The real estate investment trust benchmark ETF, the Real Estate Select Sector SPDR, ended the day down just a little, but some REITS had a very good day.

Independence Realty Trust Inc IRT gained by 2.65%, leading the sector with that substantial percentage move:

Price chart analysts will notice that today's candlestick is a “bullish engulfing.” It went lower than Friday’s low and then closed above Friday’s high. There was no news on the REIT, which owns rental properties nationwide and continues to pay a slightly lower-than-the-sector dividend of 2.69%.

More on Real Estate Investments:

- This REIT You've Probably Never Heard of Has Paid a Dividend Above 8% For The Last 5 Years

- Jeff Bezos-Backed Arrived Homes Acquires Another $23 Million Worth Of Single-Family Rental Homes

- How This Real Estate Fund Is Still Posting Positive Returns For The Year

New Residential Investment Corp NRZ is changing its name to Rithm Capital and the market seems to like it. Units were up by 1.12% as the price continues to trade well above the early June lows.

New Residential is a mortgage REIT and pays a 10.18% dividend. Even with the rally of the last few days, you can see on the price chart just how much further it needs to go to retake the early May peak.

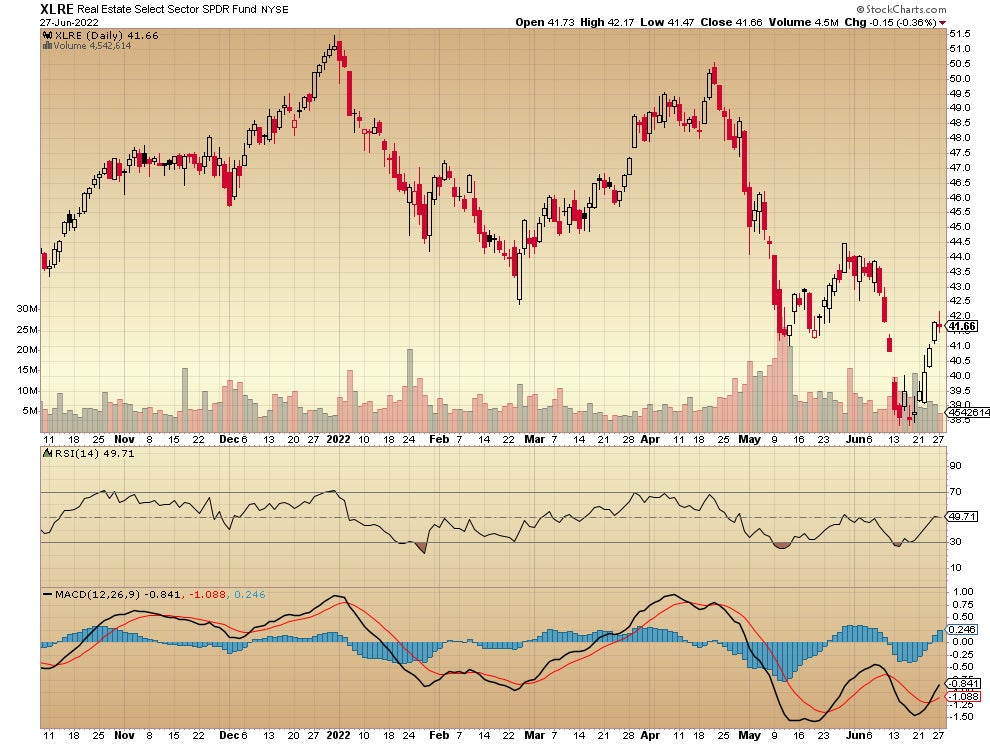

The Real Estate Select Sector SPDR lost 0.36% today:

This benchmark for the REIT sector managed to stay above Friday’s low and posted a 5-day higher high before backing off and closing in the red. It’s paying a 3.03% dividend at this price.

Note that the Real Estate Select Sector SPDR closed more or less in line with the S&P 500 today which was off by 0.30%.

Not investment advice. For educational purposes only.

Charts from StockCharts

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.