The crypto bull run is here. 2024 has not only shaken off the winter snow but turned out to be a massive boom for all types of crypto assets. With significant updates like Bitcoin ETF, the crypto arena has evolved. That means there are new opportunities and trends that will shape this year's most lucrative investment opportunities.

Determining these trends can be tricky waters, given that investors and experts come from different angles, with each group having its own perspectives and reasonings.

For most investors, firms like CLS Global can help them navigate the ever-evolving crypto sector, helping identify which specific industry is most likely to grow this year.

DeFi Dependency Will Increase

The logical evolution of crypto as a means of value storing and transfer, Decentralized Finance (DeFi) will see increased adoption this year. Challenging traditional financial setups, DeFi is preferred for opening up financial opportunities in the crypto space.

DeFi's uptake this year will be most seen in three key areas, including

- DEXs (Decentralized Exchanges): With assets remaining in user custody, all trades are peer-to-peer, without any platform intervention.

- AMMs (Automatic Market Makers): Replacing traditional order books, liquidity pools such as AMMs help facilitate trading, lending, and a range of other financial services.

- Borrowing/Lending: The public gains access to capital (or lends it out) without any middlemen. This leads to lower interest rates for borrowers, while higher rates for lenders, facilitating both parties.

NFTs Beyond Images

While NFTs gained popularity as digital art, the unique tokens are being adopted for other, more practical uses. Unique in their nature and coming with different programmable attributes (soul NFTs, dynamic NFTs, etc), these digital assets are being swiftly adopted in different industries.

As the crypto market increases, including an uptick in the traditional arena, there are expectations that NFTs will follow suite. Particular interest this year is focused on ERC404, an experimental token standard that offers a unique hybrid fungible and non-fungible approach with fractional ownership.

