Fundrise came out with a new real estate fund at the beginning of 2021. In less than two years, it has reached $1.3 billion in value and granted its investors 36.1% in accumulated returns. At the moment, it’s accepting new investors with a minimum investment of just $10.

Here are three good reasons why that could turn out to be a wise decision this quarter:

1. It’s Ready To Secure Millions Of Dollars Worth Of Single-Family Rentals In The Event Of A Crash

Well-respected economists have recently concluded that further real estate market downfalls are likely. If that turns out to be true, thousands of high-yielding properties will hit the market at a fraction of their current cost. Securing these units will lock in steady cash flow and appreciation will skyrocket if the markets bounce back up (which, historically, has happened every time).

If you want to take advantage of the potential upside but don’t want to put hundreds of thousands on the line by investing in a single property, Fundrise’s Flagship Real Estate Fund can be of great service, especially if you take the third reason on this list into account.

The Fund is pooling millions of dollars from investors. Once the market conditions sync up, the company can use these funds to acquire discounted properties at a price tag unfeasible for most investors. The profit from those properties will then be distributed to the investors passively.

2. The Fund Proved It Can Generate Returns In Harsh Times

The prospects weren’t looking good when the Fund opened its doors to investors at the beginning of 2021. The economy was trying to recover from the pandemic, and the markets were beginning to show signs of weakness.

Nevertheless, the Fund has managed to score impressive returns for its investors.

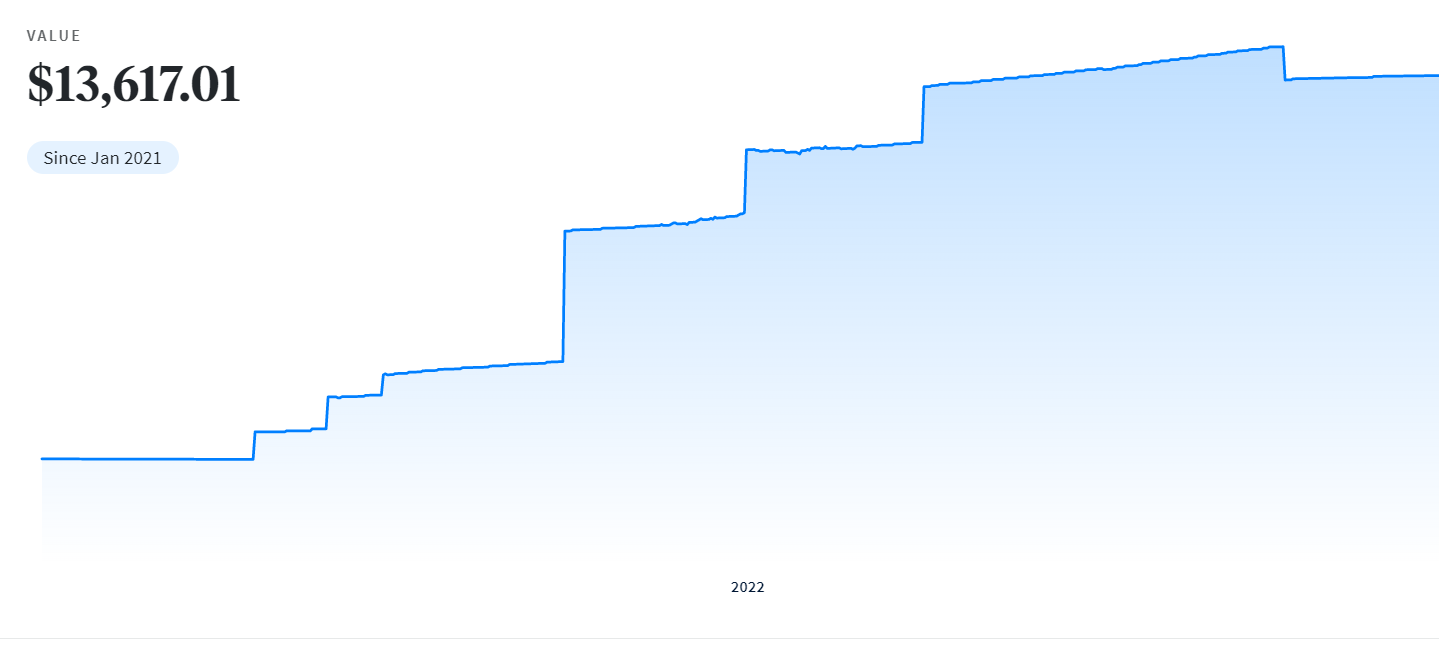

As shown in the graph below, the Fund’s accumulated returns added up to 36.2% as of December 2022.

Come what may, in the next months or years the market will stabilize at some point. When that happens, it is reasonable to think that the Fund will be able to produce even more impressive results.

That’s what the Fund’s parent company consistently provided in its years of existence.

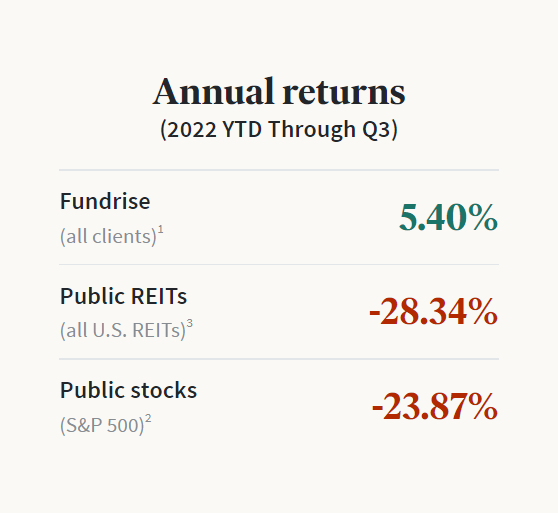

It has left many of its competitors in the dust by showcasing noteworthy returns since its inception. In 2022, it outperformed S&P500 and publicly traded real estate investment trusts (REITs) with a double-digit margin.

Consequently, the platform amassed a great user base with more than 371,000 investors.

3. The Real Estate Know-How It Provides Will Be More Crucial Than Ever In The Coming Months

If a market crash is really at hand, real estate values will take a substantial dip. At some point, that dip will hit rock bottom. Naturally, at that point, many rentals that are currently yielding hefty amounts will be available at much lower prices.

Knowing when that dip will happen is, of course, impossible. However, Fundrise has the resources needed to make the closest estimate. Nothing is left to intuition. Every year it invests millions of dollars in market research and artificial intelligence that helps minimize investment risk. In the coming months, the company will be firing on all cylinders.

If you’d like to cash in on its findings, click here to invest in Fundrise’s Flagship Fund before the market plummets.

This post contains sponsored advertising content. This content is for informational purposes only and is not intended to be investing advice. Nothing in the advertising material should be construed as tax advice, an offer, recommendation, or solicitation to buy or sell any security. All investing includes risk, including the possible loss of money you invest, and past performance does not guarantee future performance. Additional information about Fundrise is contained in its Form ADV Part 2a.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.