Image credit: CME Group

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

AT-A-GLANCE

- The pandemic is just one long-term consideration for economies as the world adjusts to several new phases

- Short-term risks are elevated, but a focus on interactions between major long-term risks could prove critical for market participants

The news cycle is exceptionally volatile and market participants can’t lose sight of the long-term transitions that are in progress. One needs to appreciate the most important risks to manage and to see the opportunities being created. Here are five critical phase transitions in focus:

From Pandemic to Endemic

Economies will fully re-open, but some behaviors will have been altered permanently.

Inflation is Here

Central banks are shifting gears to move from accommodation to more neutral policies.

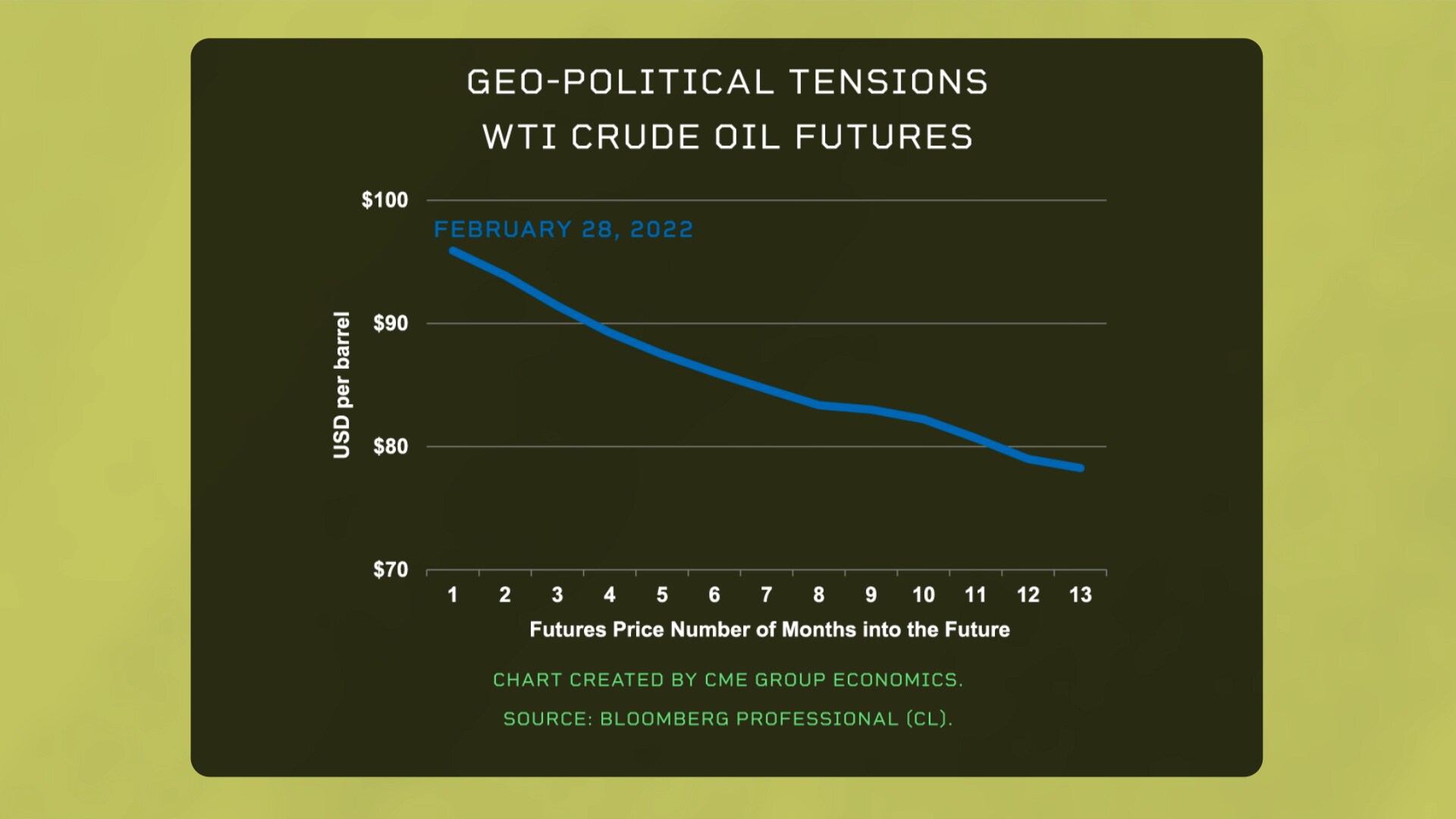

Geopolitics has Entered an Era of Heightened Tensions

Pax-Americana is in the past. Major powers are competing for influence, and aggressively using the tools at their disposal, from military to economic sanctions.

Climate Change is Accelerating

Storms are larger and more powerful, droughts and heat may be more severe depending on the region.

Mature industrial Countries are Aging

Demographic patterns change slowly, but without labor force growth, economic growth in many countries will slow.

The bottom line is that there are complex behavioral feedback loops among these five transitions. One must avoid analyzing one transition without accounting for the others. Traditional economists build models and often assume everything else is equal; but it never is, especially now. Linear analysis can fail because the interactions may change the course in critical ways.

The pandemic helped cause inflation and central banks are reacting, yet in the context of a new geopolitical order, with higher energy prices, and slowing economic growth. Yes, the short-term risks are elevated, but that misses the point. A focus on the long-run and an emphasis on the interactions among these critical phase transitions is required to appreciate that the nature of the risks has changed. That focus is also necessary to see the opportunities being created amidst the rise in complexity.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.