Shipping names are rebounding strong Thursday morning, as Diana Shipping Inc. DSX is up over 4 percent, Teekay Tankers Ltd. TNK added 1.75 percent, Frontline Ltd. FRO is up about 2.75 percent and Euronav NV EURN is up over 3.35 percent. However, the broadly followed The Guggenheim Shipping ETF SEA has declined 6 percent since the beginning of 2016.

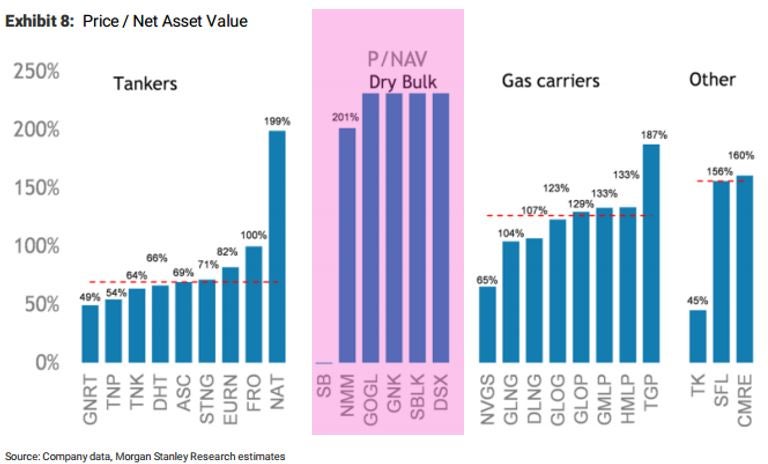

Traders are looking to take advantage of short-term momentum in lieu of a struggling industry saddled with debt and populated with dry bulk names trading at excessive valuations to Net Asset Values (NAV).

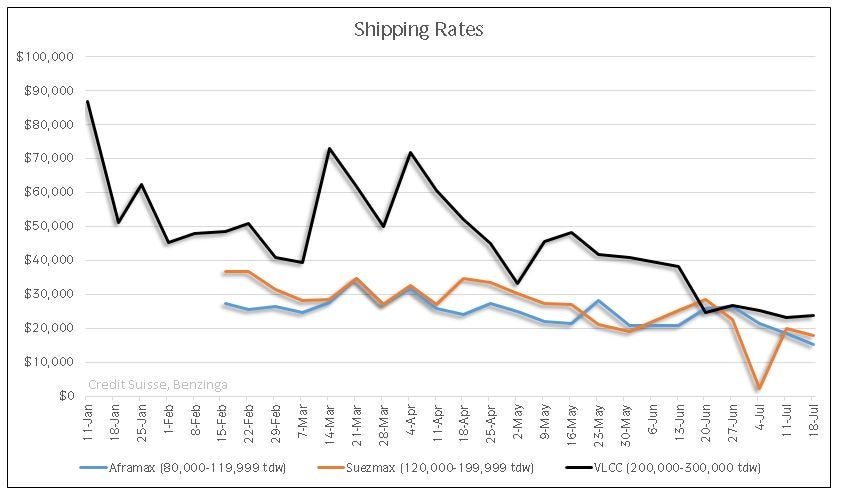

Tankers have struggled over the past year as day rate volatility drove uncertainty for those seeking charters. Using data from Credit Suisse, Benzinga plotted the day rates for Suexmax, Panamax, and Aframax shippers since the start of the year:

Declines in rates have been driven by a drop in Venezuela's production industry among other factors such as export declines, dwindling demand for ships to store oil, retiring of tankers, among others. As noted Wednesday, China's steel industry is coming under pressure and the nation needs to unload inventories as its construction market cools.

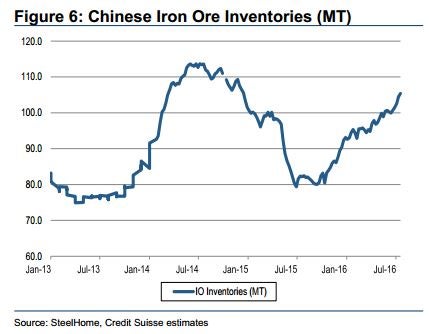

Credit Suisse data shows China's Iron Ore Inventories are closing in on July 2014 highs and as the Chinese introduce regulations to contain swelling home prices within the region, the demand for construction supplies has dried up leaving a deluge of Iron Ore inventories:

Aside from China, pressures from Nigeria have dampened investor excitement as the region battles with militant attacks on pipelines and Exxon Mobil Corporation XOM's recent force majeure (here and here) has resulted in a decline in ship demand.

Low day rates coupled with a material uptick in Chinese demand for ships to move inventories has Wall Street excited for a possible momentum trade, as an increasing Baltic Dry Index acts as the recent data-driven catalyst:

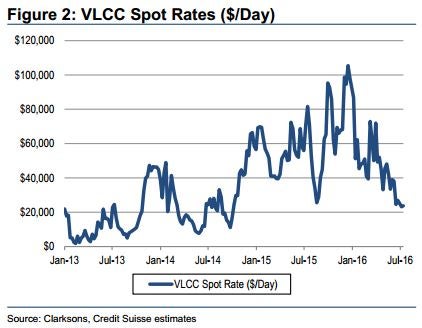

The recent drop in day rates for VLCCs matches the analog from the mid-2015 decline in rates and traders are getting into shipping names they believe will benefit from a rise in demand which will increase day rates, thereby helping those ever struggling shipper margins:

The latest catalyst of China's demand appears to be over-riding the concern from a decline in demand originating from Nigeria and Venezuela. The excitement over shippers Thursday morning appears unwarranted, given the outlandish valuations placed on dry bulk carriers from a Price to NAV perspective.

Per Morgan Stanley:

The story for tankers, based on regional exposure, offers a bullish momentum trade but the longevity of such a trade remains questionable. More importantly, the strength in the Baltic Dry Index appears to be driving dry bulk names higher, expanding the disconnect in valuations noted in Dry Bulk names in the image above.

The underlying story moving the needle on shippers is not one that would be akin to a typical economic expansion. Trade accordingly.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.