Bitcoin continues to capture headlines — not just for its role in reshaping global finance, but for its staggering price growth over the years.

As of this month, the price of one Bitcoin is trading at $78,837. In April 2024, it was trading at $69,336. Back in 2023, Bitcoin stood at $28,353.

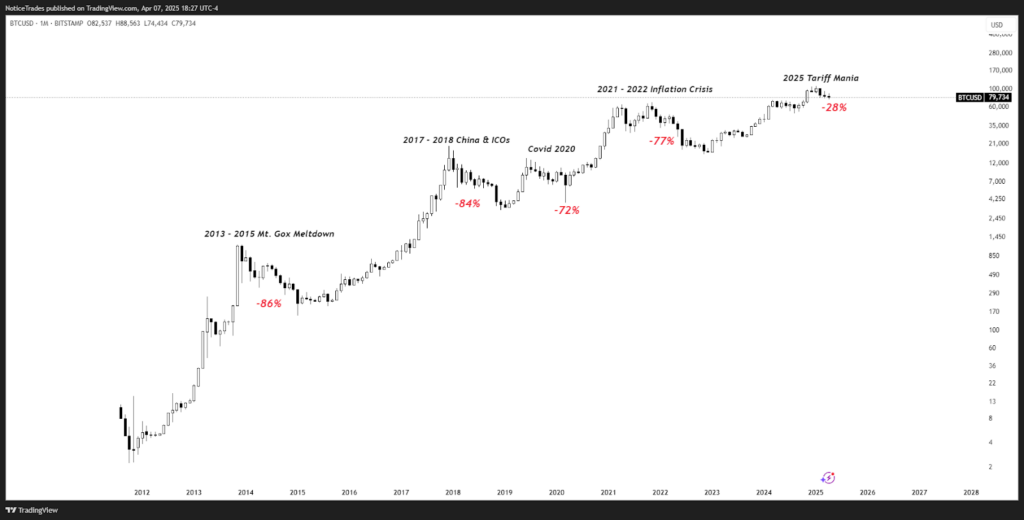

Bitcoin has always been a volatile market, often experiencing steep declines from its highs.

Don't Miss:

- Maker of the $60,000 foldable home has 3 factory buildings, 600+ houses built, and big plans to solve housing — this is your last chance to become an investor for $0.80 per share.

- ‘Scrolling To UBI' — Deloitte's #1 fastest-growing software company allows users to earn money on their phones. You can invest today for just $0.26/share with a $1000 minimum.

Past examples include the 2013–2015 Mt. Gox drawdown of 86%, the 2017–2018 correction during the China crackdown and ICO boom, the 2020 COVID flash crash with a 72% drawdown, the 2021–2022 global inflation crisis with a 77% decline, and currently, the 2025 “Tariff Mania,” with Bitcoin currently down 28% from its highs.

Source: TradingView (User & Screenshot Source – @NoticeTrades)

Trending: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

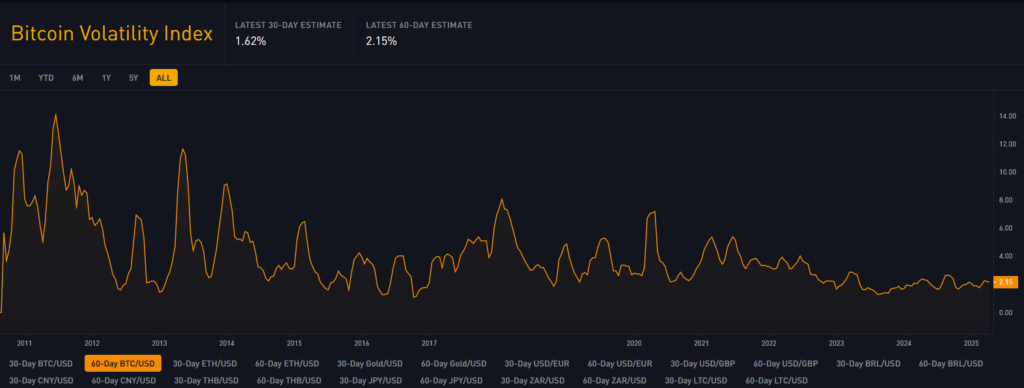

From Wild Swings to Stabilization: Bitcoin's Evolving Volatility

Volatility has played a major role in these drawdowns. In Bitcoin’s early stages, there wasn't as much institutional backing as there is today, which led to greater volatility on both the upside and downside.

Over the last few years, volatility has decreased significantly as Bitcoin has gained more recognition and adoption from countries around the world.

Source: BitBoi.IO (Screenshot Source – Nick Thomas)

The average 30-day BTC/USD volatility has decreased over the past 15 years. Back in 2010–2011, the average was around 6%–8%, and it has since dropped to approximately 2% over the last two years.

As volatility decreases, this implies that future drawdowns may not be as extreme—but it also means that the upside percentage gains from current levels may not be as dramatic as they were in previous years.

This kind of behavior is typical of a maturing asset. A helpful analogy is that of a young child—early in life, emotions can be intense and unpredictable. But as people grow older, they usually become more stable, measured, and less reactive. Similarly, Bitcoin's volatility has decreased over time as the asset has matured and gained broader acceptance.

See Also: BlackRock is calling 2025 the year of alternative assets. One firm from NYC has quietly built a group of 60,000+ investors who have all joined in on an alt asset class previously exclusive to billionaires like Bezos and Gates.

Zooming Out: Bitcoin's Drawdown in a Macro Context

What should be understood is that Bitcoin has continued to show strength and trades higher over time, even in the face of fundamental challenges within the asset itself.

Recently, we've seen increased volatility across all markets — not just Bitcoin. It's easy to point fingers and say, "I told you so," but the reality is that this goes beyond a single market's drawdown. This is a broader, macro-level issue.

With that said, don't let short-term noise influence your decision-making. Take a step back and ask: Why is Bitcoin down?

Has something fundamentally changed with the asset? Or are we just seeing the effects of broader macroeconomic pressure?

In my view, it's the latter — which means I don't believe this is a time to sell and run for the hills.

Both the fundamentals, which have only strengthened over time, and the technicals can help guide you.

I've recently written about Bitcoin's key levels, which you can read about here.

Read Next:

- Are you rich? Here’s what Americans think you need to be considered wealthy.

- Inspired by Uber and Airbnb – Deloitte's fastest-growing software company is transforming 7 billion smartphones into income-generating assets – with $1,000 you can invest at just $0.26/share!

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.