Zinger Key Points

- The 3 ways to exit the trade allow for flexibility depending on your own risk tolerance

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

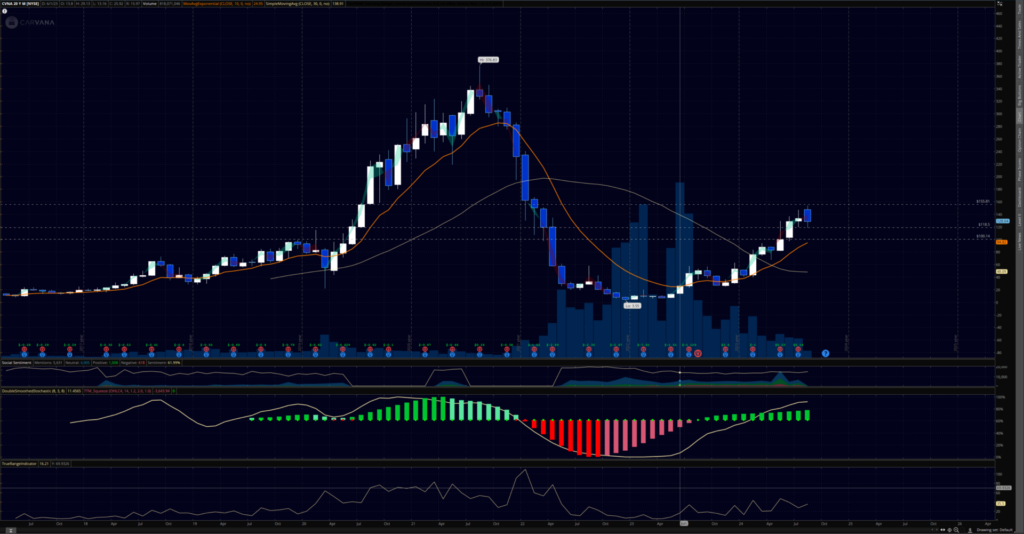

Earnings provide opportunities for outside moves and as volatility expands, I like to call this ‘butterfly season'. And though I normally put both sides of the trade for bullish and bearish stances, today I will sit on one side of the trade with Carvana

Today's post earnings trade comes to us from CARVANA ($CVNA)

The premise is the following – over the next 45 days, we expect to see the stock move away from its current location – in a general mean reversion trade back into the moving averages below.

Trade structure

The long put butterfly

A long put butterfly is positioned so the ‘long wing' of the trade give us a likelihood of returns, while using the short wing to finance part of the trade.

The long put butterfly- this is a long put spread (a bearish position) and a short put spread (a bullish position) that share the middle strike.

Buy to open 1 CVNA 20 SEP 110 puts

Sell to open 2 CVNA 20 SEP 100 puts

Buy to open 1 CVNA 20 SEP 90 puts

The put butterfly above will cost $1.29 (the max loss for this position) which makes the max profit $8.71(outside of commissions). Total profits will begin to erode if the price of $CVNA stays below $100

The strategy result provides three choices to exit the trade.

- To sell the entire butterfly spread once the middle strike of either spread is tested – that means we look at setting an alert for $100

- To sell the spread once it hits your loss threshold as determined by personal risk.- this will happen with extreme movement.

- To sell the spread into the week before expiration, if all is going well and you have decided to hold the trade into closer to the end of expiration (I have had many a trade go sideways taking it down to the wire and not capturing gains, so I do not advise this)

- Anne-Marie Baiynd is a 20-year veteran trader of stocks, options and futures and is the author of “The Trading Book: A Complete Solution to Mastering Technical Systems and Trading Psychology.” She writes for Benzinga as well as a variety of stock and options media outlets.. You can find her on X at @AnneMarieTrades

Photo via Shutterstock.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.