Risk tolerance is critical to constructing your portfolio, but the industry in general does a poor job of using it.

The first problem is a lack of standard definitions.

Being “Aggressive” or “Moderate” or an “8 out of 10” can mean very different things to different people. A second major problem associated is inappropriate application – your willingness to take risk is only part of the equation. Your objectives for taking risk are just as important as your stomach for it.

So how do you determine the right level of risk for your portfolio? Read on to see two examples of how two people use risk tolerance – in concert with other factors – in designing their portfolios.

A 40-Year-Old Discovers She Needs a Moderately Aggressive Portfolio

Below is a snapshot of a 40-year-old woman’s financial profile:

- $400,000 invested for retirement

- $120,000 annual spending

- $20,000 annual saving

- Moderate risk tolerance

With this profile, she actually needs a fairly aggressive risk level. Why? Assuming a 4% real return (after inflation), she is projected to retire at 63 with around $1.7 million.

Also assuming $24,000 in Social Security, a modest 15% tax rate and a generic “4% withdrawal rate”, she will be able to spend roughly $82,000 per year in retirement. That may sound ok, but still represents a 30% reduction from her current spending rate, which may be tough.

Given her need for growth, her desire to come close to her current standard of living and her ability to take some risk given her long 20+ year investing horizon, at least a moderately aggressive portfolio may be preferable – despite her moderate risk tolerance.

A Retiree Discovers He Can Afford a Conservative Portfolio

The second example is a 63-year-old man who retired with the following financial profile:

- $1.7 million saved for retirement

- $24,000 in income (Social Security)

- Desired annual spending of $60,000 per year

- Conservative risk tolerance

Given his profile, his expected withdrawal rate is 2.5%. The math there is = (($60,000 – $24,000)*1.15)/$1,700,000 = 2.5%). The 1.15 represents a 15% generic tax rate on withdrawals.

A withdrawal rate under 3% is considered low. In this scenario, not only does he not need to take high risk, it would be foolish to do so. A few bad years in an aggressive portfolio could raise the new expected withdrawal rate above 4%. For most people, it does not make sense to risk losing the game when they’ve already won.

The Real Trick: Designing a Portfolio to Reflect Your Risk

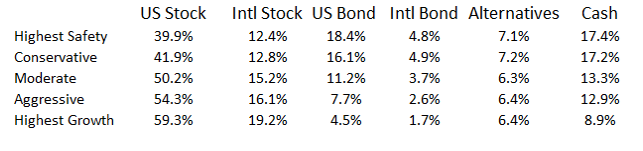

The step after identifying your risk tolerance is designing a portfolio based on that– and that you will stick with. It turns out, a mismatch between stated risk tolerance and portfolio design is widespread. A look at Personal Capital user data shows the following asset allocations for users grouped by risk tolerance:

While the averages look reasonable, the mismatch is hidden behind these figures: for those who say they have aggressive risk tolerance, 20% have less than 40% invested in stocks. While an aggressive risk tolerance doesn’t always mean you should have an aggressive asset allocation, this kind of allocation likely signals some kind of disconnect.

In Sum, Selecting the Right Risk Level

Risk tolerance is an important, but often misunderstood aspect of investing. If you are going to lose sleep if market declines erase 30% of your liquid net worth, then you do not have an “aggressive” or “8 out of 10” risk tolerance. Then again, just because you can handle this kind of volatility doesn’t mean you necessarily should subject yourself to it.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.