This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

AT-A-GLANCE

- Equity investors have generally reacted positively to the prospect of higher Fed policy rates

- A reversal of QE could push long-term bond yields higher, reversing equity investor sentiment

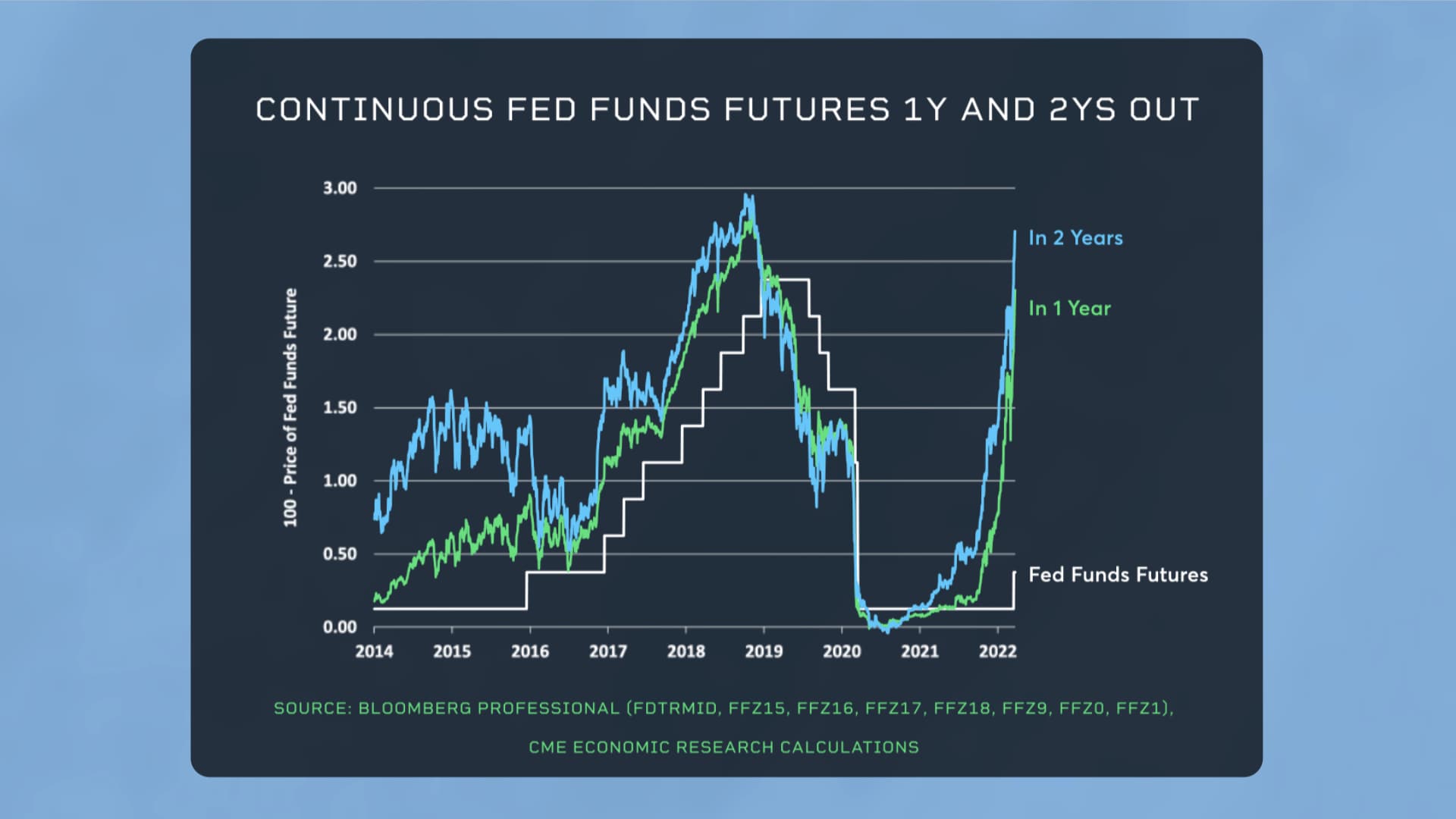

The Fed lifted off zero rates with a 25 basis point (bps) hike. At the same time as they got off zero, they also released their “dot plot” – a survey of where FOMC members think that rates might go in the future.

The results were somewhat of a surprise. On average, FOMC members see themselves hiking rates to around 2% this year. That implies a 25 bps rate hike at each of the remaining six meetings in 2022 and possibly even one 50 bps hike.

