The housing market and all of the uncertainty plaguing it is undoubtedly on the minds of prospective buyers, sellers and investors.

As the Federal Reserve continues to try to curb inflation through the increase in rates, its been indirectly driving up the cost of the home loan that 90% of buyers obtain — the 30-year fixed-rate mortgage. The average 30-year fixed rate mortgage in the U.S. climbed to 6.82% as of Sept. 29 — more than double what it was on Sept. 30, 2021, when the average rate was at 3.01%.

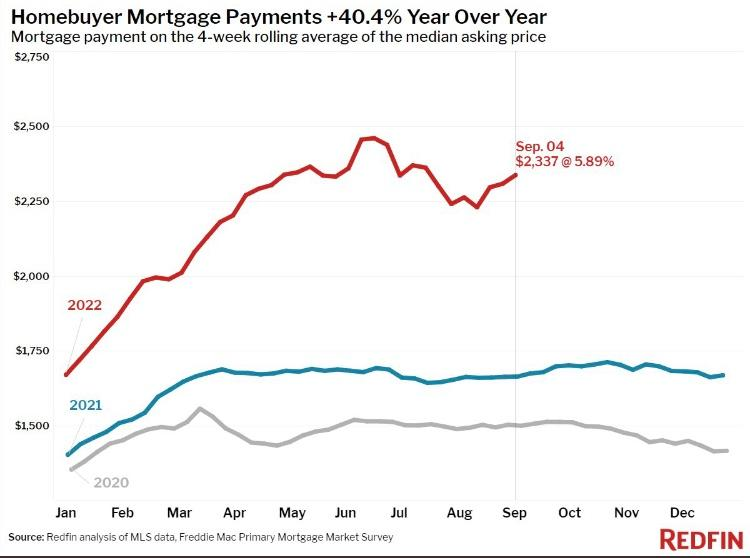

As a result, there is a growing affordability crisis plaguing potential homebuyers because the average monthly payment has increased by over 50% since last year. This month, mortgage interest rates hit a high not seen since the 2008 housing crash.

See also: Investors Earned A 41% Return On This Real Estate Debt Investment

Due to the rate increase and the still historically high home and listing price values, the market is starting to see a decline in demand and an increase in supply.

According to the National Association of Realtors, “Existing sales fell for the sixth consecutive month in July. Sales dropped 5.9% from June and 20.2% from a year ago.”

According to Realtor.com, “The supply of homes for sale is growing, up 27% at the start of September compared with the same time a year ago.”

While housing prices and home values were at historical highs last year, historically low interest rates allowed buyers to be able to afford purchases. Now, the market is seeing a price correction as housing prices and values are still at near peaks while rates have made for increasingly unaffordable monthly payments. Additionally, more prospective sellers are deciding to stay put as the see an increase in supply and a decrease in demand. They understand that if they’re to obtain a mortgage for the purchase of a new home, they will see an interest rate nearly twice as high if they had refinanced in 2020 or 2021.

Real Estate Debt Investments

Investing in real estate-backed mortgage debt could offer a portfolio hedging strategy. Investing in debt, compared to equity, is more secure for investors because a physical property is held as collateral. When you invest in real estate debt, you are effectively lending money to a borrower who, in most cases, will rehab the home or make upgrades and sell the property.

Related: Real Estate Debt Investments Offer Relief With 8% to 12% Returns

Rather than buying a property yourself and paying a higher interest rate to finance it, investing in debt allows investors to benefit from higher interest rates. Lending at higher rates equates to higher returns for the lender.

While it is true that investment in debt compared with equity offers a lower ceiling of potential return, in a period of market uncertainty, you can still enjoy strong returns with the added benefit of security.

The holding period is much shorter in debt investing than it is for buying a property you must hold before seeing a return. The hold period through some debt investment platforms can be as short as six and 24 months compared to equity deals, which are typically five to 10 years.

If the borrower defaults on the loan, debt investors can recoup a portion or all of their investment through a property auction. With an equity investment, however, they likely will see their capital disappear.

Investing in real estate debt is a way to feel more secure as home prices correct. With real estate-backed loans, investors are gaining more predictability when it comes to the amount and frequency of returns — in addition to the security of a property-backed investment.

Chart: Courtesy of Redfin

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.