A Reddit post recently blew up after one user shared a story about their friend who refused a $5,000 raise. Why? Because they thought it would push them into a higher tax bracket and actually make them take home less money.

A Misunderstanding That Went Viral

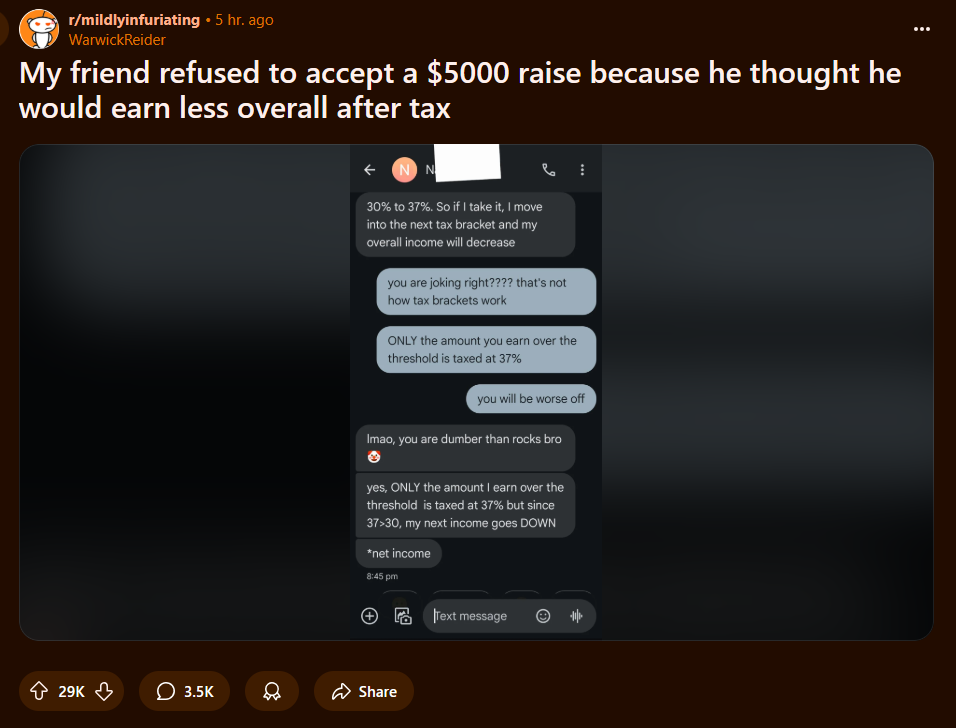

The post, shared in r/mildlyinfuriating, included a text conversation where the friend said, "30% to 37%. So if I take it, I move into the next tax bracket and my overall income will decrease."

Don't Miss:

- It’s no wonder Jeff Bezos holds over $250 million in art — this alternative asset has outpaced the S&P 500 since 1995, delivering an average annual return of 11.4%. Here’s how everyday investors are getting started.

- Dogecoin millionaires are increasing – investors with $1M+ in DOGE revealed!

The Redditor tried to explain how taxes actually work, by explaining that "ONLY the amount you earn over the threshold is taxed at 37%." Still, the friend wasn't convinced, responding, "Yes, ONLY the amount I earn over the threshold is taxed at 37%, but since 37>30, my next income goes DOWN."

Frustrated, the Redditor pointed out the mistake, but the friend refused to accept it, replying, "Lmao, you are dumber than rocks bro." The exchange sparked a wave of reactions from Reddit users, with many expressing disbelief at how widespread this misconception still is.

One commenter summed it up: "That's the thing with dumb people, they don't think they are dumb. It's the smart people who realize how much they don't know." Another added, "How do people this dumb end up in the 37% tax bracket? That is the real question."

Trending: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Several users shared similar encounters with people who misunderstood tax brackets. One person recounted how a carpenter they knew refused to earn over a certain amount for years because he thought it would lower his income. Another shared a baffling experience: "A manager at my old job told my coworker not to push for a raise because ‘you'll go up a tax bracket and be making less overall.'” They showed her the actual numbers, and she still insisted they were wrong.

Many users debated why this misunderstanding persists. Some blamed poor financial education, while others pointed out that misinformation spreads easily. One user wrote, "As a kid, I always heard adults saying they didn't want to get into the next tax bracket. So, the only natural conclusion I could come to as a kid was that the tax bracket rate was on all monies. I assume many people grew up hearing the same nonsense."

See Also: Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

Some speculated that this kind of financial illiteracy benefits employers, with one commenter joking, "His boss is probably thinking about firing him because he's so stupid," while another countered, "His boss loves him because he's dumb enough to keep working for the same salary."

Understanding marginal tax brackets isn't actually complicated. If you make just enough to enter a new tax bracket, only the portion above the threshold is taxed at the higher rate. The rest of your income is still taxed at the lower rates. For example, if you make $100,000 and the next bracket starts at $101,000, only that extra $1,000 gets taxed at the higher rate. You're still walking away with more money.

This viral thread highlights a widespread issue: many people don't understand how taxes work, even when it directly affects their income. And when misinformation meets stubbornness, the results can be both frustrating and amusing. As one commenter put it, "If you choose to receive nothing, that's like taking a 100% tax on the money you didn't receive."

Read Next:

- The secret weapon in billionaire investor portfolios that you almost certainly don't own yet. See which asset class has outpaced the S&P 500 (1995-2024) – and with near-zero correlation.

- Are you rich? Here’s what Americans think you need to be considered wealthy.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.