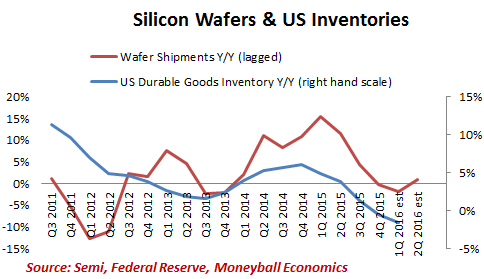

Moneyball Economics’ Andrew Zatlin said the latest semiconductor numbers are another sign that the global economic slowdown will continue. Zatlin sees the semiconductor industry as the best leading indicator of overall U.S. economic strength.

He views recent commentary by Celanese Corporation CE CEO Mark Rorh about “sluggish global economic growth, deflationary raw material trends and heightened geopolitical tensions” as particularly discouraging.

“Celanese is a leading manufacturer of acetyl based chemicals. Everyone uses its products: automotive, consumer electronics, construction, industrial, food, pharmacy and agriculture,” Zatlin explained. “Things are worse than they appear: CE’s 1Q 2016 topline still shrank after initiating significant price hikes.”

Zatlin believes that semiconductor data calls into question China’s relatively strong official 6.7 percent GDP growth number for Q1. He noted that Korean and Taiwanese exports have collapsed in recent quarters, and China is typically the destination for those exports. He sees weakness in Korean and Taiwanese exports as a red flag that things aren’t as good in China as the government says they are.

Zatlin expects more aggressive monetary stimulus from China in coming quarters.

In the United States, Zatlin believes a significant stock market pullback is imminent.

“It’s gone too high, too fast, and it is completely disconnected from underlying earnings expectations,” he said.

He urges investors to get defensive and consider buying some short ETF’s like the ProShares Short S&P500 (ETF) SH.

Disclosure: The author holds no position in the stocks mentioned.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.