Real estate investment trusts (REITs) are a favorite among investors that enjoy the passive dividend income. These companies typically have predictable cash flow and consistent distributions, making them a great way for long-term investors to compound their returns.

The REITs that get the most attention are the publicly traded companies, like Realty Income, Prologis and Simon Property Group. However, there are a number of great opportunities available with public, non-traded REITs.

Non-traded REITs are still regulated by the Securities and Exchange Commission (SEC), but their shares don’t trade on the major stock exchanges. While the value of a publicly traded REIT is set by the market, the share price of a non-traded REIT is directly tied to the company’s net asset value (NAV). This often means non-traded REITs are much less volatile and offer a more predictable total return.

1st Streit Office

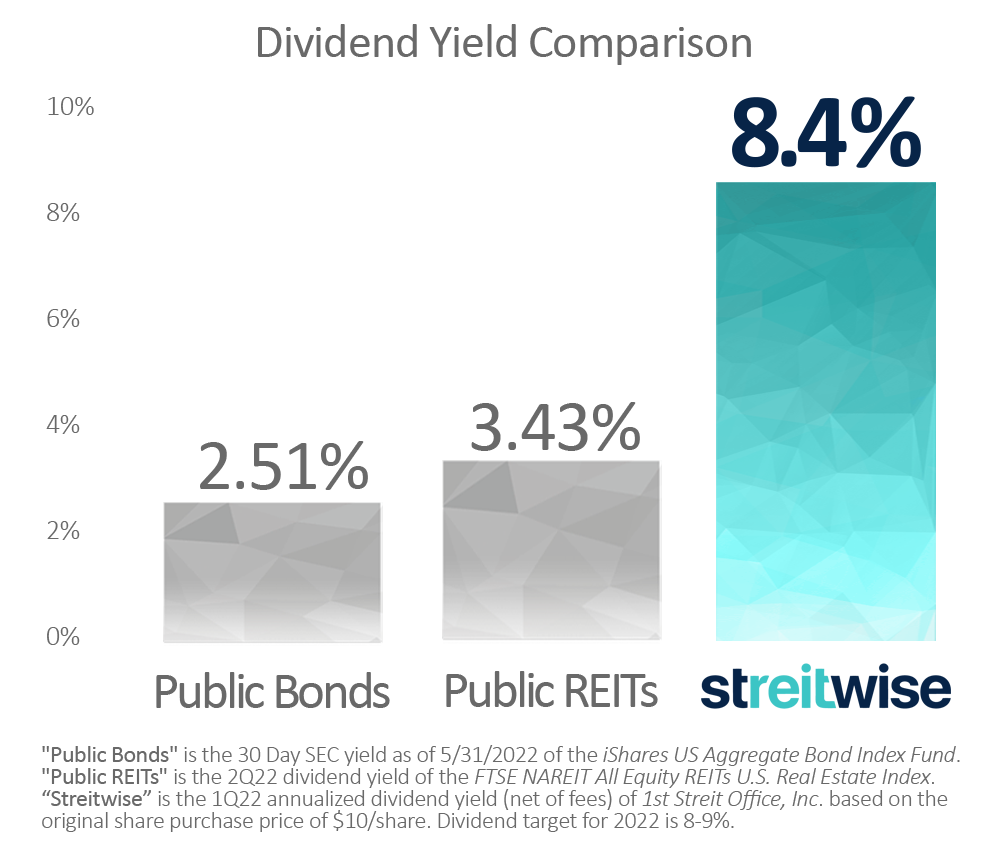

1st Streit Office (Buy Shares) is a non-traded REIT offered through the Streitwise investment platform with a current dividend yield of 8.4%. Since its inception, the company has paid out quarterly dividends with an average annualized yield of 9.3%.

The REIT owns a portfolio of class A properties, including the Panera Bread headquarters in Sunset Hill, Missouri.

While most publicly traded REITs saw a price decline of over 50% at the beginning of the COVID-19 pandemic, 1st Streit Office only saw a 1.4% decrease in value in the first quarter of 2020, and actually finished 2020 at a higher price than the start of the pandemic while maintaining an 8.4% dividend yield all year.

How to Buy Shares of 1st Streit Office: Since investors can’t buy shares of non-traded REITs on a major stock exchange, shares have to be purchased directly through Streitwise.

The REIT is currently priced at $10.15 per share with a minimum investment of 500 shares.

How to Sell Shares: Non-traded REITs are meant to be a long-term investment and are best suited for investors willing to maintain their investment for at least five years. After a minimum holding period of one year, investors have the option to liquidate their shares through the platform’s redemption program. After five years, investors can redeem their shares for 100% of the current value.

Visit Streitwise for more information

Photo by Iracema Navarro on Unsplash

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.