Real World Assets (RWA) Is Bridging The Web2/3 Gap

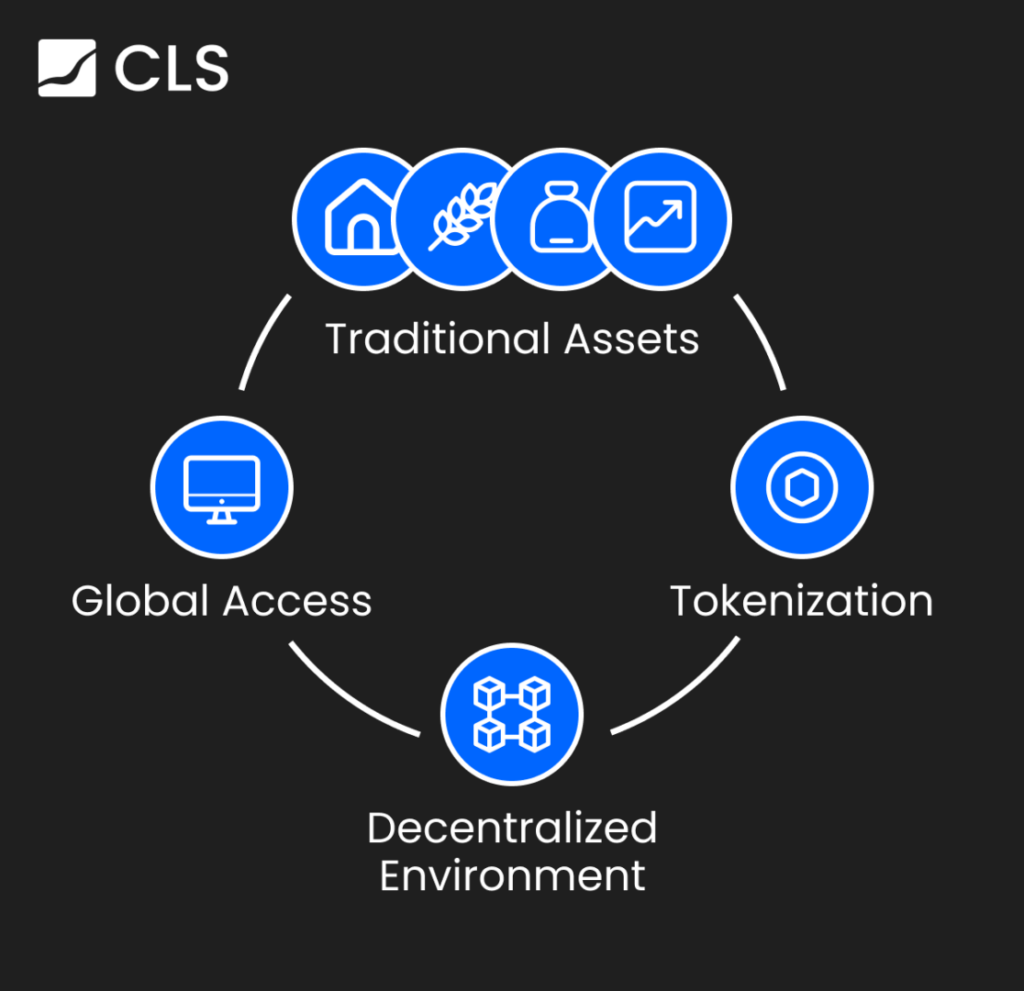

While the debate amongst Web2 and Web3 enthusiasts goes on, a small but expanding circle of investors is concentrating on connecting the best of the two. Using Real World Assets (RWAs), they are able to take traditional assets down the decentralized rabbit hole.

Imagine commodities, securities, real estate, even gold and other bullions you would normally go on stock exchanges or other financial houses to buy and sell – all available at the tip of your fingers, in a decentralized environment, thanks to tokenization of the assets. RWAs provide ease of access to investment, without the traditional clout such as intermediaries, obscure procedures of handling, high broker fees, etc.

Of all the different crypto trends that one can invest in, this is by far the most complicated one, requiring a keen eye on the tokenized assets themselves, and the regulatory environment as well.

For example, trading bullion-backed assets require guarantees of the issuers holding enough precious metal in the first place (third-party audits, regular records publishing, etc.), while the legality of trading security tokens (tokenized company shares) can be ambiguous.

On the other hand, RWAs open up liquidity and markets on both sides of the proverbial coin. Web3 gains access to the Web2 economy, while the latter accesses the former's market and user base.

The Courts, Regulators and Legislation

Even with a decade and a half of the crypto industry's existence, it has been challenging for its adoption and acceptance within an approved regulatory framework. While some jurisdictions have clear-cut laws that incorporate crypto, major markets like the USA and EU are still evolving their regulations.

The different nature of assets and their use (RWAs and what they represent, for example) can make it extremely complicated. This makes it paramount for any project or firm launching their RWA tokens to ensure there are no legal issues down the road, as well as putting pressure on investors to make sure they don't land in hot water.

Sailing The Crypto Seas With CLS Global

For people and organizations seeking to take advantage of current crypto trends, finding the right projects and digital assets can be tedious, requiring extreme due diligence – perhaps even an army of lawyers to unwrap legal knots for compliance.

Understanding all the nitty and gritty is essential and this is what CLS Global excels at. From investments in projects that can reshape the industry to investment advisory services to market outlook – CLS Global offers a holistic approach to the biggest trends in the crypto arena.

With seasoned experts and comprehensive services, CLS Global can help in entering the market with the safest options, unlocking the true potential.

As the market continues to evolve and trends develop, having a partner like CLS Global can help you achieve your crypto goals for the year and more to come.

This post was authored by an external contributor and does not represent Benzinga’s opinions and has not been edited for content. This contains sponsored content and is for informational purposes only and not intended to be investing advice. Cryptocurrency is a volatile market; do your independent research and only invest what you can afford to lose. New token launches and small market capitalization coins are inherently more risky than large cap cryptocurrencies. These tokens are subject to larger liquidity and market risks.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.