Zinger Key Points

- Tech stocks have regained their leadership role, causing declines in other sectors.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

The broadening out of the rally that we had been seeing in the very-late summer and early-fall has faded. The tech stocks (and the “Magnificent 7” names in particular) have taken over as the key leadership group once again.

Last week's relatively positive earnings were not enough to help the group to rally. Instead, it declined, and the stock market followed it lower. This group now stands at a key technical juncture, so its next compelling move is going to be crucial for the markets.

Here’s where the Magnificent 7 are taking the markets next.

Everybody desperately wants the bull market that began in October of 2022 to broaden out in a meaningful way.

Yes, we have seen that take place for a period of time on several occasions over the past year or so. We saw it when the Russell 2000 outperformed the tech stocks (and the SPX) in the 4th quarter of last year. We saw it again for quite a few weeks when the market bounced off its August lows, following its first "summer pullback" of 2024.

However, the tech stocks have taken over its leadership role once again. Since the lows of the second "summer pullback" in early September, the S&P 500 has rallied 5.9%, the Russell 2000 has popped 5.6%, and the S&P 500 Equal Weight index has advanced just 3.7%. This compares to a 9.8% jump in the XLK technology ETF, and a 13.4% rally in the Bloomberg Magnificent 7 Price Index!

The tech laden NDX Nasdaq 100 has also outperformed over the past two months, with a 8.7% rally. So, it is very safe to say that big-cap tech has moved solidly back into its leadership position in recent weeks.

This will not be a major problem, unless the tech stocks start to roll-over in any significant way. As I have highlighted several times over the past six months, we can all hope all we want for the non-tech stocks to outperform going forward, but it will not happen if the tech stocks begin to decline in any material way.

They're just too highly weighted in the S&P 500 (over 30%) and the NDX 100 (over 60%) for those indices to advance while the tech sector is falling.

And if the major indexes start to decline (as the tech stocks lead them lower), the money will not "rotate" to other groups. It will "rotate" towards cash, bringing the whole market down.

We have seen the earnings and guidance from many of the most important tech stocks over the past two weeks, with five of the "Mag 7" stocks reporting last week. Most of them reported positive numbers, but they were not enough to cause the group to advance.

GOOGL and AMZN were able to see nice bounces after they reported, but the sector overall has not acted well during this earnings season. The XLK tech ETF has dropped 3% over the past two weeks, the SMH semiconductor ETF has dropped 4.6% in the past three weeks. .and the Bloomberg Mag 7 index declined 1.8% last week.

Given that the tech sector has taken back its leadership role, it's no surprise that the indices fell last week as well.

[For More Matt and His Top Trades for Potentially Doubling Your Money — Within a Year, Click Here!]

No, none of these declines have been disastrous ones. So, if they can bounce back quickly, and can break above their 2024 highs, it will be very bullish for the sector (and thus the broad stock market). However, last week's poor performance for many of these stocks does raise some concerns, especially when we learned this weekend that Warren Buffett sold a whopping 25% of his AAPL holdings in Q3, and Jeff Bezos filed to sell 16.2 million more shares of AMZN this weekend.

Moving back to the fundamental outlook for these key stocks, the entire situation goes back to the argument we've been making since August. As good as the earnings have been for most of these companies, they are not expanding to the degree investors were hoping a year ago (or even as recently as this past spring).

More importantly, we're not seeing the kind of extensive broadening out of the earnings from the AI phenomenon that people have been expecting, and that the tech group (and the market) has been pricing-in.

That's not to say that it hasn't broadened out at all. It just is not doing so to the degree that will likely allow these names to rally significantly further going forward, unless we continue to get strong liquidity injections.

With all of this in mind, we wanted to take a look at the charts of the Mag 7 index this weekend. On the bullish side of the ledger, when you look at the weekly chart on this index, it shows that it is very close to a positive weekly MACD cross:

The last three times it has seen a positive weekly cross, it has been followed by a very nice (further) rally for these big-cap tech names (and thus for the stock market). Therefore, if it can see a meaningful positive cross, which would certainly also involve a break above the summer all-time highs for this index, it will be extremely bullish.

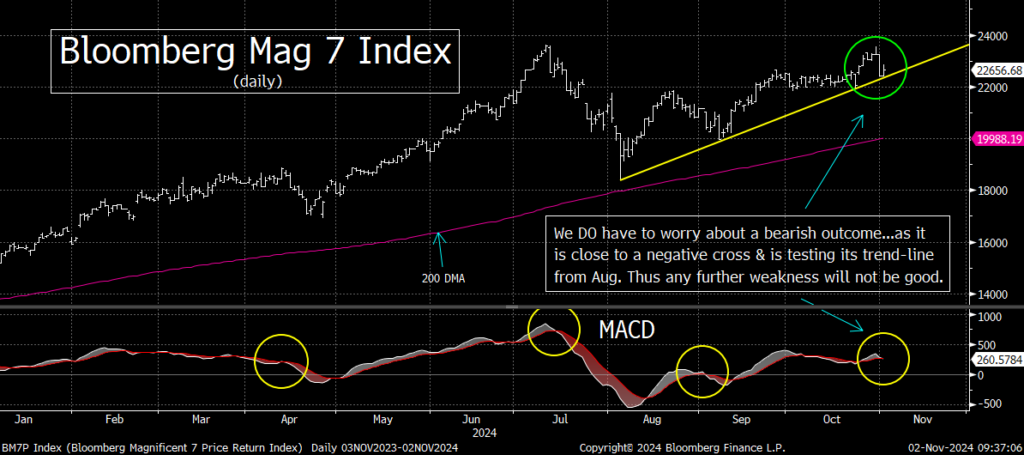

On the bearish side of the ledger, if last week's weakness becomes more prevalent, for whatever reason (micro or macro), it will create some problems. Even though its weekly MACD chart is close to a positive cross, its daily MACD cross is VERY close to a negative one:

The Mag 7 Index is also sitting right on its trend-line from the August lows. Thus, it won't take much more downside follow-through to take it below its short-term trend line and a negative "cross," which would both signal that a change in trend has taken place, at least on a near-term basis.

We obviously have a lot of things going on that could impact just how this key index will move over the coming days and weeks. Not only do we have more earnings (although Nvidia doesn't report for three more weeks), but we also have the election, the Fed meeting, and the situation in the Middle East.

So, it's hard to know which way this situation will play out going forward. However, there is no question that the tech stocks, led by the big cap tech names, stand at a critical juncture. Whichever way they break will have an extremely important impact on how the rest of the market moves in the weeks and months ahead.

For 25 years, he worked with Salomon Brothers and Merrill Lynch. He’s been interviewed by Bloomberg and CNBC over 600 times… Big name money managers pay $50,000 a year to access his trades… And right now, you can get his top trades that could potentially double your money within a year. Just click here to get more details before he takes them down.

Image generated with Dall-E 3.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.