The negative interest rate environment in Japan coupled with depressed rates around the world has created an unprecedented investment dynamic among Japanese investors. According to Federal Reserve Bank of San Francisco analyst Sean Creehan, more and more Japanese investors are choosing to make foreign investments directly in borrowed foreign currency.

“Typically, Japanese institutional investors have funded their overseas investment with yen and exchanged them for dollars using long-term cross-currency swaps,” Creehan explains in a new blog post.

Related Link: Just How 'Safe' Are U.S. Stocks Post-Brexit?

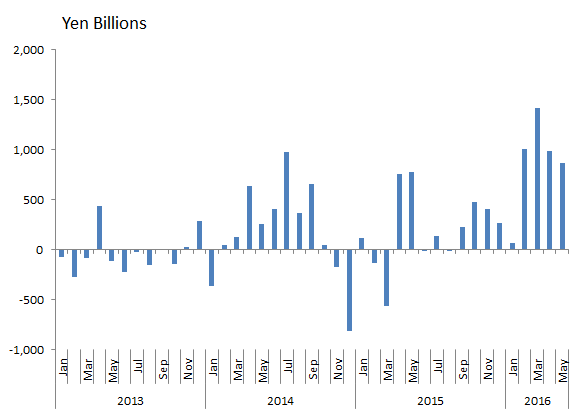

However, lately, the amount of debt issued by Japanese firms has skyrocketed. As of early June, Japanese firms had issued $52.6 billion in debt in 2016. That’s roughly 50 percent more than last year’s pace.

Why are Japanese lenders opting to invest by borrowing in foreign currency? The combination of increasing costs related to currency hedging and historically low global interest rates means that there is not enough margin to absorb the hedging costs.

“Given Japan’s new negative interest rate environment and a domestic economy that does not offer significant growth opportunity, Japanese investors are almost certain to continue their recent trend of overseas expansion,” Creehan concludes.

So far this year the PowerShares DB US Dollar Index Bullish UUP down 3.4 percent while the Guggenheim Currency Shares Japanese FXY is up 16.8 percent.

Disclosure: the author holds no position in the stocks mentioned.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.