The real estate investment platform Arrived Homes released six new properties on its platform today through its latest Regulation A+ offering, allowing retail investors to purchase shares of rental properties.

The latest offering includes properties in markets where Arrived Homes has made previous investments, including Arizona, Georgia, Alabama and South Carolina. The company has also expanded into a new market with a 1,790 square foot rental property in the Nashville Metropolitan Area.

According to ArcGIS, Nashville’s population grew at an annual rate of 14.2% between 2010 and 2020, almost double the national average. Nashville is also ranked fourth in the country for population growth and job creation in the LaborIQ® Index of the largest 150 U.S. metros.

Fractional Real Estate Investments

Platforms like Arrived Homes remove many of the barriers that have historically prevented most people from investing in real estate. Large capital commitments, limited access to deals and the responsibilities that go along with being a landlord have made real estate a difficult asset to add to a portfolio.

However, fractional ownership removes these barriers. Retail investors can buy shares of rental properties for as little as $100 while a professional management company handles the day-to-day responsibilities of finding tenants, collecting rents, handling maintenance and repairs, and choosing the right time to sell to maximize gains.

Investors simply receive passive income through dividends from the rental revenue while their equity grows from the mortgage balance being paid down and, hopefully, the property appreciating in value.

Is There Still Room to Profit From Residential Real Estate?

Single-family homes have spiked in value over the past year, which understandably has many investors questioning whether now is the right time to invest in residential real estate. The Great Recession is still fresh in many people’s minds. House prices plummeted in most areas of the country after the housing bubble in 2006 and early 2007. It took about five years for prices to recover on a national level, while some areas never recovered.

Source: U.S. Census Bureau and U.S. Department of Housing and Urban Development, Average Sales Price of Houses Sold for the United States, retrieved from FRED, Federal Reserve Bank of St. Louis

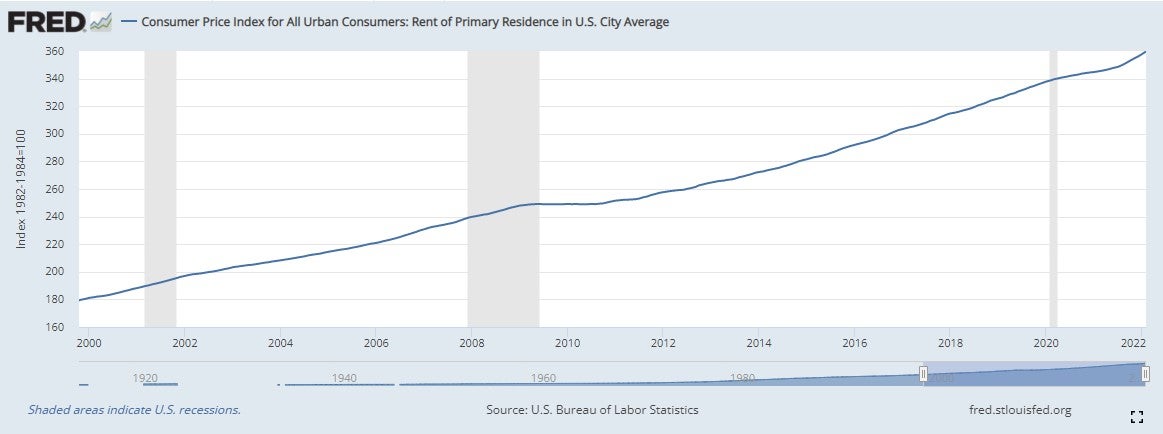

However, there’s more to investing in rental properties than housing prices. While sales prices have gone through cycles, rental prices have historically remained on a consistent upward trend.

Source: U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average, retrieved from FRED, Federal Reserve Bank of St. Louis

Regardless of the current value of a rental property, the income it generates should continue to increase as long as it’s properly managed. Investors that go into real estate with a target hold period of at least five to seven years shouldn’t be concerned about housing prices until it’s time to sell.

You can view fractional real estate offerings for Arrived Homes and other top real estate investing platforms through Benzinga’s real estate offering data.

Photo: Courtesy of Arrived Homes

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.