Zinger Key Points

- This 'Golden Age of Medicine' comes with a surge of new drug and medical discoveries

- These 3 Stocks are pouring money into cutting edge research

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

A year ago, medical experts and Nobel Laureates interviewed by The New York Times proclaimed "a Golden Age of Medicine" is here.

And in the 12 months since, a flurry of new drug and medical discoveries has proven them to be right.

From new cancer treatment breakthroughs, to the first-ever FDA-approved genetic editing treatment for illness, new medical advances are helping to cure millions of people from diseases that used to stump scientists.

And in the process, the "Golden Age of Medicine" has lit a fire under three pioneering biotech stocks.

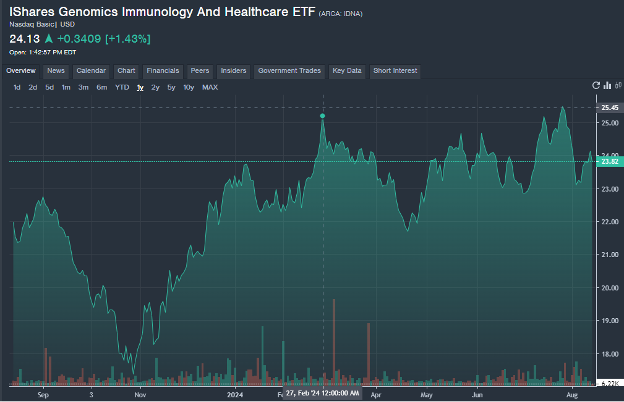

As you can see below, the iShares Genomics and Healthcare ETF—a basket of health care and genetic-editing stocks—is seeing a surge of momentum as biotech companies soar on the strength of new treatments and breakthroughs.

Source: Benzinga Pro

Make no mistake—the "Golden Age of Medicine" is here.

Even before this era, biotech stocks were some of the most powerful wealth-builders in the world.

In fact, of the 25 most successful stocks of the last 30 years, five of them (Novo Nordisk, Regeneron, Intuitive Surgical, Eli Lilly, and UnitedHealth) were in the biotech and health care sector. The slowest-growing of these five, UnitedHealth, still achieved a 12,275% return.

Investing in the right biotech stocks can be life-changing. And with the "Golden Age of Medicine" in full swing, there may never be a better time in your life to do so.

Here are three biotech stocks to consider today.

"Golden Age of Medicine" Stock #1: Eli Lilly and Company (LLY)

Headquartered in Indianapolis, Indiana, Eli Lilly is a 148-year-old company—yet it may still have explosive growth ahead of it.

The company's treatments target dozens of afflictions, including diabetes, rheumatoid arthritis, depression, osteoporosis, anxiety disorder, and hyperplasia. But LLY isn't resting on its laurels… its new Lilly Seaport Innovation Center in Boston Seaport will accommodate 500 scientists and researchers, as well as 200 employees from Lilly Gateway Labs, to accelerate the development of novel medicines.

Over the last 12 months, LLY has spent $10.2 billion on research and development. That's a 25% increase from the 12 months prior, and a strong signal that the company is sparing no expense in bringing new treatments—and potential cash cows—to market.

And despite being older than the Dow Jones Industrial Average itself, Eli Lilly is growing like a small-cap company. LLY grew earnings by 68% last quarter, while revenues grew by 36%.

The company is also on a dividend-growing hot streak. LLY has increased its dividend by over 15% in each of the last three years.

"Golden Age of Medicine" Stock #2: Sanofi (SNY)

Sanofi (SNY) is a $134 billion company based in Paris, France. It engages in research, development, manufacture, and marketing of specialty care for neurological and immunological diseases and rare blood disorders, as well as drugs for diabetes and cardiovascular diseases.

The company pays a dividend yield of 3.8% as of this writing—more than double that of the average S&P 500 company.

Sanofi's wide range of pharmaceutical products gives the company stability, while its solid track record of bringing drugs to market, with several in the pipeline, provides plenty of potential upside.

Not for nothing has Warren Buffett's Berkshire Hathaway held shares of Sanofi since 2006—with Buffett buying shares at least 10 more times since. This company offers one of the safer paths to potentially profiting from a biotech boom—while enjoying a hefty dividend payout in the meantime.

"Golden Age of Medicine" Stock #3: Rhythm Pharmaceuticals (RYTM)

Rhythm Pharmaceuticals (RYTM) is a riskier and more speculative play than the two biotech giants listed above. But if its "hunger switch" drug IMCIVREE passes Phase III clinical trials, this $2.8 billion company could soar in short order.

Headquartered in Boston, Massachusetts, RYTM is a commercial-stage biopharmaceutical firm that specializes in rare neuroendocrine diseases.

The company is unprofitable for now, but it has $319.1 million in cash, compared to just $112.5 million in debt. It also grew revenues by 51% year-over-year last quarter,

Last August, RYTM shares surged after beating analysts' estimates and Bank of America analyst Tazeen Ahmad rated RYTM a "Strong Buy."

Meanwhile, a flurry of institutional buying suggests that the most plugged-in minds in the investing landscape agree. Last quarter, BlackRock—the world's biggest private equity firm, with $10.5 trillion under management—purchased 212,000 shares.

27% profit every 20 days? Here's how I do it.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.