

Because of this, shares have been very volatile.

EnerSys ENS

Although EnerSys is a recognized player in the energy storage industry, it is focused on a particular market niche. EnerSys is the global leader in the supply of stored energy solutions for various industrial applications. These include reserve power products used in telecommunication equipment, lighting, military submarines and industrial forklifts.

The company has a strong brand image, an important attribute for a market that is more interested in the reliability of the product than the price. Its distribution network spans 200 countries. In places with erratic power supply, EnerSys products come in handy in helping reduce downtime of equipment.

Overall, the company’s fundamentals look solid, but there are some areas of concern. Revenue growth has been modest at an average rate of 7.8 percent per year in the last five years. Year on year, revenue growth is down 11.4 percent.

Operating margins and net margins have also been on a downward trend in the last two quarters, with the latter declining to 4.2 percent during the third quarter of 2015, from 8 percent in the previous quarter. Operating cash flows are healthy at $61.6 million, which is the three times the company's net income.

Johnson Controls Inc JCI

Another active player in the battery industry, Johnson Controls, operates in three main segments: building efficiency, automotive experience and the power solutions segment, which manufactures lead-acid batteries used in powering conventional and electric vehicles.

Having diversified from its HVAC unit earlier this year, it appears that the company is looking to place more focus on its battery unit.

Research and development is currently focused on next-gen electric vehicle batteries -- it's unlikely this company will enter the grid storage industry anytime soon. Year over year revenues have been on a steady growth path for the past three years, but key fundamentals do not seem to be performing that well.

Take for instance, gross and net income margins for 2014, which were at 15.47 percent and 2.8 percent, respectively -- well below rivals. Johnson's balance sheet shows long-term liabilities of $21 billion against assets of $33 billion, but the quality of the assets raises some red flags.

Net receivables and inventory total about $8 billion.

Opportunity Enormous

Besides the three companies mentioned above, there are other players in the growing energy storage solutions industry.

These include The AES Corporation AES, mPhase Technologies, Inc. XDSL, Eos Energy Storage LLC and SolidEnergy LLC.

mPhase, for example, is looking to revolutionize the industry with the mPhase Smart NanoBattery for storing energy with unlimited shelf life.

While a number of these technologies are mostly still in the development stage, the opportunity has never been greater, with the stream of renewable energy capacity that is likely to come on board in the next decade.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.