Last week was very busy and this week the stock market has started off with a degree of concern.

However, the selling pressure that we saw on Monday was much different than the selling pressure that we saw last week, so let's talk about why.

I have been very vocal about my belief that the probability of a market crash in 2016 is high. My focus is on liquidity using simple supply and demand models as that relates to societal norms and lifetime investment patterns as those are defined by my macroeconomic work, The Investment Rate, but I also have taken that further by integrating immediate liquidity concerns as those relate directly to margin debt.

Although we can never be sure until months later, because the data is usually significantly delayed, something appeared quite obvious during last week's decline. In the middle of last week it seemed as if investors were selling first and thinking later, and the selling was broad based.

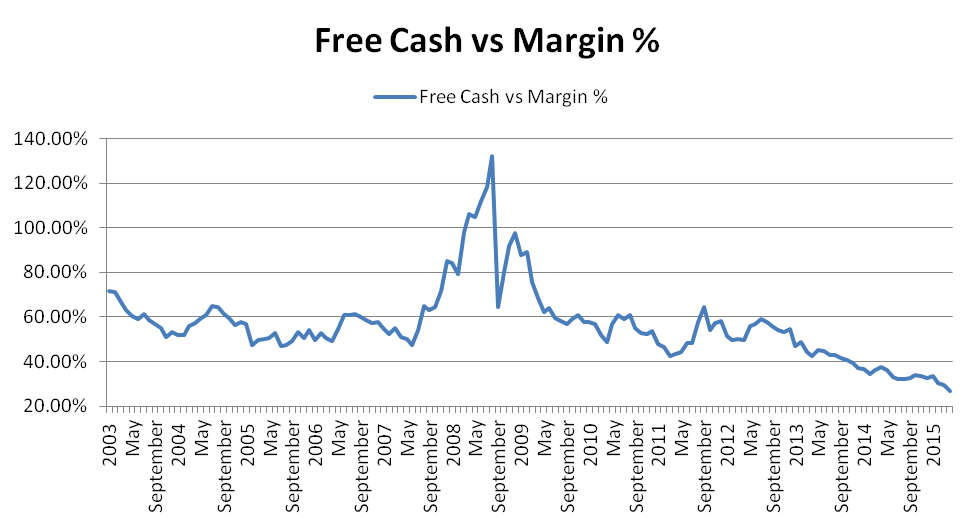

My interpretation of that selling pressure is that it could be simply due to institutional investors reducing their exposure by lowering their margin debt. Late last year the net cash to margin debt ratio on the New York Stock Exchange reached an all time low, which means that institutional investors had less cash available as a percentage of margin debt and therefore less of an ability to assume additional debt to buy equities on a percentage basis than they have ever had before.

Another way of looking at that is that they were essentially all in.

One could argue that they were paying close attention to the 'market's almanac last year,' because the 'almanac' would support the historical fact that the market had never been down during the third year of a second presidential term and it was mostly strong during the third year of a first cycle presidential term as well, so using history as a tell, it may have helped investors rationalize going all in during last year's periodic declines.

However, the weakness at the end of the year put all that into question, and arguably the selling pressure that started at the beginning of the year had plenty to do with an unwinding of margin debt, at least to a certain extent most likely, but that may have come to a head last week.

In my point of view the unabated selling pressure that happened last week was a sign that institutional investors just decided to get out and reduce that margin debt exposure. They did it in a broad based manner, from what I observed, but we cannot be sure about the changes in net margin debt exposure on the New York Stock Exchange until the data is officially updated, and it won't be official for a while.

This is where the comparison between what happened last week and the selling pressure that I am seeing on Monday comes into play. The selling pressure that is happening on Monday is much different than what we saw last week. Instead of being an unabated desire to sell to generate liquidity and reduce margin debt, the selling pressure today is much more controlled and normal given the sharp spike that happened from the oversold condition that existed in the middle of last week.

The market surged from the middle of last week until the end of the week if you include its intraday lows especially, so a modest pullback like what we were seeing on Monday is not abnormal.

My opinions last week also suggested that a series of backing and filling would be extremely healthy for this market on a near term basis, and that is exactly what may be happening at this time. The pullback on Monday may absolutely be part of the backing and filling process.

Certainly, when our eyeballs reach beyond the past few days and extend to the beginning of the year again we can see that the market is still much lower than it was and therefore many investors can rationalize that the market also has some additional upside.

Our Sentiment Table Strategy would suggest exactly that, and so would our Swing Trading Strategy. Both of these were double long the NASDAQ using ProShares Ultra QQQ (ETF) QLD when I wrote this based on the oversold conditions that triggered last week.

Stock Traders Daily is an independent provider of market analysis and a developer of investment strategies designed to be capable of working in any market environment, but investing n the stock market involves a high degree of risk and the risk of loss is real. Investors should consult with their personal financial advisors before making any decisions to invest.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.