The following post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga.

Real estate investment trusts (REITs) are a popular option for income-seeking investors, especially in today’s low-interest-rate environment. However, most REITs are still vulnerable to the same market volatility as other publicly traded companies.

One option that’s overlooked by many retail investors: non-traded REITs. These REITs aren’t traded on any major stock exchanges and can’t be bought or sold through your brokerage app.

Non-Traded REITs Explained: A non-traded REIT is basically the same as any publicly traded REIT in terms of how the companies are structured and how they operate. They still have to follow the same rules established by the IRS to qualify as a REIT, including paying out at least 90% of the taxable income to shareholders in the form of dividends.

The main differences between traded and non-traded REITs have to do with regulations. Non-traded REITs don’t have the same disclosure and reporting requirements as publicly traded companies. While this typically means less transparency for investors, it can also mean higher yields, since non-traded REITs have lower compliance expenses.

1st Streit Office, Inc: This REIT is offered through the real estate investment platform Streitwise. It has a portfolio of two class A office properties with a list of strong credit tenants including the Panera Bread headquarters.

The REIT’s shares are priced based on the company’s net asset value (NAV) at $10.13 per share, with a minimum investment of 500 shares.

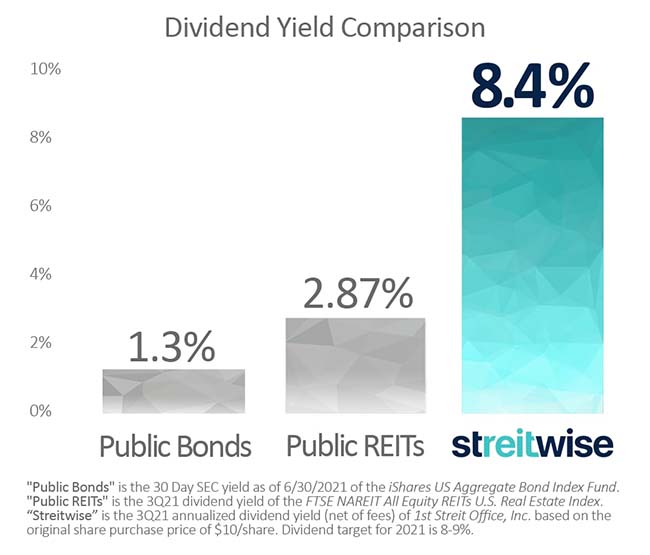

The company’s target dividend yield is 8% to 9%, which it has hit every quarter since the REIT’s inception in 2017. The most recently announced dividend equals an annualized rate of 8.4%.

Image source: Streitwise

How To Buy Shares of 1st Streit Office: Investors can purchase shares of the REIT directly through the Streitwise platform, and the offering is available to both accredited and non-accredited investors.

Are Non-Traded REITs a Good Investment? When deciding if this is a good investment option for you, consider two important factors — the limited reporting requirements and liquidity options.

Since non-traded REITs aren’t bought and sold on the open market, Streitwise offers liquidity options after minimum holding periods. Shares have to be held for a minimum of 1 year, at which point they can be redeemed for 90% of the current NAV. Shares can be redeemed for the full value after 5 years.

If you’re comfortable with the amount of information the company provides and plan to keep your money invested for at least 5 years, then non-traded REITs are definitely worth considering for your portfolio.

See also: Streitwise Review

Photo by LYCS Architecture on Unsplash

The preceding post was written and/or published as a collaboration between Benzinga’s in-house sponsored content team and a financial partner of Benzinga. Although the piece is not and should not be construed as editorial content, the sponsored content team works to ensure that any and all information contained within is true and accurate to the best of their knowledge and research. This content is for informational purposes only and not intended to be investing advice.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.