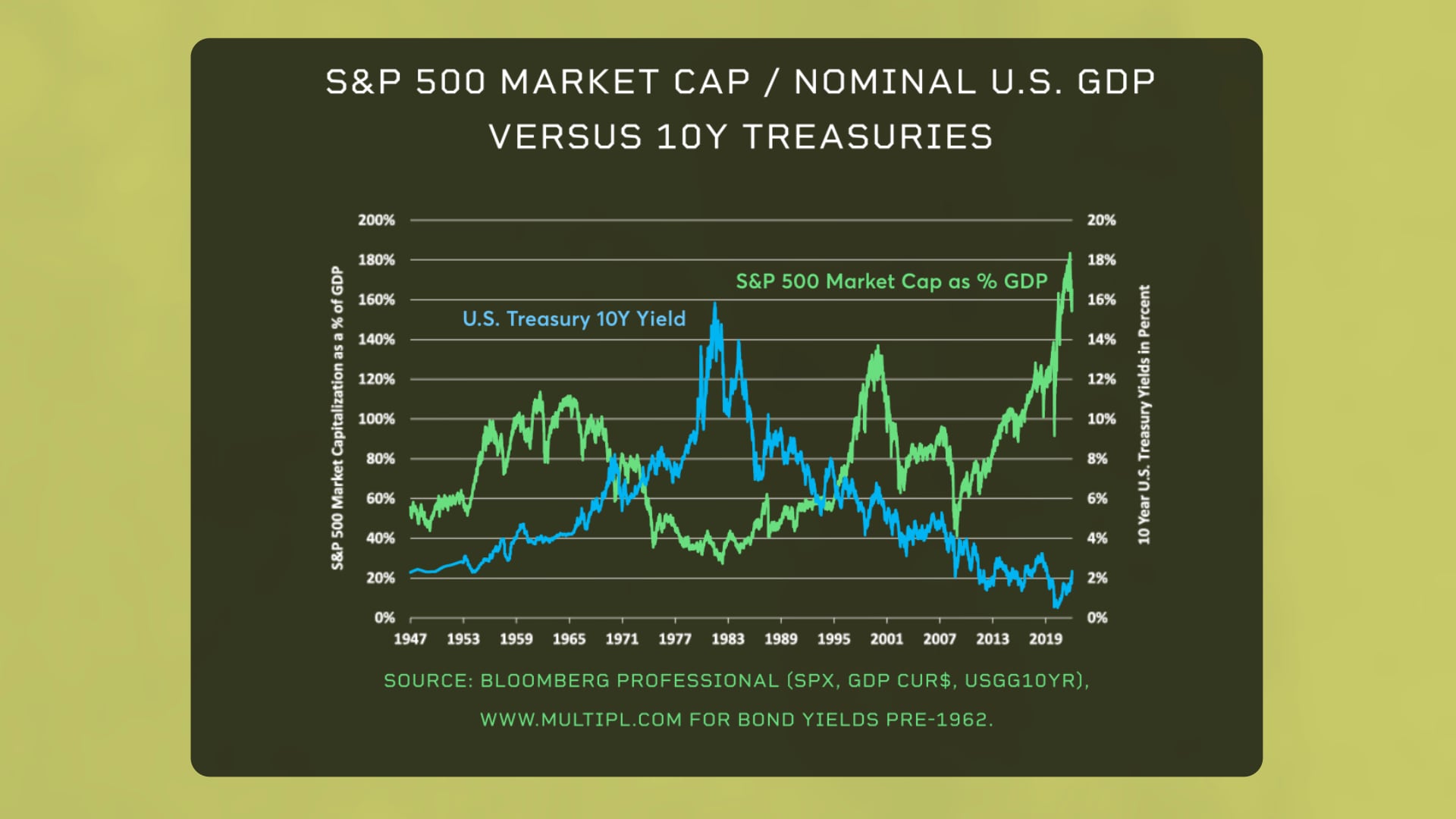

So, was the stock market upset with this? Not at all! Stocks generally reacted positively to the news. But why? Shouldn’t higher rates be bad for stocks? The answer is complicated. Equity valuations tend to vary inversely with the level of long-term bond yields.

Read the Full Report on Equities’ Reaction to Fed Policy

Part of the reason why the stock market has near record valuation levels is because long-term bond yields are still relatively low. But bond yields have been rising amid persistent inflation.

Hence the reaction to the Fed announcement. Higher short-term interest rates from the Fed might keep a lid on inflation expectations. Keeping a lid on inflation expectations might, in turn, keep a lid on long-term bond yields. Keeping a lid on long-term bond yields might allow the equity market to float to higher valuation levels. But higher inflation and higher bond yields remain a major risk.

This post contains sponsored advertising content. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.