Zinger Key Points

- This Star has raised dividends once a year since 2005. In that time, they’ve gone from $0.364/share to $0.6775/share—a 79% increase

- Morgan Stanley anticipates a 2% annual hike to the big telecom's quarterly common stock payout this year

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

With Fed Chair Jerome Powell very clearly signaling a rate cut of at least 25 basis points ahead of his

September 17 conference—and possible as high as 50—you can find no shortage of stock market bulls

anticipating a flood of cheap money.

But for over a year now, I've said investors should be careful what they wish for…

When it comes to the imminent rate cuts, I've warned to "rue the pivot" because falling interest rates usually

mean something is breaking in the economy.

This is especially true with a rate cut of 50 basis points or higher. Consider the last two times the Federal

Reserve cut rates by 50 basis points in one fell swoop—January 2001 and September 2007.

In both cases, the S&P 500 went on to fall by more than 12% over the next year.

And this setup comes as firms and economists ramp up their forecasts for a recession before the end of

2024—most recently with J.P. Morgan Research raising the probability from 25% to 35%.

Whether it's by the end of 2024 or later, the bill is coming due. No bull market has lasted forever… and as we

enter the third year of this one, I've spent more and more time thinking about defensive strategies.

When it comes to a hedge against a possible market collapse, I have three criteria:

First, can the investment hold more or less steady, even as the overall market is in freefall?

Second, can it pay a large and growing dividend, to help protect shareholders from the volatility?

Third, is it undervalued—and therefore, offering investors the "margin of safety" that Warren Buffett's mentor

Benjamin used to make up to 500x his initial investment even in the Great Depression's aftermath?

Today I've found a company that meets all three…

Better Protection than Bonds

With three-month Treasury bills paying yields as high as 5.1% this month, many investors will be tempted to

rush into those for protection, especially before the anticipated rate cuts make higher Treasury yields harder

to find.

But I consider Verizon Communications Inc. (VZ) to offer better protection, and with stronger potential

upside.

The company provides cellular service to 95 million customers, and broadband and Fios cable to millions

more. Customers tend to only cancel these services under extreme duress—and only after they've cancelled

monthly Netflix subscriptions, or cut back on Starbucks lattes, or decided to drive less amid high gas prices.

Source: Benzinga Pro

For most people, Verizon's services aren't consumer discretionary—that's to say, they won't cancel them on a

whim to save money in tough times. That's a major element to Verizon being "recession-proof" in a way that

consumer discretionary companies like Netflix, Apple, Starbucks, and Amazon aren't.

Of course, it's one thing to be recession-proof in theory… but how has Verizon actually held up under the last

two great shocks to the system?

In the months after Covid-19 shut down much of the world, Verizon managed to grow earnings, from

$0.95/share in Q2 2019 to $1.13/share in Q2/2020. Consumer revenue decreased by 4%, to $21.1 billion,

while business revenue decreased 3.7%, to $7.5 billion.

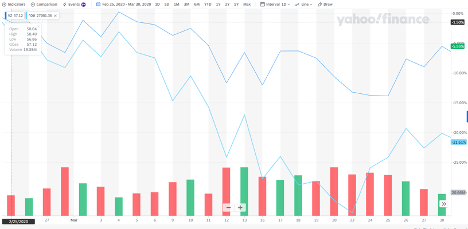

You can see Verizon's resilience in the chart below… while the Dow plunged more

than 21% from late February to late March 2020, Verizon shares lost just 5.55%:

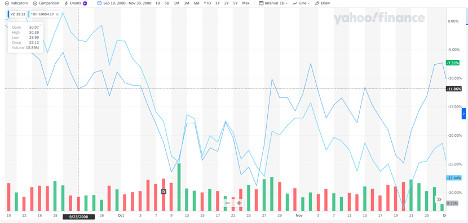

Verizon also outperformed in the dark days of 2008. As you can see, from 10 September—days before Lehman

suddenly collapsed—to the end of November, the Dow fell more than 27%. But Verizon stock held losses to

just 7.32%:

I even like Verizon's performance in a crisis compared to government bonds—supposedly the ultimate safehaven. People forget that in March 2020, after an initial rush to the relative safety of US Treasuries, Treasury

bills suffered under more selling pressure than any other major sovereign bond market as demand for cash

surged.

So Verizon is a tried-and-true outperformer in times of crisis. That doesn't guarantee its outperformance in

the next great selloff, of course. But its historical resilience can only reassure investors.

And that's all before we get to…

Eighteen Years of Rising Dividends—Including in Each Economic Collapse

Verizon has raised dividends once a year since 2005. In that time, they've gone from $0.364/share to $0.6775/share—a 79% increase.

It even kept up these increases in the last two financial crises. From 2007 to 2008, Verizon hiked its dividend

by more than 10%. In 2020, it hiked its dividend by 2.4%, impressive considering companies around the world

clashed dividends by $220 globally in 2020.

Of course, the question for investors today is whether Verizon's dividend hot streak can continue.

I see several reasons for confidence that the company can keep growing its dividend for years. Verizon’s cash

flow is thick and heavy, as it operates a business with millions of regularly paying subscribers. This means it

has plenty of financial muscle helping it flex that high dividend. At the moment, its cash dividend payout ratio

is under 80%, which indicates the distribution is well-funded and sustainable, barring any sudden catastrophe

with the company.

This is why Morgan Stanley anticipates a 2% annual hike to the big telecom’s quarterly common stock payout, putting the next quarterly distribution at nearly $0.68 per share.

As CEO Hans Vestberg put it in Verizon's earnings call in April:

"Our cash flow strength allows us to deliver on our capital allocation priorities, including supporting our

dividend and paying down our debt. With strong momentum already in the start of the second quarter, I’m

confident in our ability to sustain progress towards unlocking Verizon’s full potential for all stakeholders."

Finally, There's Potential for Capital Appreciation to Consider…

Interestingly, mainstream analysts seem to have a solid understanding of Verizon's growth prospects. A year

ago, they put a price target of $45.7 on the company (the stock is at $43.62 today).

Today, they're forecasting 5.4% growth for the next quarter, and 2.4% growth next year. That may not sound

like much—but when you consider what history suggests is in store for the markets a year after the imminent

rate cuts, I believe a lot of people will look back and wish they had bought a position in Verizon.

Ordinarily, I wouldn't put much stake in what Wall Street analysts think—but Verizon is a rare company where

they've been close to spot on, coming within 3.7%, 0.9%, and 2.7% in their earnings estimates for each of the

last three quarters—not including Q2, which they nailed perfectly at $0.91/share.

Of course, this speaks to the predictability of Verizon's business. And in these volatile times, some

predictability—along with Verizon's seemingly bullet-proof 6.5% yield—is exactly what most investors need.

Regards,

Gianni Di Poce

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.