The following originally appeared on the Direxion Xchange blog.

OPEC announced that it would cut oil production by 1.2 million barrels per day to 32.5 million. This is the cartel’s first cut in eight years and will take place by January. The agreement exempted Nigeria and Libya, but included Iraq, and did allow Iran to raise its output as it recovers from US sanctions. In addition to OPEC, Russia also agreed to cut output.

Over the past two years, OPEC countries’ profits have dropped due to higher supply and lower demand. Wealthier members like Saudi Arabia have been able weather the storm. But the less wealthy, like Venezuela and Nigeria have struggled. OPEC has kept production levels stable because Saudi Arabia and Iran wanted to keep market share. But prices continued to drop – until last week’s cut.

The impact was almost instantaneous, as WTI crude oil blasted up 8.6%, nearly breaking $50, and energy stocks skyrocketed. Oil and energy-related stocks rallied.

The market was somewhat prepared, as the general consensus among traders was 50/50 as to whether the OPEC members would come to an agreement on the supply cuts.

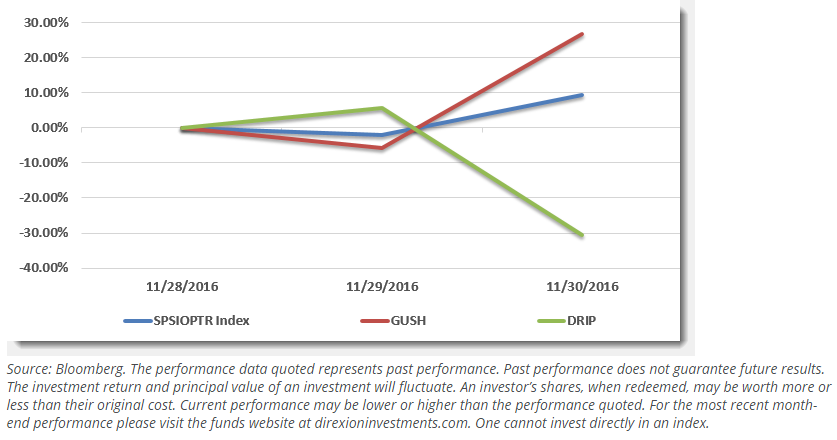

Energy stocks, especially those of oil & gas exploration & production companies reacted sharply.

The Daily S&P Oil & Gas Exp. & Prod. Bull 3x Shares GUSH, and The Daily S&P Oil & Gas Exp. & Prod. Bear 3x Shares DRIP reacted sharply to the OPEC announcement.

Can OPEC countries trust each other?

The big question is whether individual OPEC countries can trust each other. As any undergraduate economics student knows, the incentive to cheat for a cartel member is commensurate with the rise in price. The strength of the deal will depend on the commitment of all its members. So even though the back and forth headlines regarding OPEC policy that we’ve experienced since 2014 may seem to have come to an end, the truth is they probably haven’t.

As the weeks and months unfold, and the President-elect and the GOP has to commit to articulating and passing real policy, traders will have to find ways to find opportunity in the uncertainty. Now more than ever, direction matters.

Related Funds:

GUSH –Daily S&P Oil & Gas Exp. & Prod. Bull 3x Shares

DRIP – Daily S&P Oil & Gas Exp. & Prod. Bear 3x Shares

ERX – Daily Energy Bull 3x Shares

ERY – Daily Energy Bear 3x Shares

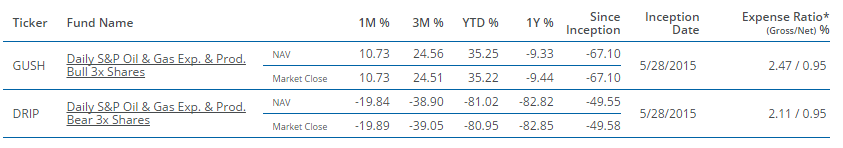

Performance (as of 9/30/2016)

* The Net Expense Ratio includes management fees and other operating expenses, but does not include Acquired Fund Fees and Expenses. The Funds’ Advisor, Rafferty Asset Management, LLC (“Rafferty”) has entered into an Operating Expense Limitation Agreement with each Fund, under which Rafferty has contractually agreed to cap all or a portion of its management fee and/or reimburse each Fund for Other Expenses through September 1, 2017, to the extent that the Fund’s Total Annual Fund Operating Expenses exceed 0.95% (excluding certain expenses such as management fees, taxes, swap financing and related costs, acquired fund fees and expenses, dividends or interest on short positions, other interest expenses, brokerage commissions, or other expenses outside the typical day-to-day operations of the Fund). If these expenses were included, the expense ratio would be higher.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. For the most recent month-end performance please visit the funds website at direxioninvestments.com.

Shares of Direxion Shares are bought and sold at the market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns. Market Price returns are based upon the midpoint of the bid/ask spread at 4:00 pm EST (when NAV is normally determined) and do not represent the returns you would receive if you traded shares at other times. Fund returns assume that dividends and capital gains distributions have been reinvested in the Fund at NAV. Some performance results reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable.

These leveraged ETFs seek a return that are 300% or -300%of the return of their benchmark index for a single day. The funds should not be expected to provide returns which are a multiple of the return of the benchmark’s cumulative return for periods greater than a day.

Direxion Shares Risks – An investment in the ETFs involve risk, including the possible loss of principal. The ETFs are non-diversified and include risks associated with concentration that results from the Funds’ investments in a particular industry, sector, or geography which can increase volatility. The use of derivatives such as futures contracts, forward contracts, options and swaps are subject to market risks that may cause their price to fluctuate over time. The Funds do not attempt to, and should not be expected to, provide returns which are a multiple of the return of the Index for periods other than a single day. For other risks including Correlation, Leverage, Compounding, Market Volatility, specific risks regarding S&P Oil Services securities, and for the Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 3x Shares risks related to shorting. Please see the summary and full prospectuses for a more complete description of these and other risks of each Fund.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.