Stocks fell last week, with the S&P 500 shedding 0.5% to end at 5,277.51. The index is now up 10.6% year to date and up 47.5% from its October 12, 2022 closing low of 3,577.03.

-

Is the stock market up a lot?

Sure.

This bull market, which started in October 2022, has seen the S&P surge 48% in just 19 months. It’s been a move that’s had Wall Street’s top market forecasters scrambling to revise up their price targets.

It’s the kind of activity that’s sure to get some investors a little nervous.

However, at the same time, this bull market hasn’t been unusually strong.

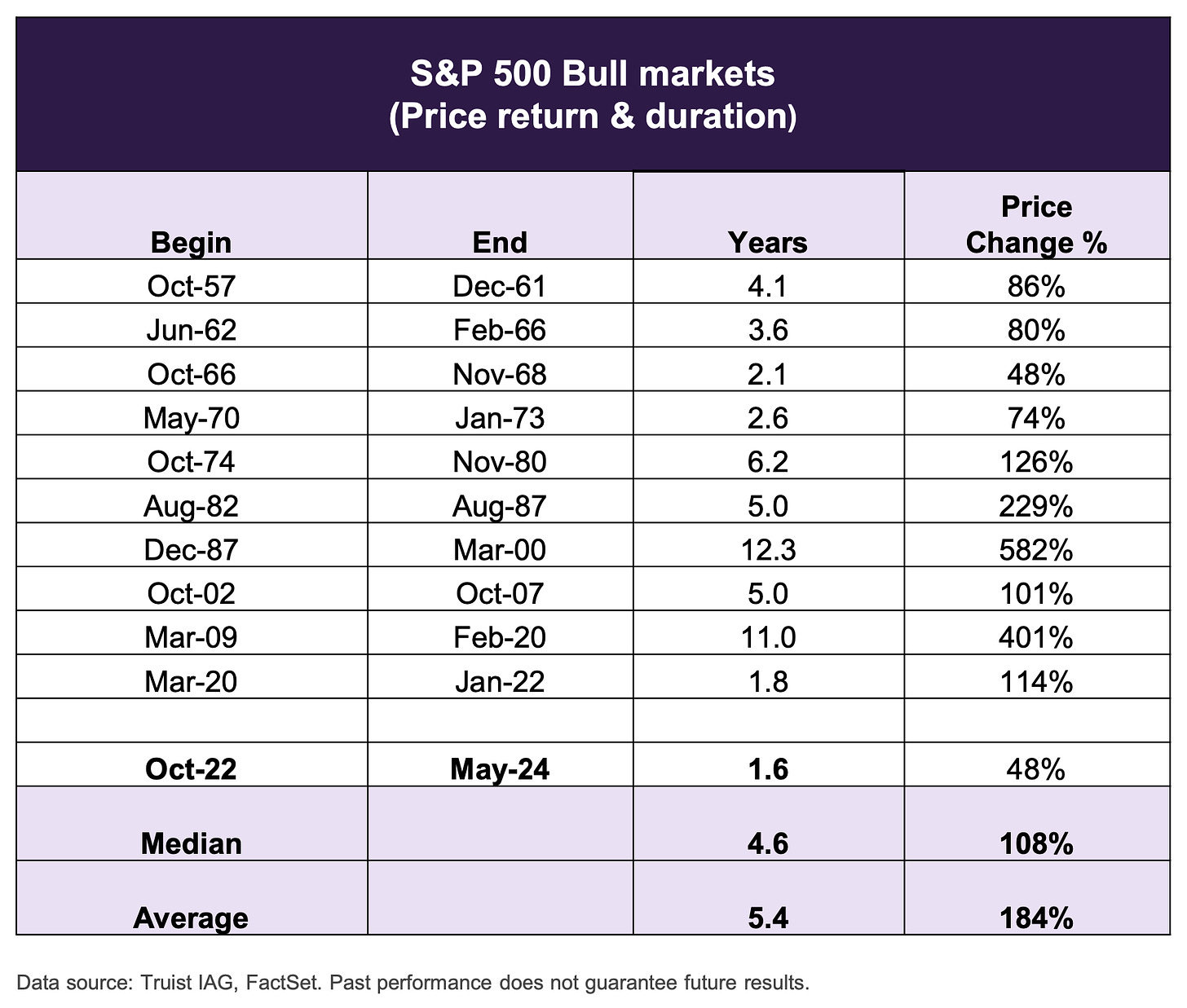

Truist’s Keith Lerner recently compiled the returns and durations of the previous ten bull markets. He found that nine of them had better gains than the current one with an average duration of about five years.

History suggests this bull market has further to run. (Source: Truist)

Maybe this bull market goes down in history as one of the weaker ones. We’ll know in hindsight.

For now, it doesn’t seem crazy to see prices continue to trend higher for at least two reasons:

-

Stocks usually go up: Historically, the stock market has been in a bull market about 80% of the time. Even after setting record highs, which the S&P most recently did on May 21, prices tend to continue going up in the months to follow, setting many new record highs.

-

Earnings growth prospects are positive: Forward earnings are looking up, with analysts continuing to forecast double-digit annual growth through 2024 and 2025. And earnings are the most important long-term driver of prices.

There’s some concern out there that valuations appear stretched. Unfortunately, as TKer Stock Market Truth No. 6 reminds us, valuations won’t tell you much about what prices will do in the near term.

On valuations, keep in mind that prices don’t have to fall for valuations to get cheaper. If earnings are growing, then the E in P/E ratios will rise just with the passage of time, putting downward pressure on the metric.

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.